Get the free MO-1120V 2025 Corporation Income Tax Payment Voucher ... - dor mo

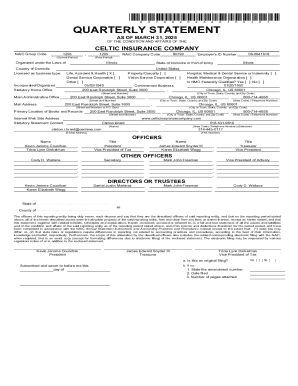

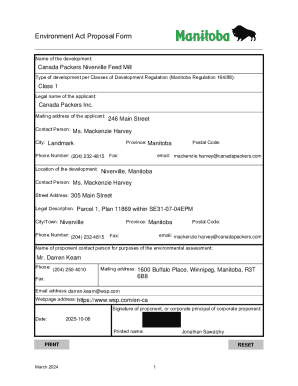

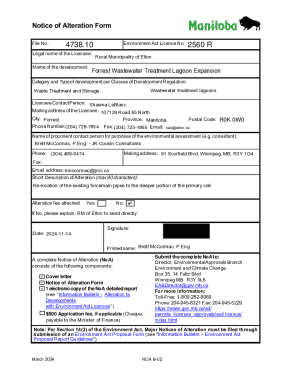

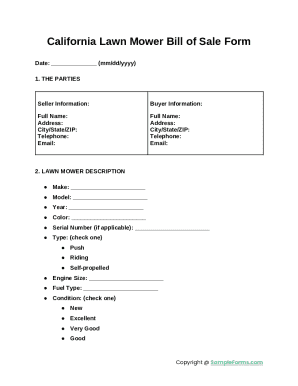

Get, Create, Make and Sign mo-1120v 2025 corporation income

Editing mo-1120v 2025 corporation income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo-1120v 2025 corporation income

How to fill out mo-1120 2021 corporation income

Who needs mo-1120 2021 corporation income?

A complete guide to the MO- corporation income form

Comprehensive overview of the MO-1120 corporation income form

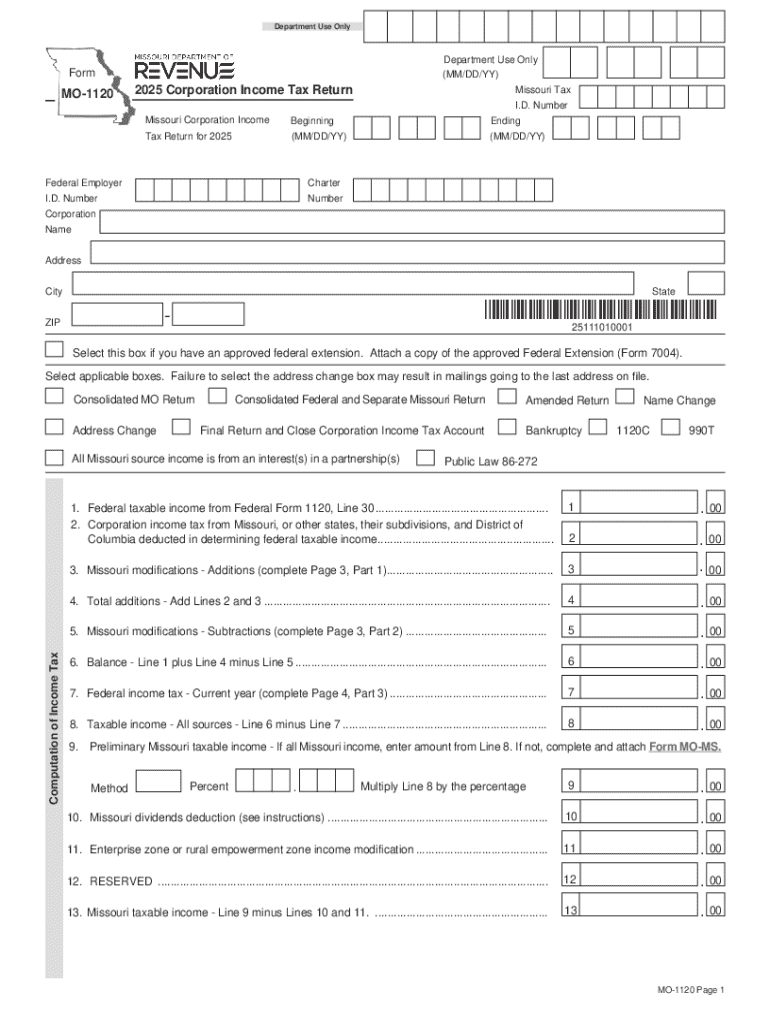

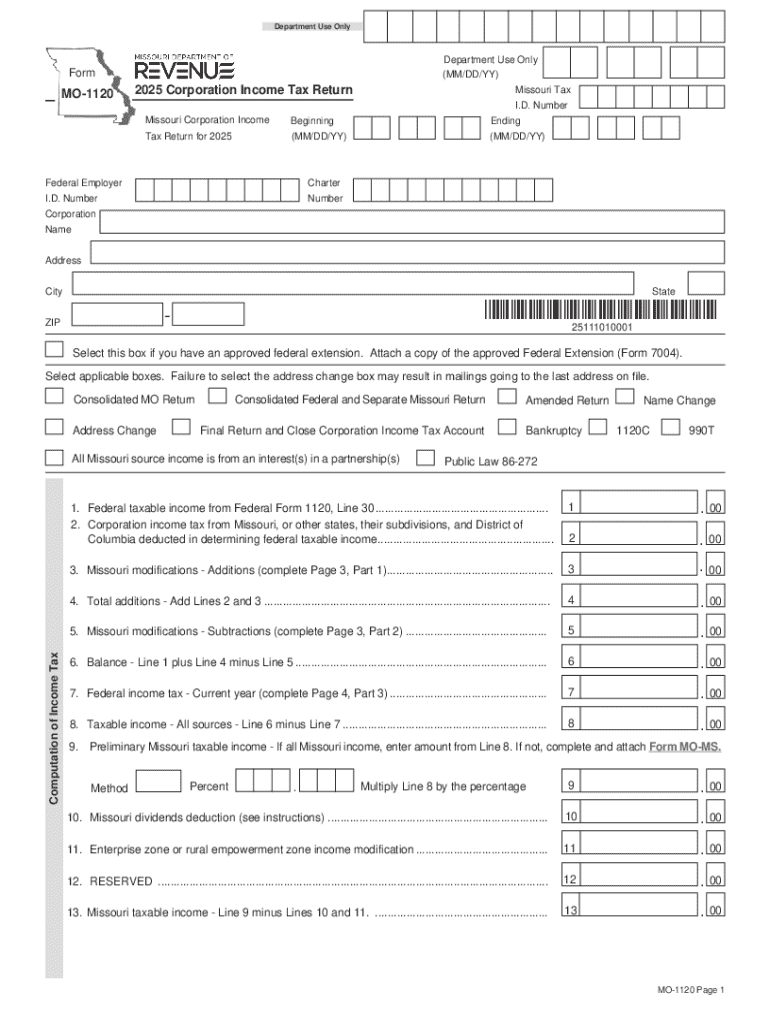

The MO-1120 form is crucial for corporations operating in Missouri, serving as the statewide equivalent of the federal corporate income tax. Filing this form is essential for assessing the taxable income of corporations and determining their tax liability to the state. With different definitions around taxable income and a structured method for reporting, completing the MO-1120 helps businesses stay compliant while clarifying their financial standings.

All corporations that conduct business in Missouri, including those registered outside the state but earning income from Missouri sources, are required to file this form. Additionally, certain tax-exempt organizations must also file if they engage in unrelated business activities. It is critical for businesses to understand who needs to file to avoid unnecessary penalties.

In 2021, several key changes were introduced to the MO-1120 form that businesses must be aware of, including updates to deductions, credits, and reporting requirements. Staying informed about these changes ensures that corporations can file accurately and strategically.

Preparing to file the MO-1120

Before completing the MO-1120, thorough preparation is vital. Essential documents include accurate financial statements demonstrating income, expenses, and overall business performance. Previous tax returns can assist in identifying trends and ensuring consistency in reporting. Additionally, corporations must gather their identification numbers and any required supporting documents.

Understanding taxable versus non-taxable income is key in preparing for this filing. Taxable income generally includes revenue from sales, services, and other business operations, while non-taxable income might include specific investment returns or certain grants. Businesses should effectively categorize their revenue streams during this preparation phase.

Additionally, having background information on your business structure and if you operate on a fiscal year instead of a calendar year can affect your filing strategy. Gathering this information helps create a clearer picture of your overall financial health and obligations.

Detailed instructions for completing the MO-1120

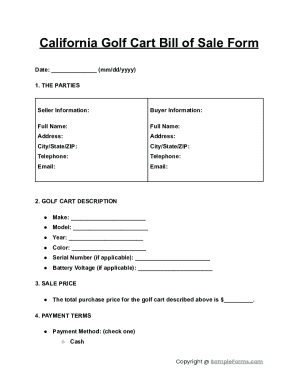

Filling out the MO-1120 form requires attention to detail. The first section involves basic header information, where you will input your business name, address, federal ID number, and the tax year for which you are reporting. This ensures the Missouri Department of Revenue correctly identifies your filing.

In the income section, businesses must accurately report their total revenues and allowable deductions to derive their taxable income. This section is fundamentally important as it sets the base for calculating the corporation's tax liability. Additionally, tax credits can significantly reduce the overall tax bill, making it essential for corporations to research available credits and ensure they meet the eligibility criteria.

Lastly, the signature and declaration section requires the authorization of a corporate officer or representative. The accurate completion of this section may prevent delays in processing the MO-1120 form.

Interactive tools for simplifying MO-1120 completion

Utilizing interactive tools can simplify the process of completing the MO-1120. Platforms like pdfFiller provide easy document access and management, allowing users to fill in information conveniently from anywhere. This is particularly advantageous for busy organizations or teams managing multiple tax filings.

Visualization tools such as tax calculators can help project potential tax obligations based on different income levels and deductions. This helps in making informed financial decisions ahead of time, ensuring your business complies with tax regulations without facing surprises during filing.

Common mistakes to avoid when filing the MO-1120

Filing the MO-1120 form can be complex, and common pitfalls exist that could lead to delays or penalties. Misreporting income is a frequent issue and could occur due to miscalculating or misunderstanding taxable income. It is crucial to ensure all income is accurately reported and categorized.

Moreover, companies need to be mindful of filing deadlines. Late submissions can incur financial penalties. Keeping a checklist of necessary items and deadlines can help streamline your filing process.

Managing your MO-1120 form after submission

Once the MO-1120 form has been filed, it's important to understand how to manage this document and track its status. Typically, corporations can check their filing status online through the Missouri Department of Revenue's website, providing peace of mind and clarity over pending submissions.

Keeping organized records of your submissions and financial documents is essential for future reference. This would be particularly useful in the event of an audit, where the corporation must provide its financial history to substantiate reported claims. Any discrepancies can be addressed quickly if the necessary documentation is readily available.

Additional considerations for corporations

If any errors are found in the submitted MO-1120 form, corporations may need to file amendments or corrections. It is advisable to address any mistakes promptly and consult relevant resources to understand your state's specific regulations regarding amendments.

Engaging with professional tax advisors can provide valuable insight into complex issues and ensure compliance with state laws. As regulations evolve, having expert support aids in more strategic business planning.

FAQs about the MO-1120 form

It is common for corporations to have questions regarding the filing of the MO-1120. A frequently asked question is what happens if a form is forgotten or overlooked. Ignoring tax obligations can lead to penalties, so it is essential to address any missed filings as soon as possible.

Addressing these common FAQs not only prepares corporations for potential issues but also fosters a clearer understanding of the tax responsibilities associated with the MO- corporation income form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mo-1120v 2025 corporation income in Chrome?

Can I sign the mo-1120v 2025 corporation income electronically in Chrome?

How can I edit mo-1120v 2025 corporation income on a smartphone?

What is mo-1120 2021 corporation income?

Who is required to file mo-1120 2021 corporation income?

How to fill out mo-1120 2021 corporation income?

What is the purpose of mo-1120 2021 corporation income?

What information must be reported on mo-1120 2021 corporation income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.