Get the free Homeowner's Tax Credit - Utah State Tax Commission

Get, Create, Make and Sign homeowneramp039s tax credit

How to edit homeowneramp039s tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out homeowneramp039s tax credit

How to fill out tc-90cb renter refund application

Who needs tc-90cb renter refund application?

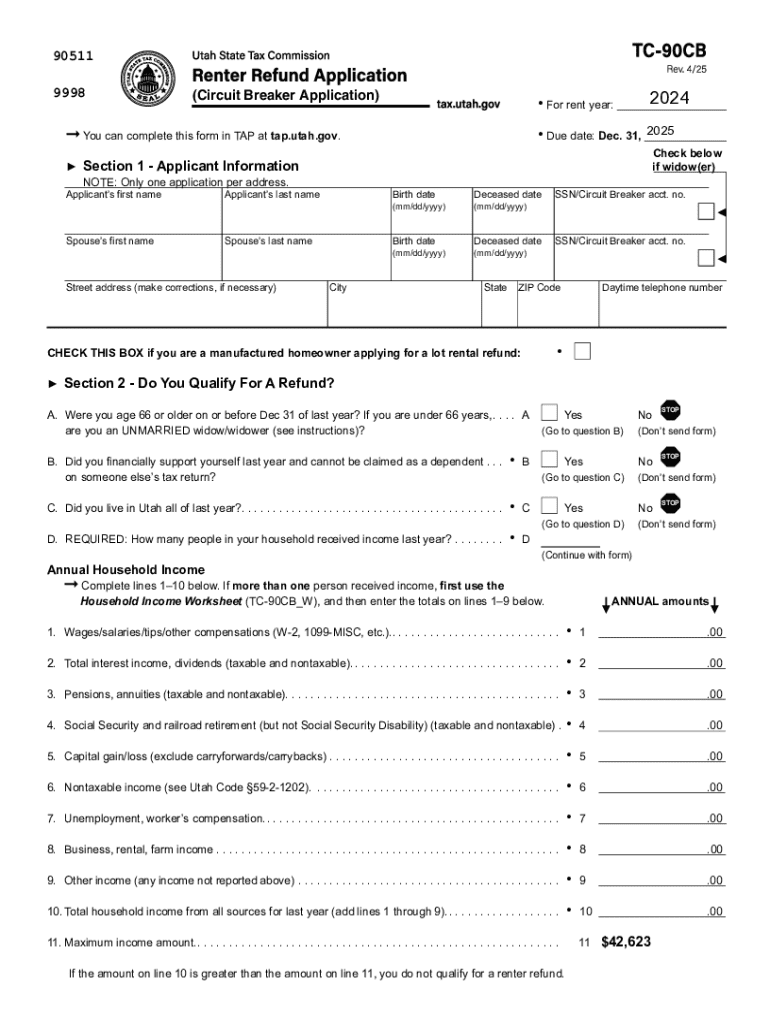

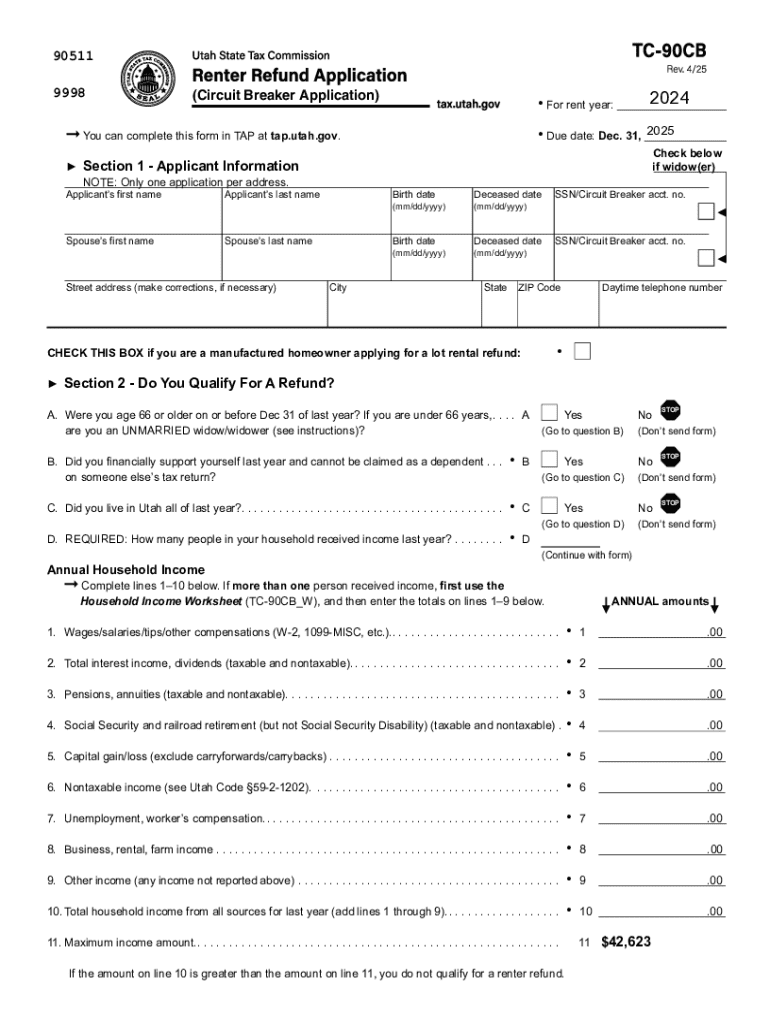

Understanding the TC-90CB Renter Refund Application Form

Understanding the TC-90CB renter refund

The TC-90CB renter refund application form is a crucial document aimed at providing financial relief to eligible renters. Designed to assist individuals who meet certain income and residence criteria, the TC-90CB form acts as a request for reimbursement of rental expenses through tax relief initiatives. These programs are implemented at both state and local levels, aiming to alleviate the financial burden on renters, especially during challenging economic times.

Renter refunds can serve as a vital financial cushion, particularly for those who may struggle to keep up with rising living costs, making knowledge of this form and its application process imperative.

Eligibility criteria for TC-90CB renter refund

To qualify for the TC-90CB renter refund, applicants must meet specific eligibility criteria, including income requirements and residency stipulations. Generally, this requires that applicants demonstrate their financial status, proving they fall within certain income levels and have resided in the renting property for a designated period.

Eligibility also extends to ensuring that the rental property meets specific qualifications as defined in local regulations. Generally, participants must provide proof of residency, income statements, and rental agreements to substantiate their claims for a refund.

Preparing to apply for the TC-90CB renter refund

Before beginning the TC-90CB renter refund application process, it is vital to gather all necessary documentation. This documentation not only supports your application but also streamlines the process, reducing potential delays in receiving your refund.

Required documents often include proof of income, such as pay stubs or tax returns, identification, proof of rent payments, and lease agreements. Keeping these organized and at hand before filling out the form will save time and reduce frustration during the application process.

Understanding key terminology

Navigating the TC-90CB form requires familiarity with specific terms that are integral to the application process. Understanding phrases such as 'eligible renter' and 'property tax relief' can greatly enhance your ability to complete the form accurately.

'Eligible renter' often refers to individuals or tenants meeting specified income and residency criteria, while 'property tax relief' denotes the assistance provided to reduce financial burdens associated with housing costs. Familiarity with these terms will ensure that your application aligns with eligibility requirements and regulations.

Step-by-step guide to filling out the TC-90CB application form

Accessing the TC-90CB application form is straightforward. Applicants can typically download the form from local government websites or access it directly through platforms like pdfFiller, which allows for easy editing and completion.

To ensure your application is filled out correctly, follow this step-by-step guide: Begin by accurately entering your personal information, including your full name, address, and contact details. Make sure your information is entered as it appears on legal documents to avoid discrepancies.

Next, accurately report your income, ensuring that all sources are included. This is critical because discrepancies in income reporting can delay your application or result in denial. Finally, provide thorough details about your rental situation, ensuring your rental property's address and type are clearly stated.

Common mistakes to avoid include failing to provide accurate income information and neglecting to verify the property address. Additionally, ensure that the form is signed and dated appropriately. Double-checking all information before submission can prevent unnecessary delays.

Submitting your TC-90CB renter refund application

Once the TC-90CB application is completed, applicants have several options for submitting their forms. The online submission process is frequently the fastest method, especially using platforms like pdfFiller, which enable direct submissions in a user-friendly manner. For those less inclined to use technology, mailing the application is still a viable option.

In-person filing may also be available at designated local government offices, where representatives can assist you with any last-minute questions about the application process. Regardless of the submission method, ensure you obtain confirmation of your application to track its processing and refund status.

Tracking the status of your application is essential. Most local government websites provide an online tracking tool, allowing you to check the status of your application. Generally, processing times can vary based on the volume of applications, so prepare for some wait while your application is processed.

Frequently asked questions about TC-90CB renter refund

After submitting your TC-90CB application, you may wonder what the next steps are. Typically, processing times can vary, so be patient as your refund is processed. Keep in mind that during peak periods, such as tax season, delays may be more frequent. Be sure to check the local government's guidelines for anticipated refund schedules.

If your application is denied, common reasons for this include missing documentation or exceeding income limits. If you find yourself in this situation, review the rejection notice closely, as it usually outlines the specific reasons for denial. You have the right to appeal or reapply, providing amended information as necessary to address any issues identified.

To maintain eligibility for future refunds, ensure that you file your applications in a timely manner each year and update any changes in income or residency accordingly. Keeping track of income fluctuations and moving situations will assist you in avoiding issues in subsequent applications.

Utilizing pdfFiller for your TC-90CB form needs

pdfFiller stands out as an excellent tool for filling out the TC-90CB renter refund application form. With its straightforward interface, users can edit PDFs and incorporate digital signatures with ease. The platform allows for real-time collaboration, making it an ideal choice for those who might need support while completing the application.

Moreover, pdfFiller provides interactive tools that facilitate easy modifications to the form, ensuring compliance with local regulations. With the ability to save, share, and retrieve documents effortlessly, users can streamline their application process, making it less daunting.

Additional resources for renter refunds

For those seeking further assistance with the TC-90CB renter refund application, local tax offices often offer additional resources. Websites provide valuable contacts and tax assistance programs to facilitate the refund process and help clarify any uncertainties applicants may have.

Staying informed about changes in tax laws and renter rights is also vital. Regularly checking updates from state or local government can provide insights into changes that could affect your eligibility or the application process. Engaging in local community resources can foster support for renters navigating their rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send homeowneramp039s tax credit for eSignature?

How can I get homeowneramp039s tax credit?

How do I fill out homeowneramp039s tax credit on an Android device?

What is tc-90cb renter refund application?

Who is required to file tc-90cb renter refund application?

How to fill out tc-90cb renter refund application?

What is the purpose of tc-90cb renter refund application?

What information must be reported on tc-90cb renter refund application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.