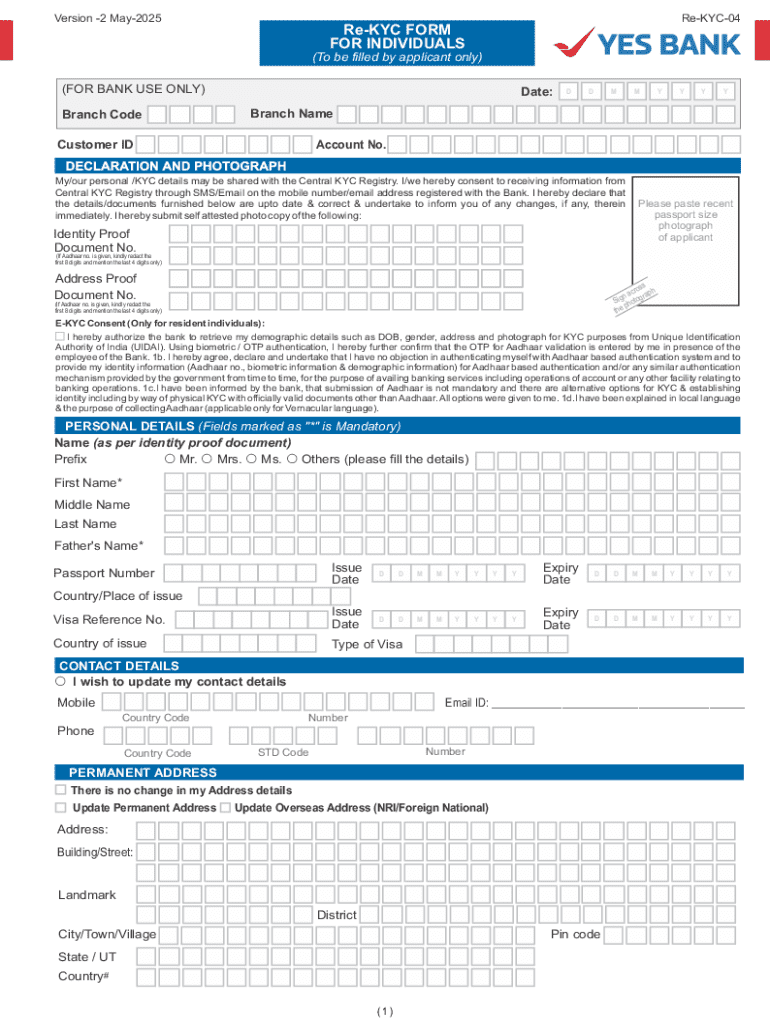

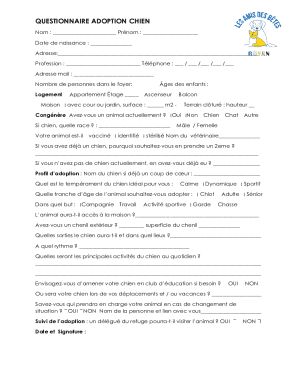

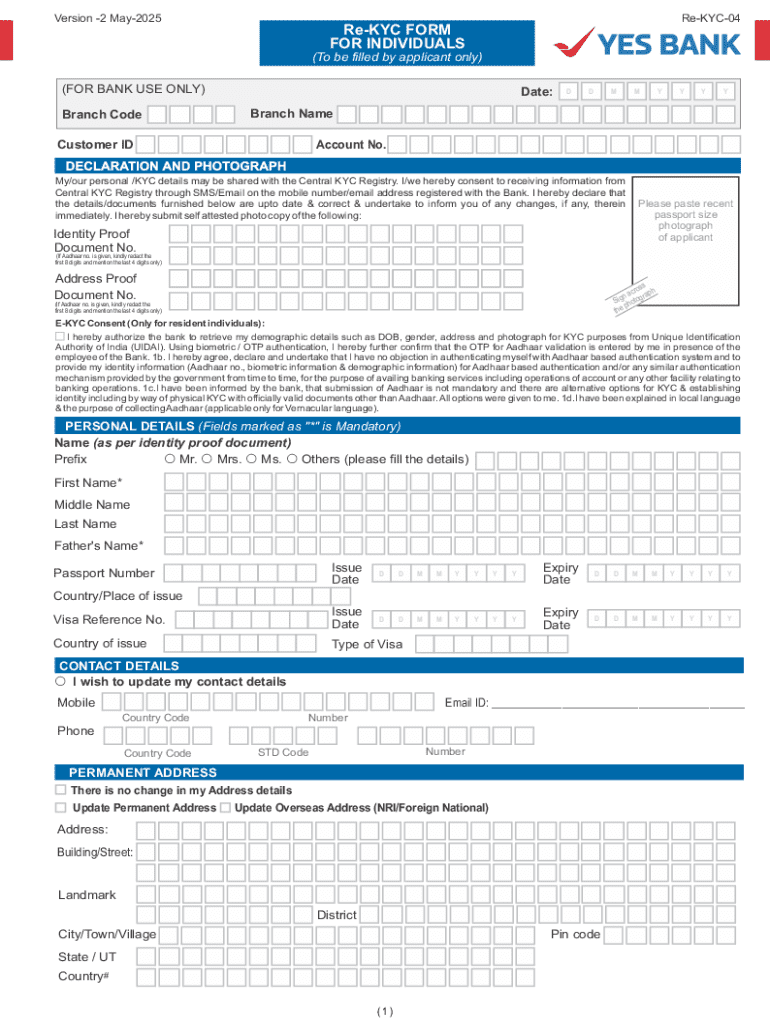

Get the free Re-KYC FORM FOR INDIVIDUALS - Yes Bank

Get, Create, Make and Sign re-kyc form for individuals

Editing re-kyc form for individuals online

Uncompromising security for your PDF editing and eSignature needs

How to fill out re-kyc form for individuals

How to fill out re-kyc form for individuals

Who needs re-kyc form for individuals?

Re-KYC Form for Individuals: A Comprehensive Guide

Understanding Re-KYC: What it means for you

Re-KYC refers to the process of periodically updating the information that a financial institution holds about an individual’s identity. This procedure is critical in enhancing customer verification measures to prevent fraud, money laundering, and other financial crimes. Financial institutions, including banks and investment firms, are legally required to maintain up-to-date customer information as part of their compliance with anti-money laundering (AML) regulations.

Understanding when Re-KYC is required is key for individuals. Changes in your personal circumstances, such as moving to a new address, an update in your legal name, or changes in your financial situation, may trigger the need for Re-KYC. Additionally, financial institutions may initiate Re-KYC processes on a periodic basis, commonly every two to five years, to ensure their records are accurate.

The Re-KYC process explained

The Re-KYC process typically involves several essential steps that both the financial institution and the individual must follow. Initially, the bank or financial institution will notify customers of the need to complete Re-KYC, often providing a deadline for submission. Individuals are then required to gather and submit the necessary documentation. Finally, the institution verifies the information against its existing records, and once confirmed, the updated data is integrated into the client's profile.

Key stakeholders in this process include the banks or financial institutions that oversee the Re-KYC procedure, as well as the individuals whose information is being updated. It is crucial for both parties to participate efficiently to avoid any disruptions in service or issues in account management.

What information is needed for Re-KYC?

When preparing to complete the Re-KYC form for individuals, you’ll need to gather certain documents that verify your identity and address. Commonly, individuals will be required to present several types of proof, including:

It's important to note that the requirements may vary based on the institution you are dealing with, so checking their specific guidelines is advised.

How to fill out the Re-KYC form

Completing the Re-KYC form can seem daunting, but breaking it down into manageable steps can simplify the process. Here’s a step-by-step guide to help you successfully fill out the Re-KYC form:

Common mistakes to avoid include missing information, submitting incorrect documents, and failing to sign the form. Ensuring everything is correctly filled out can save time and expedite the Re-KYC process.

Using pdfFiller for your Re-KYC form

pdfFiller provides an efficient solution for those looking to manage their Re-KYC forms effectively. With pdfFiller, you can easily edit and customize your Re-KYC document, ensuring it meets the requirements set by your institution. The platform offers convenient eSignature capabilities, making it simple to sign documents without needing to print them out.

Collaborative features allow teams to work together seamlessly on the form, and cloud-based storage ensures that your documents are accessible from anywhere, at any time. This simplifies not just the Re-KYC process, but all document management tasks you may have.

Managing your Re-KYC submission

Once you have completed the Re-KYC form, the next step is submitting it to your financial institution. Depending on their protocols, you may be required to upload the form online, send it via email, or deliver it in person. After submission, it’s beneficial to track the status of your Re-KYC to ensure it has been processed in a timely manner.

In case your submission is rejected, it's imperative to address any issues promptly. Review the feedback provided by your institution carefully, correct any errors, and resubmit the form as soon as possible.

Frequently asked questions about Re-KYC

Individuals often have specific concerns regarding the Re-KYC process. Here are some common questions:

Privacy and security considerations

During the Re-KYC process, protecting your personal information is crucial. Ensure that your financial institution implements strict security measures to safeguard your data, such as encryption protocols and secure servers. Platforms like pdfFiller prioritize data protection, incorporating robust encryption and compliance with regulations such as GDPR and CCPA, ensuring your documents are safe.

It’s essential to be aware of the privacy policies of your institution and how your information will be used and stored. This helps foster confidence in the Re-KYC process.

Case studies: Real-world examples of successful Re-KYC submissions

Many individuals have successfully navigated the Re-KYC process, often sharing their experiences to aid others facing similar challenges. A client named Sarah encountered hurdles due to missing address proof but was able to resolve the issue quickly by using pdfFiller to edit her document and include the correct utility bill. Her quick action enabled her to meet the submission deadline without any hassle.

Another case involved a family who faced challenges due to multiple accounts across different banks needing updates. By coordinating their efforts and using collaborative features offered by pdfFiller, they streamlined the process, ensuring timely submissions and minimal frustration. These testimonials reflect how effective strategies and the right tools can significantly enhance the Re-KYC experience.

Enhancing your document management skills

Mastering your document management skills can further streamline your Re-KYC experience and other necessary documentation. Taking the time to learn about various document management tools on pdfFiller can prove invaluable. The platform offers resources for creating, editing, and managing documents efficiently. Utilizing features like templates can save time and enhance your productivity.

Best practices for maintaining updated KYC records include setting personal reminders to check your information, regularly reviewing documents for accuracy, and utilizing available tools to keep your documents organized. As you enhance your skills, not only will your Re-KYC processes become smoother, but your overall document management will improve, leading to greater efficiency in all aspects of your personal and professional life.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my re-kyc form for individuals directly from Gmail?

How can I get re-kyc form for individuals?

Can I create an electronic signature for signing my re-kyc form for individuals in Gmail?

What is re-kyc form for individuals?

Who is required to file re-kyc form for individuals?

How to fill out re-kyc form for individuals?

What is the purpose of re-kyc form for individuals?

What information must be reported on re-kyc form for individuals?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.