Get the free TC-20 Utah Corporation Franchise Income Tax Return. Forms & Publications

Get, Create, Make and Sign tc-20 utah corporation franchise

How to edit tc-20 utah corporation franchise online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-20 utah corporation franchise

How to fill out tc-20 utah corporation franchise

Who needs tc-20 utah corporation franchise?

A Comprehensive Guide to the TC-20 Utah Corporation Franchise Form

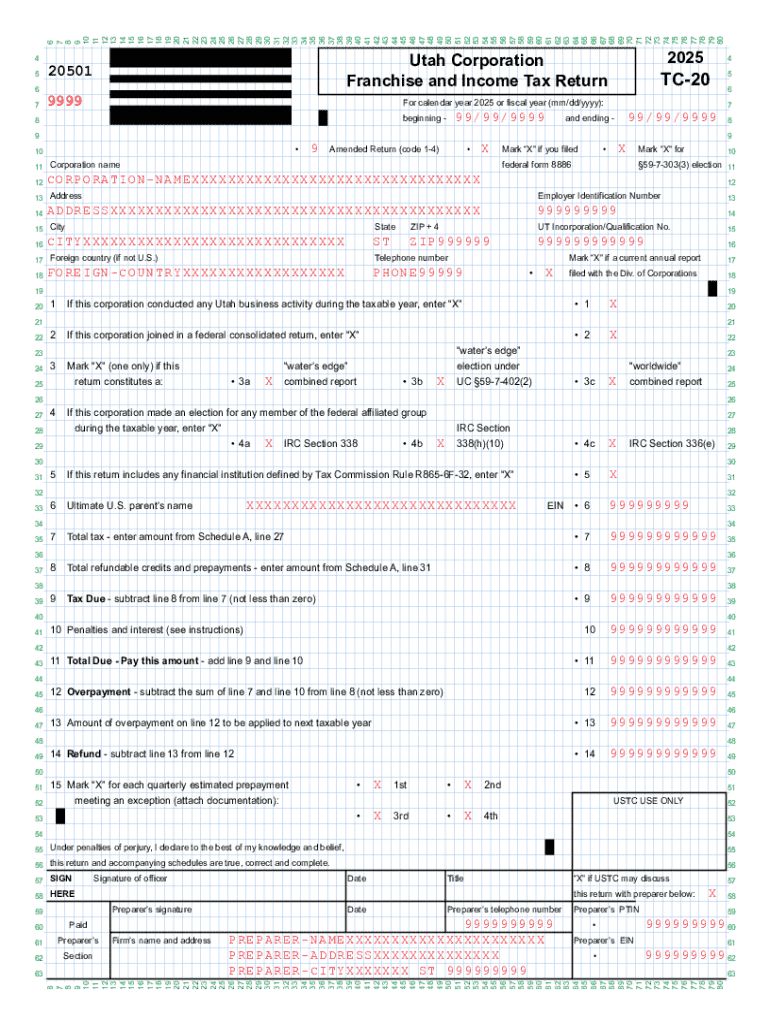

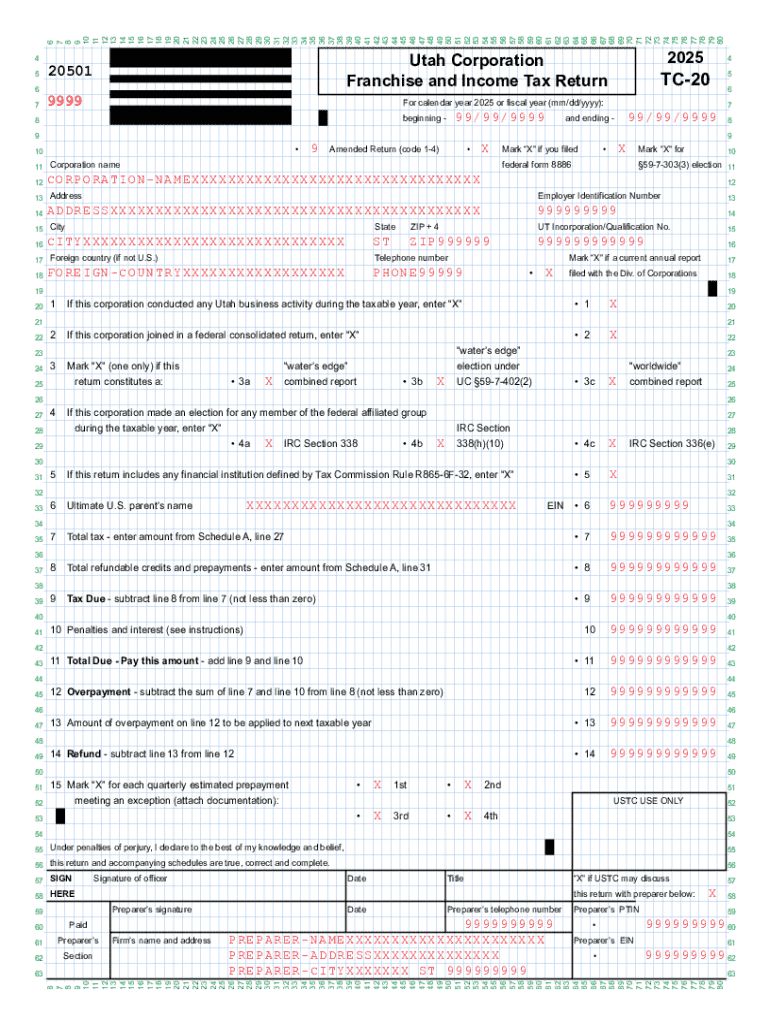

Overview of the TC-20 Utah Corporation Franchise Form

The TC-20 is a critical form issued by the state of Utah, specifically designed for corporations to facilitate their franchise tax reporting. This form is essential for corporations operating within the state as it helps track their financial obligations regarding business taxes. Its accurate completion and timely submission are paramount for ensuring compliance with state tax laws.

Filing the TC-20 is not just a bureaucratic task; it holds significant implications for corporate operations in Utah. It serves as a means for the state to assess the franchise tax attached to corporations, ultimately influencing corporate financial health. Proper utilization of the TC-20 helps corporations maintain good standing with state authorities and avoid potential penalties.

Eligibility criteria

Understanding who is required to file the TC-20 form is crucial for compliance. Generally, all corporations registered to do business in Utah must file the TC-20 form regardless of their revenue levels. This requirement includes domestic corporations incorporated within Utah and foreign corporations that are authorized to transact business in the state.

However, not all entities are subject to this obligation. Exemptions are granted to specific types of organizations, such as purely non-profit organizations and certain exempt entities as stipulated by the IRS and state laws. It is imperative for corporations to examine their eligibility closely to avoid unnecessary filing.

Key components of the TC-20 form

The TC-20 form is structured into several key sections, each serving a specific purpose. Understanding these sections helps streamline the filing process and reduces the risk of errors. Primarily, the form includes corporate identification information, revenue reporting, and provisions for deductions and exemptions.

Corporate identification entails details like the corporation's name, address, and taxpayer identification number, all of which establish the entity's identity for tax purposes. Revenue reporting necessitates accurate entry of total income generated, ensuring that the correct tax bracket is applied. Deductions and exemptions allow corporations to potentially lower their taxable income, requiring specific documentation to support any claims.

Step-by-step instructions for filling out the TC-20 form

Before beginning, verifying that you have the necessary documentation is crucial. Key documents include financial statements detailing your income and any records supporting your claims for deductions. This foundational preparation simplifies the form-filling process.

Here’s a comprehensive look at each section of the TC-20 form:

Tools and support for form completion

pdfFiller provides users with an intuitive platform to facilitate the completion of the TC-20 form. Utilizing interactive tools, users can fill in information accurately and efficiently, reducing errors and saving time. Templates for the TC-20 are readily accessible, ensuring you start with the correct structure.

Moreover, pdfFiller's eSignature capabilities offer a streamlined way to get necessary approvals. This feature eliminates the hassle of printing and scanning documents, allowing for a more efficient submission process. Accessing these tools can enhance your filing experience and alleviate stress.

Common mistakes and FAQs

Filing the TC-20 can be straightforward; however, certain pitfalls commonly cause complications. One major mistake is failing to report all income or inaccurately claiming deductions without supportive documentation. Both errors can result in financial penalties or additional audits from tax authorities.

It's important to address frequently asked questions directly. For instance, if you miss the filing deadline, you may incur fines. Ensure you amend any errors in a submitted TC-20 promptly to avoid potential legal complications. Typically, submitting documentation such as income statements and previously filed tax forms may be required during submission.

Post-submission actions

After you've successfully submitted the TC-20 Form, expect to receive a confirmation notice from the state confirming your filing. This notification will serve as your assurance that you've complied with corporate tax regulations, while keeping a copy for your records is equally important to indicate your compliance. Be aware that your submission may also be subjected to an audit.

To maintain compliance throughout the year, it’s advisable to consult with tax professionals regarding your ongoing obligations. Staying informed about potential changes in tax laws can help avoid surprises during the next filing period.

Additional resources and tools offered by pdfFiller

pdfFiller is not just a solution for filing the TC-20 form; it offers a variety of document management features that can enhance your overall efficiency. The platform provides tools for tracking submissions, managing document versions, and securely storing your files, allowing for quick access whenever needed.

Prioritizing security, pdfFiller ensures that sensitive documents are stored safely with encryption measures. Utilizing pdfFiller for ongoing document needs means you can easily shift focus to other critical business operations while knowing your compliance needs are adeptly managed.

Conclusion

Completing the TC-20 Utah Corporation Franchise Form accurately is vital for corporate compliance and financial health. Entities must understand their requirements and utilize the resources available through pdfFiller to streamline the entire process.

By leveraging pdfFiller’s capabilities for editing, signing, and managing documents, you can enhance efficiency and reduce stress related to tax filing. A proactive approach to completing and maintaining your TC-20 obligations ensures that your corporation remains in good standing in Utah.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tc-20 utah corporation franchise to be eSigned by others?

How can I get tc-20 utah corporation franchise?

How do I complete tc-20 utah corporation franchise online?

What is tc-20 utah corporation franchise?

Who is required to file tc-20 utah corporation franchise?

How to fill out tc-20 utah corporation franchise?

What is the purpose of tc-20 utah corporation franchise?

What information must be reported on tc-20 utah corporation franchise?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.