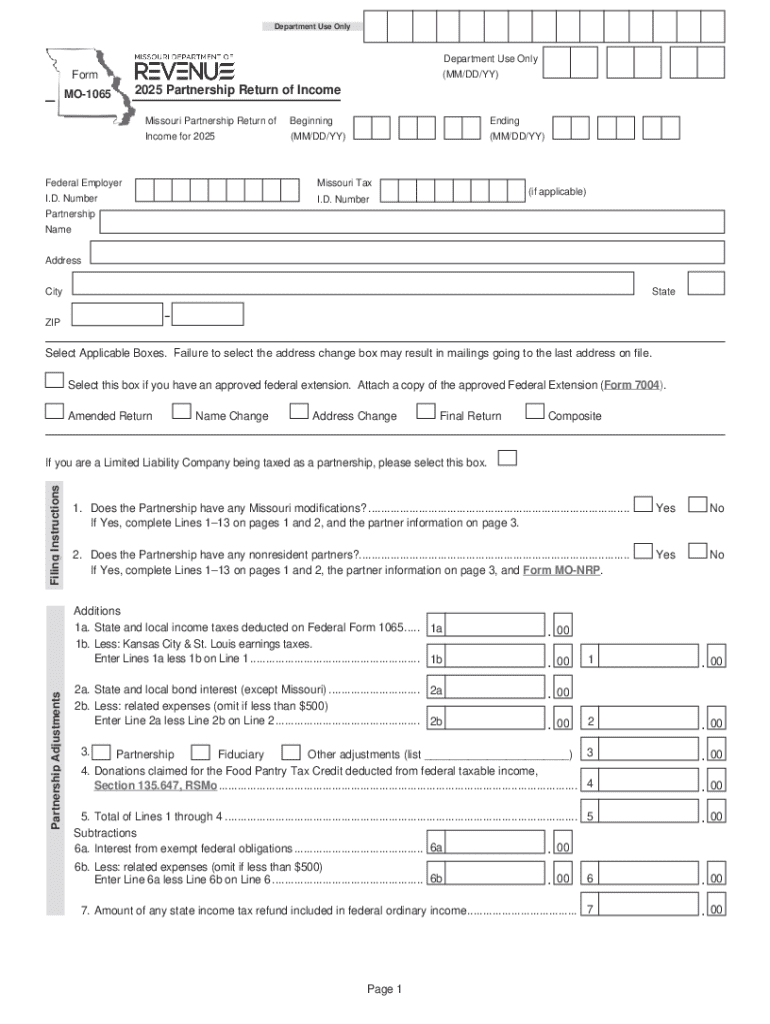

Get the free 2024-2026 form mo mo-1065 fill online, printable, fillable ... - dor mo

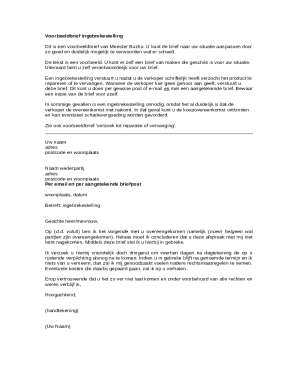

Get, Create, Make and Sign 2024-2026 form mo mo-1065

Editing 2024-2026 form mo mo-1065 online

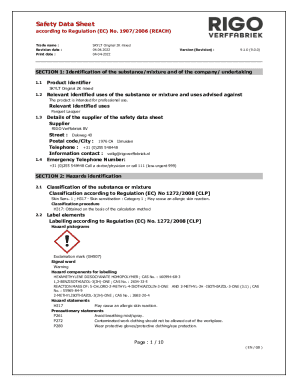

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024-2026 form mo mo-1065

How to fill out form mo-1065 - 2025

Who needs form mo-1065 - 2025?

Comprehensive Guide to Form MO-1065 for 2025

Overview of Form MO-1065 for 2025

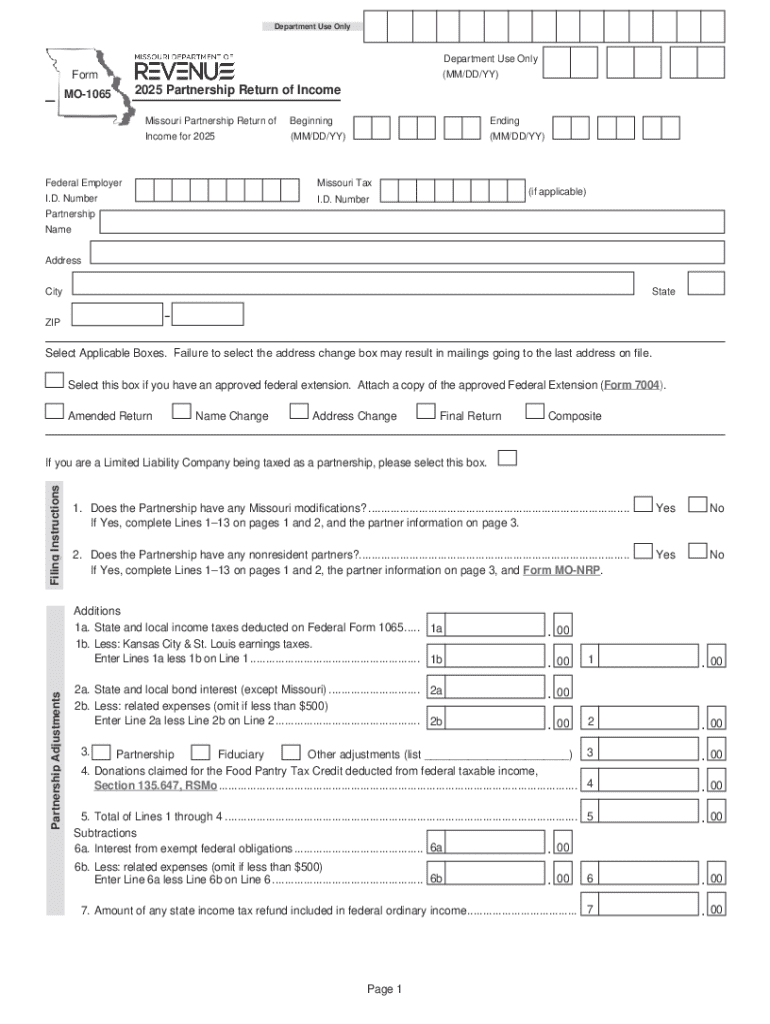

Form MO-1065 is the state of Missouri's partnership income tax return. This form is essential for partnerships and multi-member LLCs operating in Missouri, as it allows them to report the income, deductions, and credits that will be passed on to the partners for their individual tax liabilities. The importance of Form MO-1065 cannot be overstated; accurate completion is vital for compliance with state tax laws.

For the 2025 tax year, several key updates have been introduced to this form. These changes are designed to simplify the reporting process and ensure that the return reflects the most current tax laws. Understanding these updates is crucial for partnerships to ensure that they comply fully and avoid potential pitfalls.

Understanding eligibility for Form MO-1065

Partnerships and multi-member LLCs that conduct business in Missouri are required to file Form MO-1065. A partnership is defined as an association of two or more persons to carry on a trade or business, and this definition includes general partnerships, limited partnerships, and LLCs taxed as partnerships. This form is also necessary if the partnership has income that exceeds the state’s threshold, which is significant for maintaining compliance with state tax laws.

Certain exemptions exist, which may exclude some entities from filing Form MO-1065. For example, businesses that are classified solely as a sole proprietorship do not need to file. Additionally, partnerships that did not generate income during the year may be exempt; however, filing is encouraged to avoid future complications.

Detailed breakdown of the form

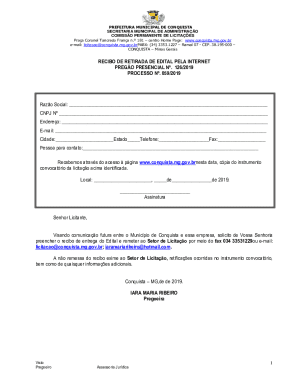

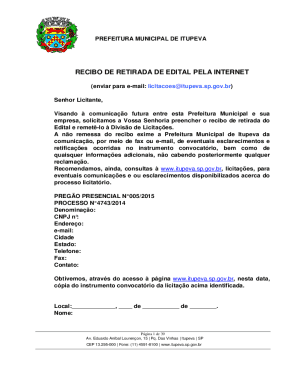

Filling out Form MO-1065 involves several specific sections, each requiring careful attention to detail. Below is a step-by-step guide to each part of the form.

Filing instructions for Form MO-1065

There are two primary methods for submitting Form MO-1065: e-filing and paper submission. E-filing is strongly recommended because it reduces the chance of manual errors and allows for faster processing times. Partners should utilize the Missouri Department of Revenue’s website for e-filing, ensuring they have all necessary documentation prepared beforehand.

Important deadlines include submitting the form by the 15th day of the fourth month after the end of the tax year. For many partnerships, that translates to an April 15 deadline for a calendar-year filer. Common mistakes to avoid include failing to report all income, missing deadlines, and not including partner signatures.

Interactive tools for completing Form MO-1065

Accessing dynamic tools can make the process of filling out Form MO-1065 much more manageable. pdfFiller offers several features designed to simplify the experience. Users can fill out forms directly within the platform, allowing for real-time edits and updates without the worry of starting over.

Collaboration features also facilitate teamwork, enabling all partners to view and participate in the activity. This enhanced supervision can ensure everyone is informed and provides input where necessary. Once completed, the form can be saved or shared securely, preserving the integrity of sensitive information.

Managing and storing completed forms

Effective document management is crucial for partnerships. Implementing best practices includes having a clear filing system for all forms related to taxes. Leveraging pdfFiller’s cloud storage capabilities allows for easy access to documents anytime and anywhere. This can prove invaluable during audits or when preparing future tax returns.

A well-organized digital filing cabinet for partnership documents not only enhances productivity but also reduces the risk of losing vital paperwork. Regular reviews of these documents can help ensure that all information is current and compliant.

FAQs and troubleshooting for Form MO-1065

Navigating the complexities of Form MO-1065 often raises several questions among filers. Common inquiries include accuracy in reporting partner information, handling multiple locations for the partnership, and the implications of late filing. It’s essential to understand these elements thoroughly to mitigate issues.

For troubleshooting, filers should carefully review the completed form for mistakes. Any discrepancies on Form MO-1065 can lead to penalties or extended processing times. Various resources are available for assistance, including the Missouri Department of Revenue’s official website and tax professionals.

Enhancing collaboration in partnership filings

Using pdfFiller’s collaboration features can significantly enhance the partnership filing process. By allowing multiple users to edit the same form, partnerships can ensure that all partners are included in the decision-making process. Techniques such as regular check-ins and shared deadlines can keep the filing process organized and communicative.

When all partners are informed and involved, the accuracy of the return is enhanced, leading to a smoother submission process. Keeping lines of communication open and utilizing electronic tools can create a more efficient workflow.

Importance of timely filings and compliance

Filing Form MO-1065 on time is critical. Late submissions can incur penalties, which can increase substantially the longer the delay continues. Furthermore, accuracy in partnership filings ensures compliance with Missouri tax regulations, safeguarding the partnership from potential audits and fines.

Utilizing reminders and tools can assist partners in staying on track. Setting internal deadlines ahead of the official due date allows ample time for review and collaboration. Form MO-1065 should not just be filed; it should be filed correctly and on time to maintain a positive standing with tax authorities.

Additional information for Missouri tax filers

Differences exist between federal and Missouri tax filing requirements that partnership filers must be aware of. For example, while the federal return may allow certain deductions, Missouri may have different stipulations. Understanding these variances is essential for proper filing.

Additional Missouri state tax forms can be found on the Missouri Department of Revenue's website. Engaging in ongoing tax education and updates helps ensure compliance and awareness of any changes in tax law.

Conclusion remarks on Form MO-1065

Successfully navigating Form MO-1065 requires thorough understanding and careful execution of each section. By leveraging the tools available through pdfFiller, users can enhance their document management experience, simplifying the collaboration and filing processes.

Ultimately, staying informed about the requirements and utilizing the right tools will contribute to a smoother filing process for partnerships in Missouri. The resources provided through pdfFiller empower users to take control of their documentation with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2024-2026 form mo mo-1065?

How can I fill out 2024-2026 form mo mo-1065 on an iOS device?

How do I fill out 2024-2026 form mo mo-1065 on an Android device?

What is form mo-1065 - 2025?

Who is required to file form mo-1065 - 2025?

How to fill out form mo-1065 - 2025?

What is the purpose of form mo-1065 - 2025?

What information must be reported on form mo-1065 - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.