Get the free 2025 Virginia Resident Form 760 Individual Income Tax Return

Get, Create, Make and Sign 2025 virginia resident form

Editing 2025 virginia resident form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 virginia resident form

How to fill out 2025 virginia schedule adj

Who needs 2025 virginia schedule adj?

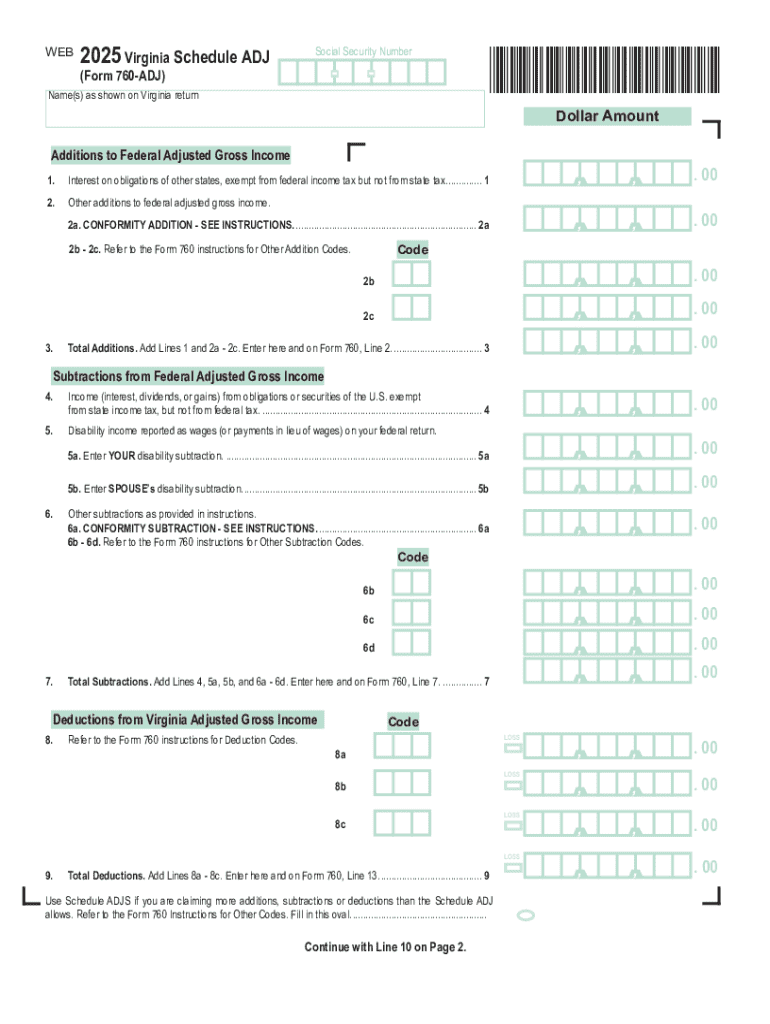

Understanding the 2025 Virginia Schedule Adj Form: A Comprehensive Guide

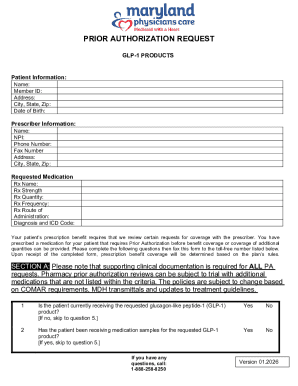

Overview of the 2025 Virginia Schedule Adj Form

The 2025 Virginia Schedule Adj Form is crucial for taxpayers looking to accurately report income adjustments, deductions, and credits for the upcoming tax year. Filing the Schedule Adj is not merely a regulatory step; it ensures compliance with Virginia tax laws and minimizes the risk of incurring penalties due to inaccuracies or late submissions. Furthermore, recent updates to tax legislation make it essential for filers to stay informed.

For 2025, several key changes are expected that may affect how filers complete this form. These changes include updates regarding allowable deductions and tax credits, along with new addendums aimed at simplifying the filing process. Staying ahead of these changes is vital for accurate tax reporting.

Understanding the structure of the Schedule Adj form

The 2025 Virginia Schedule Adj Form is divided into several distinct sections to facilitate the reporting process. Understanding these sections allows for a smoother filling experience:

Familiarity with common terminologies used in the form will enhance your ability to complete it accurately and efficiently.

How to access the 2025 Virginia Schedule Adj form

Accessing the 2025 Virginia Schedule Adj Form is straightforward. It can be conveniently downloaded from pdfFiller, which offers a user-friendly platform for managing tax documents. To download the form from pdfFiller, follow these steps:

For those looking for alternatives, the official Virginia Department of Taxation website also provides access to the Schedule Adj form. Notably, pdfFiller offers interactive features such as form fill capabilities and auto-save options, all designed to streamline the filing process.

Step-by-step instructions for filling out the Schedule Adj form

Filling out your 2025 Virginia Schedule Adj Form can be made simpler with a structured approach. Follow these steps:

Tips for submitting your Schedule Adj form

Submitting the 2025 Virginia Schedule Adj Form can be accomplished through multiple modes, with e-filing being the most convenient option. Here are some best practices to follow:

Using pdfFiller can make e-filing seamless, as it provides a direct way to file electronically and reduces potential administrative delays.

FAQs about the Schedule Adj form

Taxpayers often have questions regarding the 2025 Virginia Schedule Adj Form. Here are some frequently asked questions:

Additionally, understanding troubleshooting tips for discrepancies in reported income can be vital for smooth processing.

Additional resources and support

Aside from online tools and platforms like pdfFiller, connecting with tax professionals can provide personalized assistance. Consider seeking help from a CPA or tax advisor, especially for complex tax situations.

Accessing online communities and financial forums can also be beneficial. Engaging with fellow taxpayers allows for shared experiences and professional advice, which can significantly ease the anxiety associated with tax filings.

Interactive tools on pdfFiller for the Schedule Adj

Using pdfFiller not only enables you to fill out the 2025 Virginia Schedule Adj Form but also provides you with powerful editing and collaboration tools. Here’s how you can utilize these features:

These features greatly enhance the document management experience, making it more interactive and efficient.

Understanding the impact of the Schedule Adj on your tax position

Filing the 2025 Virginia Schedule Adj Form could significantly influence your tax refund or payment obligations. Understanding how various adjustments affect your overall tax liability is crucial for planning ahead.

For instance, you may find that certain adjustments allow you to claim a refund that could be reinvested for future expenses. It's advisable to keep track of any tax year changes, ensuring that you remain informed about revisions in Virginia tax laws that could affect future filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2025 virginia resident form in Gmail?

How do I edit 2025 virginia resident form in Chrome?

How do I complete 2025 virginia resident form on an iOS device?

What is 2025 virginia schedule adj?

Who is required to file 2025 virginia schedule adj?

How to fill out 2025 virginia schedule adj?

What is the purpose of 2025 virginia schedule adj?

What information must be reported on 2025 virginia schedule adj?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.