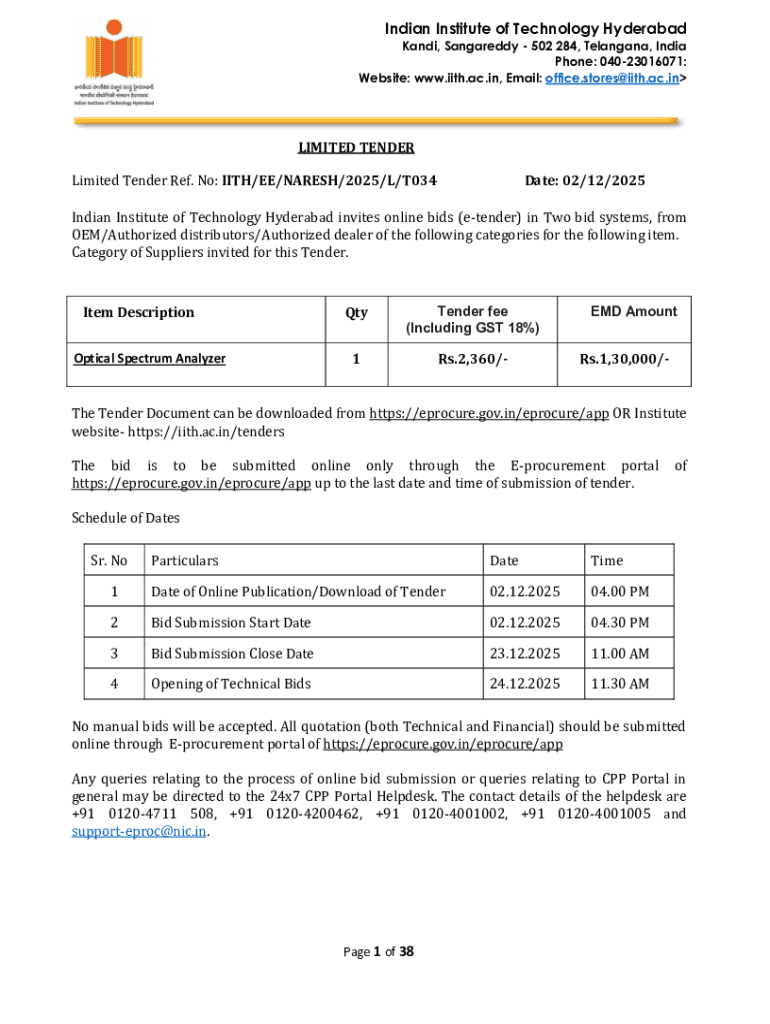

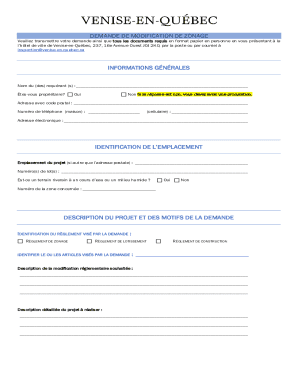

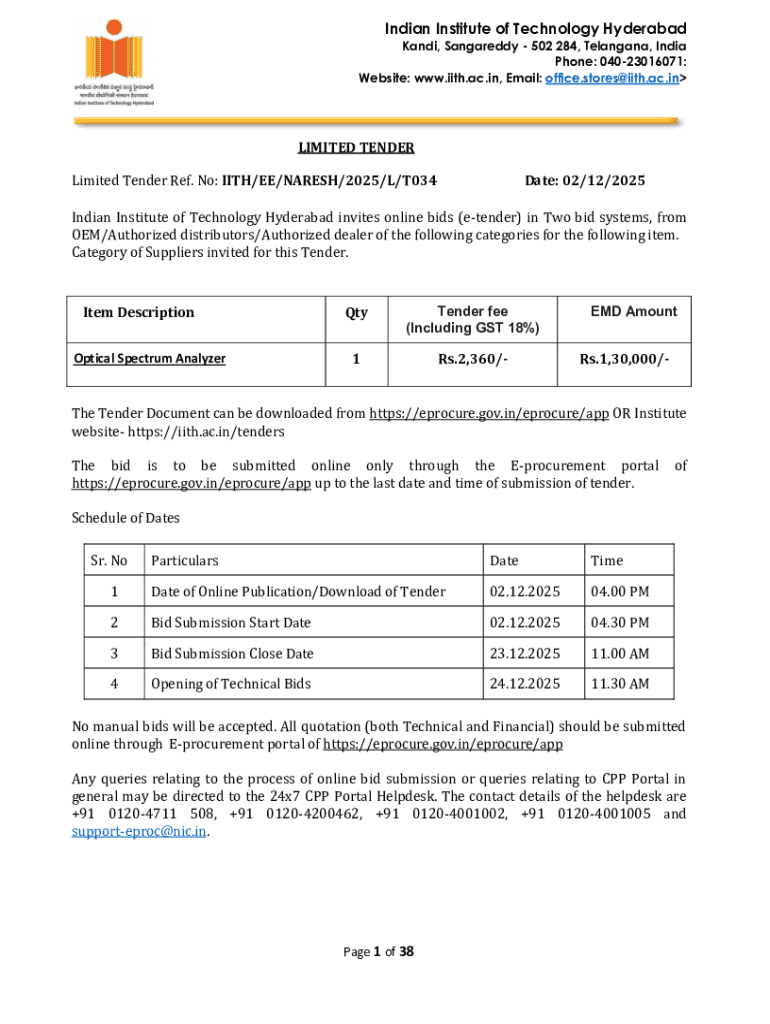

Get the free (Including GST 18%)

Get, Create, Make and Sign including gst 18

Editing including gst 18 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out including gst 18

How to fill out including gst 18

Who needs including gst 18?

Including GST REG 18 Form: A Comprehensive Guide for Taxpayers

Understanding GST REG 18 Form: Key aspects

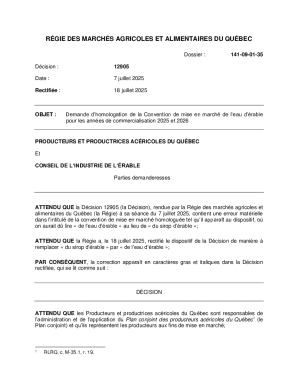

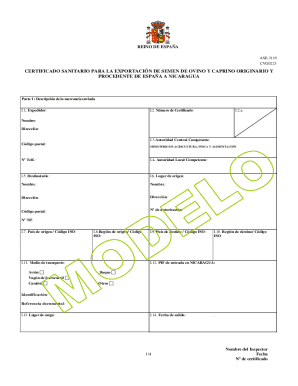

The GST REG 18 Form is a vital document in the Goods and Services Tax (GST) regime, serving as a means for individuals and businesses to submit specific information regarding their GST registration. It is tailored primarily for taxpayers responding to show cause notices or rectifying errors in their GST registration details.

This form holds significant importance as it ensures compliance with GST laws and allows taxpayers to maintain accurate records. Any inaccuracies can lead to complications, thus making it imperative that stakeholders understand when and how to use this form effectively.

Businesses, freelancers, and professionals who are registered under GST and require amendments or need to respond to inquiries from tax officers must utilize the GST REG 18 form. Understanding its nuances can prevent potential growth setbacks resulting from compliance failures.

Scenarios requiring Form GST REG 18

Form GST REG 18 becomes essential under specific circumstances. It is primarily utilized when a taxpayer needs to respond to show cause notices or seeks to correct registration errors that could affect their tax compliance.

Some common scenarios for filing GST REG 18 include:

Provisions and regulations governing GST REG 18

The GST REG 18 Form is governed by a range of GST laws and regulations that dictate its filing procedures and requirements. The legal framework surrounding this form ensures that taxpayers maintain transparency and accountability in their financial dealings.

Understanding the key provisions and updates related to GST REG 18 is crucial for taxpayers. Not only does it help them navigate the complexities of tax regulations effectively, but it also fosters compliance strategies necessary for sustainable growth in the finance industry.

Key changes in filing requirements over the years include the introduction of digital forms and online submissions, further streamlining the process for taxpayers. Keeping abreast of these changes is essential for any business aiming to maintain compliance and avoid penalties.

Step-by-step guide to filing Form GST REG 18

Filing Form GST REG 18 can be straightforward if you approach it methodically. Here’s how to navigate this process.

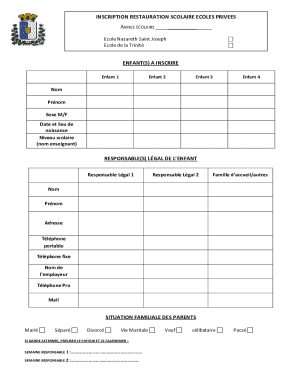

1. Preparation before filing

Before you fill out Form GST REG 18, ensure you have all the necessary documents and information at hand. This includes your GSTIN, details of previous registrations, and any official correspondence from the tax authorities. Having valid documentation is critical as inaccuracies can lead to delays or rejections.

2. Accessing GST REG 18 online

Log in to the GST portal using your credentials, where you can easily access the GST REG 18 Form. Ensure you have the latest browser updates to avoid technical issues.

Once logged in, follow these steps to locate the form:

3. Filling out the GST REG 18 form

As you fill out the GST REG 18 form, pay careful attention to each section, providing accurate details as requested. It’s crucial to avoid common mistakes, such as misreporting GSTIN or failing to attach required documents, as these can lead to rejected submissions.

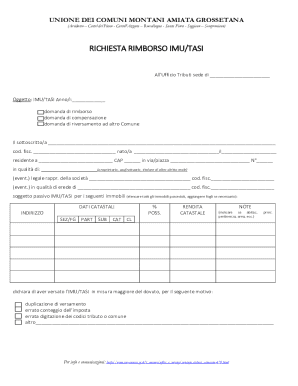

4. Reviewing your application

Before submission, take the time to review your application thoroughly. Double-check all entries and ensure the accuracy of information provided. A well-reviewed application increases the chances of approval and minimizes the need for follow-up corrections.

5. Submitting the form

Once completed and reviewed, submit the form through the GST portal. After submission, ensure you obtain a confirmation of submission, as this serves as proof of your compliance and can safeguard against future disputes.

Post-submission, track the status of your application through the portal to stay updated on any communications or required actions from tax authorities.

Interactive tools for managing your GST REG 18 submissions

Utilizing digital tools can facilitate a smooth filing process for Form GST REG 18. Various platforms, including pdfFiller, provide features for filling and editing forms efficiently.

Some resources include:

Frequently asked questions about GST REG 18

Taxpayers often have common questions regarding Form GST REG 18, reflecting the complexities surrounding GST compliance. Addressing these can alleviate confusion and streamline the filing process.

Key questions include:

Important tips for a smooth filing process

Navigating through the GST filing process can be daunting, but effective management of deadlines and utilizing the right tools make the experience smoother. Here are some practical tips:

Summary of filing process for GST REG 18

Filing Form GST REG 18 can be simplified through proper preparation, understanding of the form, and careful attention to detail. By following the structured steps outlined in this guide, taxpayers can navigate the complexities of the GST regime with greater confidence.

As the financial landscape continues to evolve, staying informed about the filing processes and utilizing available tools like pdfFiller can empower individuals and teams to manage their GST registrations seamlessly and avoid potential pitfalls. Understanding your responsibilities not only ensures compliance but also supports your growth strategy within competitive markets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my including gst 18 directly from Gmail?

How do I edit including gst 18 in Chrome?

Can I edit including gst 18 on an iOS device?

What is including gst 18?

Who is required to file including gst 18?

How to fill out including gst 18?

What is the purpose of including gst 18?

What information must be reported on including gst 18?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.