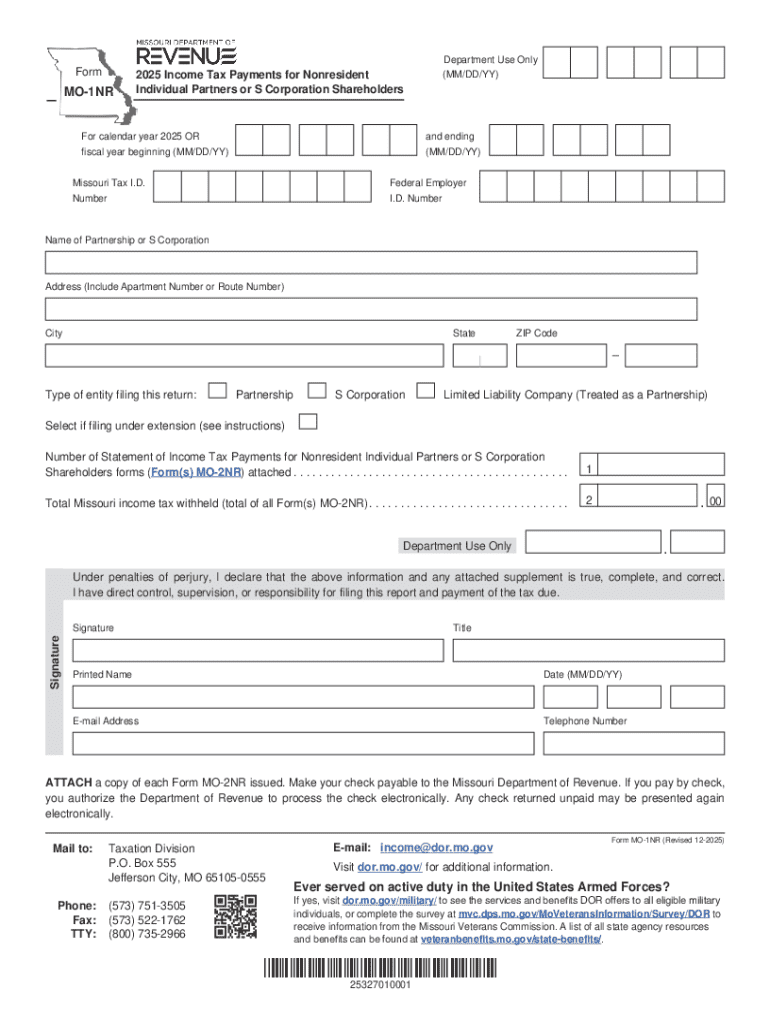

Get the free 25126010001 - Missouri Department of Revenue - MO.gov - dor mo

Get, Create, Make and Sign 25126010001 - missouri department

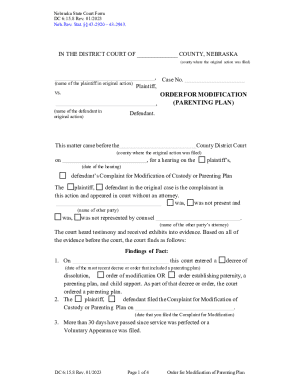

How to edit 25126010001 - missouri department online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 25126010001 - missouri department

How to fill out form mo-1nr - 2025

Who needs form mo-1nr - 2025?

Form MO-1NR - 2025 Form: A Comprehensive How-to Guide

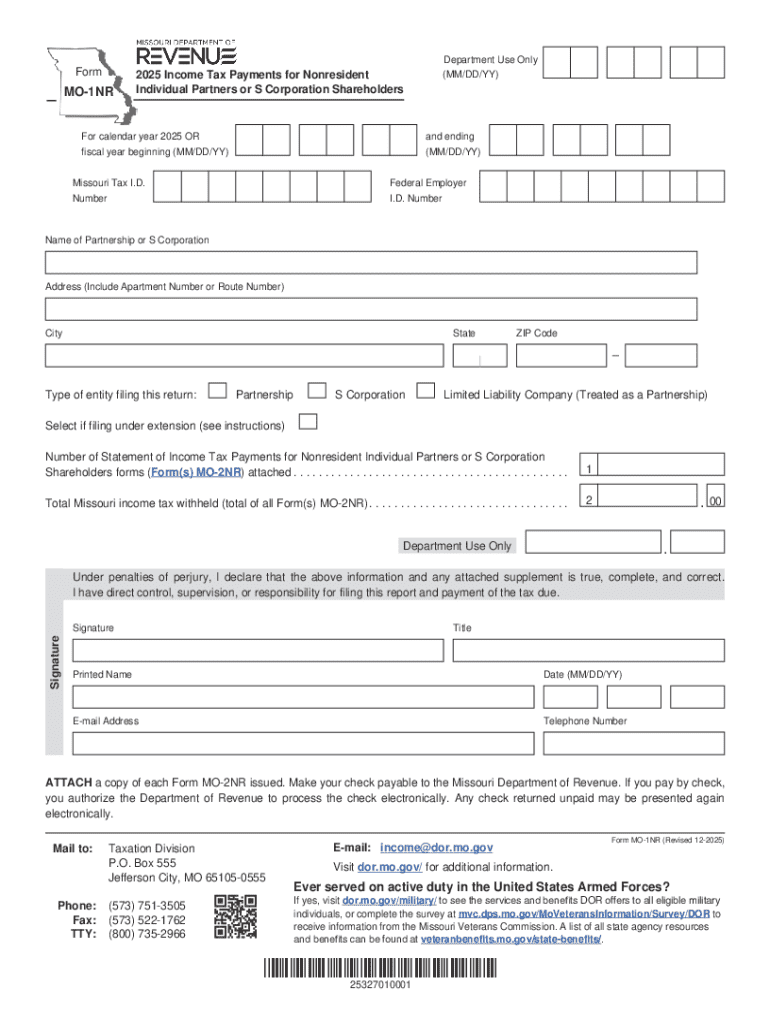

Overview of the Form MO-1NR - 2025

The Form MO-1NR is designed specifically for non-residents of Missouri who have earned income within the state. This 2025 edition reflects changes in tax law and filing requirements, emphasizing the importance of accurate reporting of income and credits. Completing this form accurately is not just a legal requirement but also essential for ensuring that you do not pay more tax than necessary.

Accurate completion of the Form MO-1NR is crucial as it affects your tax obligations and can prevent penalties. By filing correctly, you ensure that you receive any eligible refunds in a timely manner. Key deadlines for submission vary, typically aligning with federal tax deadlines but check the Missouri Department of Revenue website for specifics specific to the 2025 tax year.

Accessibility of the Form

Finding the Form MO-1NR online is straightforward. It is available through the Missouri Department of Revenue's website and can also be accessed via platforms like pdfFiller, which enhances usability for users. Individuals can easily navigate to the official resources or use pdfFiller to ensure they are using the correct, current version of the form.

For optimal access to the form on pdfFiller, it is recommended to use modern web browsers such as Chrome or Firefox, and devices ranging from desktops to tablets. These platforms ensure the best functionality, allowing users to take full advantage of the interactive features available.

Step-by-Step Instructions for Filling Out Form MO-1NR

Filling out Form MO-1NR can seem daunting, but breaking it down into manageable sections makes the process smoother. The form is divided into four main sections, each requiring specific information that is critical for tax calculations.

Section 1: Personal Information

This section requests your date of birth and Social Security number, which are vital for identity verification and processing your tax return. Ensure that the information provided here matches what is on your official documents.

Section 2: Income Reporting

In this section, you will report all your income that is subject to Missouri tax. Types of income to include are wages, rental income, and other taxable earnings. Be diligent in entering accurate figures as discrepancies could trigger audits or penalties.

Section 3: Deductions and Credits

You may be eligible for several deductions such as student loan interest or business expenses. Understanding which credits you qualify for, such as the Earned Income Tax Credit, can significantly reduce your tax liability, so it’s essential to familiarize yourself with these opportunities.

Section 4: Signatures and Certifications

Submitting the form requires proper signatures, confirming that all information is truthful and complete. When using pdfFiller, you can electronically sign the document, ensuring a smooth submission process that adheres to all legal standards.

Utilizing Interactive Tools on pdfFiller

pdfFiller offers advanced tools for enhancing your document experience. Specifically designed to simplify editing and signing processes, these features can significantly reduce the time spent filling out your Form MO-1NR.

Form Editing Features

Users can add text, images, and annotations to the form easily. The platform allows for adjustments to be made to form fields, enabling customization based on individual needs.

eSigning Made Simple

The eSigning process on pdfFiller is intuitive. Users can easily sign documents electronically and even collaborate with multiple signers, making the workflow efficient, especially for teams.

Document Management Options

pdfFiller also excels in document management, offering options to store and organize your forms efficiently. You can share documents with team members seamlessly, making it an ideal solution for collaborative environments.

Common Mistakes to Avoid

When filling out Form MO-1NR, several common mistakes can lead to issues with your submission. For instance, leaving out crucial information can result in delays or processing errors. Ensure that all sections are filled out completely and accurately.

Incorrect calculations, especially when reporting income or deductions, can also create significant complications. It’s advisable to double-check all numerical figures for accuracy. Finally, failing to review your form before submission can cost you—take the time to ensure everything is correct.

Frequently Asked Questions (FAQs)

Understanding how to amend mistakes after filing your Form MO-1NR is essential. If you find an error, you can typically amend the form by filling out a new MO-1NR and marking it as an amended return. This should be done as soon as possible to rectify any issues.

If you happen to miss the filing deadline, it’s crucial to take immediate action. You may need to file for an extension or contact the tax authority for guidance. For any additional questions or clarifications regarding the form, reaching out to support via pdfFiller or the Missouri Department of Revenue can provide you with the necessary assistance.

Tips for Teams and Businesses

For teams, utilizing collaborative features on pdfFiller can significantly improve efficiency in submissions. By allowing team members to work on the Form MO-1NR simultaneously, you can streamline the process and lessen the chance of errors.

Implementing best practices for document review is crucial. Create a checklist of requirements for each form and ensure every individual involved adheres to these guidelines. Additionally, the organizational benefits of using pdfFiller for tracking form submissions promote transparent and effective communication among teams.

Case Studies

Numerous individuals and businesses have successfully submitted the Form MO-1NR using pdfFiller. For example, a freelance contractor reported a smoother filing process by utilizing the editing and eSigning features on pdfFiller, which cut down their processing time significantly.

Testimonials from users showcase how the platform helped them manage their forms more effectively. Many have noted that the user-friendly interface, along with robust support features, allowed them to focus more on their work rather than on tedious documentation.

Next Steps After Filing

After submitting your Form MO-1NR, understanding the review process is essential. The Missouri Department of Revenue will typically verify the information provided, which may take time depending on their current workload. It is advisable to monitor your filing status through their online portal or through pdfFiller for added convenience.

Expect communications from the tax authority regarding the outcome of your filing. This may include confirmations or requests for additional information. Staying proactive in following up can ensure any queries are resolved quickly.

Latest Updates for 2025

The Form MO-1NR for 2025 includes several key updates reflecting changes in state tax laws. For instance, adjustments in income tax brackets may impact calculations for many filers, and new deductions or credits have been introduced to support taxpayers amid economic fluctuations.

It's crucial for users to stay informed of these changes as they can substantially affect your overall tax strategy. Reviewing the Missouri Department of Revenue announcements and resources can ensure you are well-prepared for your filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 25126010001 - missouri department to be eSigned by others?

Where do I find 25126010001 - missouri department?

How do I make changes in 25126010001 - missouri department?

What is form mo-1nr - 2025?

Who is required to file form mo-1nr - 2025?

How to fill out form mo-1nr - 2025?

What is the purpose of form mo-1nr - 2025?

What information must be reported on form mo-1nr - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.