Get the free 2024-2026 Form TX Comptroller 50-144 Fill Online, Printable ...

Get, Create, Make and Sign 2024-2026 form tx comptroller

Editing 2024-2026 form tx comptroller online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024-2026 form tx comptroller

How to fill out business personal property rendition

Who needs business personal property rendition?

Business personal property rendition form how-to guide

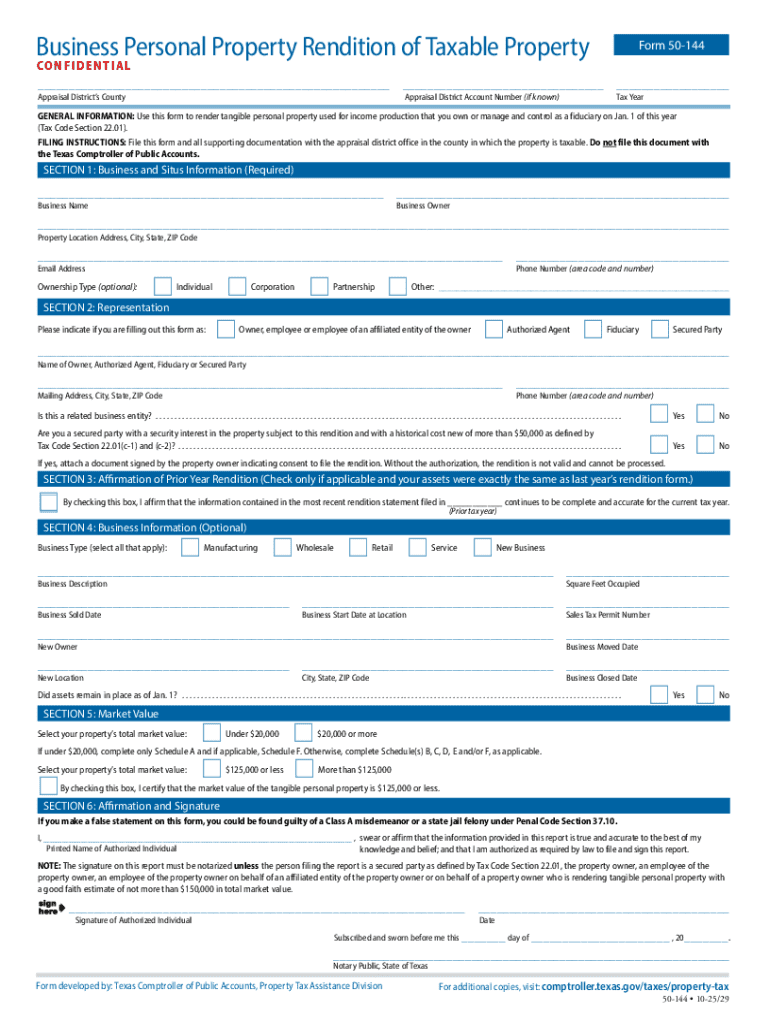

Understanding business personal property

Business personal property refers to tangible and movable assets that are used in the operation of a business and not permanently affixed to the property. This includes equipment, machinery, furniture, vehicles, and inventory. Accurate documentation, such as through a business personal property rendition form, is essential as it impacts tax assessments and ensures compliance with local regulations. Failing to report assets accurately can result in penalties and incorrect tax bills.

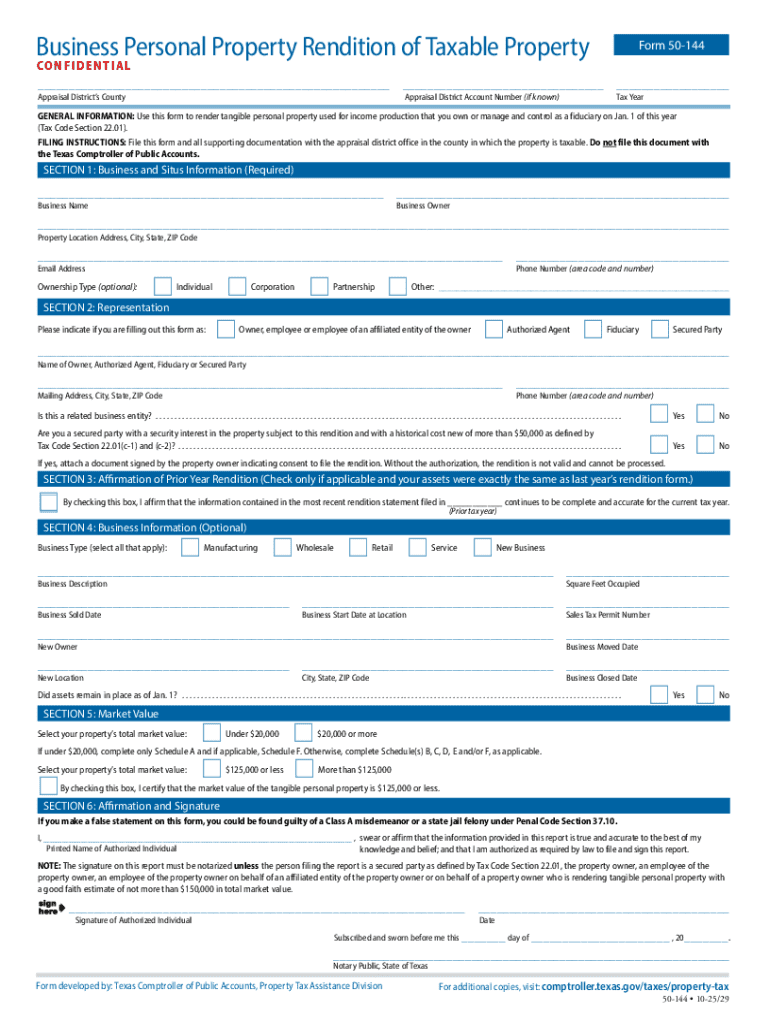

What is a business personal property rendition form?

The business personal property rendition form serves as a declaration of all personal property owned by a business, used primarily for tax assessment purposes. This form provides a comprehensive overview of business assets, enabling local government entities to determine the value of property for taxation. Generally, any business that owns tangible personal property is required to file this form annually, which can include everything from local retail shops to large corporations.

Step-by-step guide to completing the business personal property rendition form

Completing the business personal property rendition form involves several detailed steps to ensure that all required information is accurately filled out. Start by gathering all necessary documents and details about the property owned by your business.

Gather required information

Begin by collecting essential details such as: business identification information, including your business name, address, and contact information; a comprehensive description of each property item you own; and the estimated value of the personal property, which may involve reviewing financial statements and property purchase receipts.

Using tools such as spreadsheets or accounting software can assist in organizing this data. It is beneficial to keep a record of these documents as they can be referenced during the evaluation process or when filing taxes.

Fill out the form

As you fill out the business personal property rendition form, pay careful attention to each section: provide your business name and address; list descriptions for each piece of personal property, along with the estimated value. Make sure this information is consistent with your financial records to avoid discrepancies.

Common mistakes to avoid include misvaluing your assets, overlooking personal property that should be included, or missing the filing deadline, all of which can lead to penalties.

Review your submission

After filling out the form, conduct a thorough review of your submission. It’s crucial to double-check all the details for accuracy; typos or incorrect figures can lead to significant issues with taxation. Consider using a checklist based on the required information to ensure nothing is overlooked.

Editing and managing your form with pdfFiller

Managing documents can be daunting, but pdfFiller simplifies the process. The platform offers robust features for document management, allowing users to edit, sign, and collaborate on the business personal property rendition form seamlessly.

How to edit the business personal property rendition form

To edit your form in pdfFiller, upload the document to the platform, where you can make necessary adjustments. Utilizing the editing tools, you can easily adjust values or descriptions, ensuring that your submitted information stays updated.

Collaborating with team members on the form

With pdfFiller, collaboration is easy. You can invite team members to view or edit the form, enabling contributions from multiple stakeholders. This collaborative approach is particularly useful for businesses with multiple assets, ensuring all information is accurate and comprehensively represented.

eSigning your rendition form in pdfFiller

Once your form is complete, you can electronically sign the business personal property rendition form using pdfFiller’s eSignature feature. This not only speeds up the process but also ensures a legally binding signature without the need for printing or scanning.

Submitting your business personal property rendition form

Submitting your completed form requires understanding the various submission methods available. Digital submissions through pdfFiller streamline the process significantly as you can send the form directly to the appropriate local tax authorities.

Mailing vs. in-person submissions

Alternatively, you can choose to mail your form or submit it in person. If opting for the latter, be sure to confirm the office hours and address of your local appraisal authority to avoid any delays. Tracking the status of your submission can be done by following up directly with the agency, ensuring your filing is recorded correctly.

What happens after submission?

After you submit your business personal property rendition form, your local appraisal authority will review the submitted information and conduct an appraisal process. This involves assessing the value of your reported assets to ensure they align with market values.

Understanding appraisal processes

Once the appraisal is complete, you may receive notifications regarding assessed values and any adjustments made to your taxes. If discrepancies arise or you wish to dispute an assessment, you will have the opportunity to do so and should be prepared with evidence to support your case.

The role of appraisers in business personal property taxation

Appraisers play a crucial role in determining the fair market value of business personal property. They utilize industry standards and guidelines to assess properties accurately, ensuring businesses are taxed fairly according to their actual worth.

Importance of accurate valuation in tax assessments

Accurate valuations conducted by professional appraisers can significantly influence a business’s tax obligations. Over-valuation can lead to inflated tax bills, while under-valuation may result in missed opportunities for refunds or adjustments. As such, engaging with appraisers can provide peace of mind to business owners facing taxation uncertainties.

How business personal property taxes impact your business

Business personal property taxes are a significant consideration for any company. These taxes often contribute to local revenue streams that fund essential services. Understanding the implications of these taxes on your overall business operations is vital for strategic planning.

Allocation of funds: where do your tax dollars go?

Revenue generated from business personal property taxes typically supports various community services, including education, public safety, road maintenance, and infrastructure improvements. This community investment reinforces the importance of accurate tax reporting.

Strategies for maximizing tax benefits

Businesses can adopt strategies to maximize potential tax benefits, such as taking advantage of deductions, understanding local exemptions, and collaborating with financial advisors. Being proactive about tax planning can result in significant savings.

Frequently asked questions (FAQs)

Addressing common queries regarding the business personal property rendition form can help demystify the process for business owners. Here are some fundamental questions often asked:

Contact information for assistance

For further assistance with the business personal property rendition form, contacting your local appraisal authorities is a good starting point. Many agencies provide resources and guidance on navigating the filing process.

Email correspondence and inquiry directions

Most local appraisal offices have dedicated email contacts for property inquiries. Visit their official website for specific addresses and response times to ensure you receive the assistance you need.

Hours of operation for support services

It’s beneficial to verify the hours of operation for support services to avoid missed opportunities. Many agencies offer extended hours around tax season to accommodate inquiries.

Additional support and interactive tools

In addition to traditional forms, pdfFiller offers interactive tools that can elevate your document management experience. Users can access templates, helpful videos, and support documentation to aid in completing the business personal property rendition form.

Utilizing online resources for further assistance

pdfFiller hosts a range of resources online, empowering businesses to navigate the complexities of document management and taxation. Utilizing these tools can streamline your process, ensuring compliance and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024-2026 form tx comptroller without leaving Google Drive?

Can I create an eSignature for the 2024-2026 form tx comptroller in Gmail?

How do I fill out 2024-2026 form tx comptroller on an Android device?

What is business personal property rendition?

Who is required to file business personal property rendition?

How to fill out business personal property rendition?

What is the purpose of business personal property rendition?

What information must be reported on business personal property rendition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.