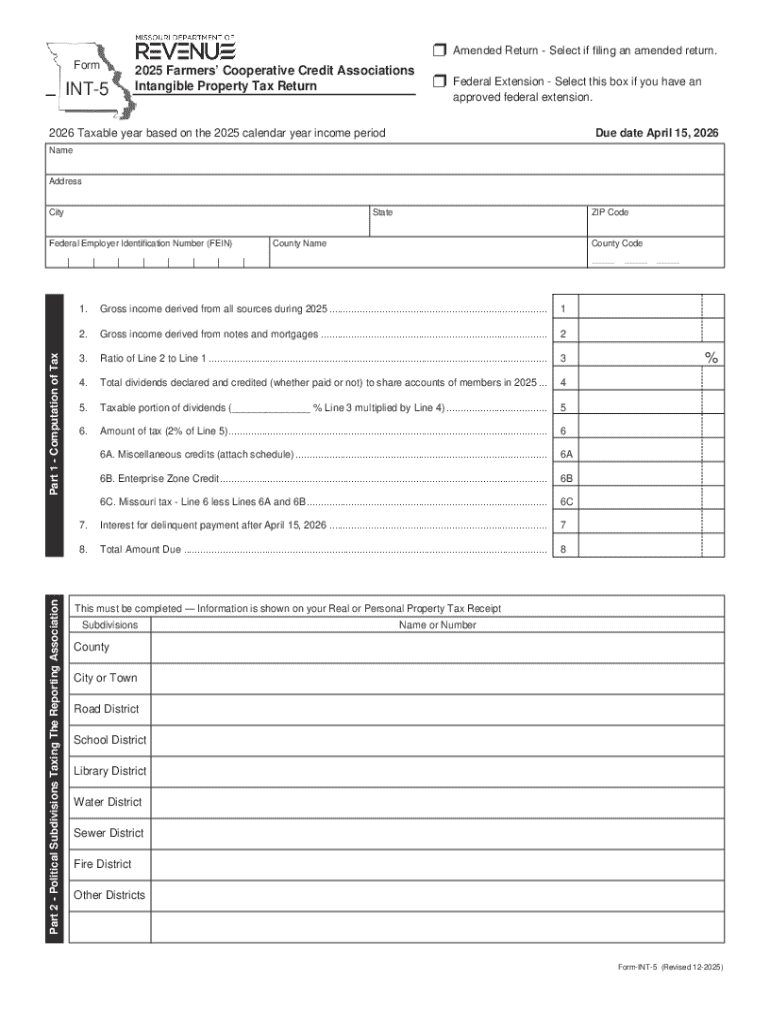

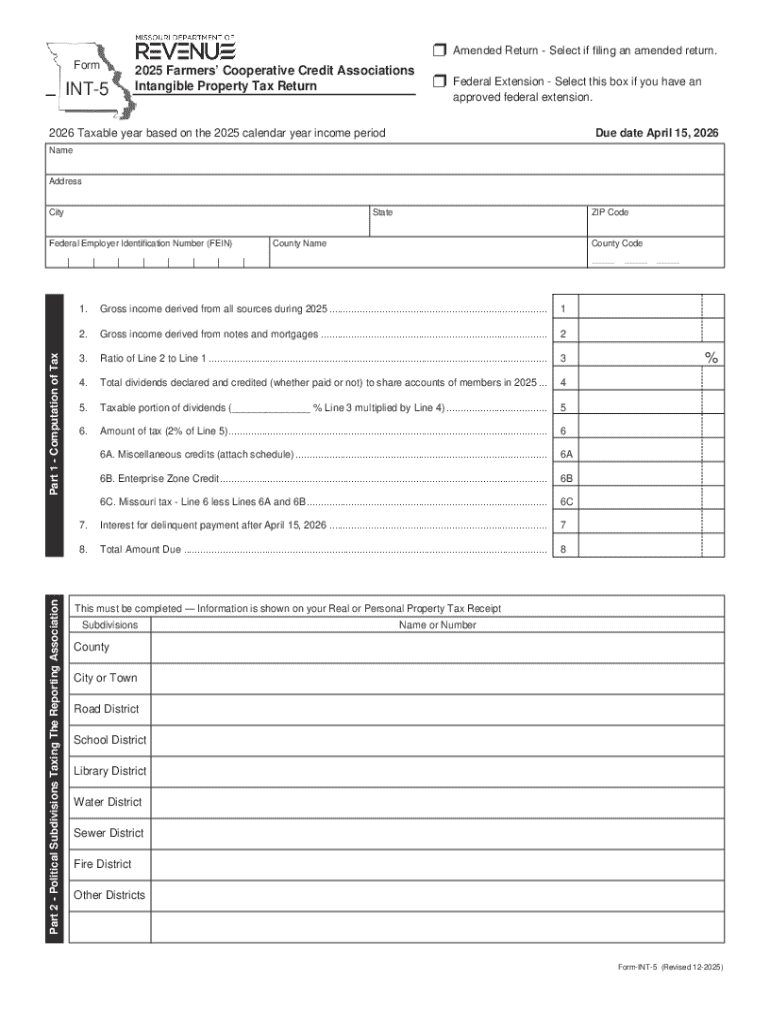

Get the free Form INT-5 - 2025 Farmers Cooperative Credit Associations Intangible Property Tax Re...

Get, Create, Make and Sign form int-5 - 2025

Editing form int-5 - 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form int-5 - 2025

How to fill out form int-5 - 2025

Who needs form int-5 - 2025?

Form Int-5 - 2025 Form: Your Complete Guide to Submission and Management

Overview of the Form Int-5 - 2025

Form Int-5 is a crucial document for individuals and organizations to report their financial and operational details for the year 2025. The form serves various departments and regulatory bodies, ensuring transparency and compliance with established guidelines.

The primary purpose of using Form Int-5 is to provide a detailed overview of financial disclosures necessary for taxation and regulation. The importance of this form in 2025 cannot be overstated, as organizations face increased scrutiny regarding their financial activities.

Key deadlines for submitting Form Int-5 vary but typically align with fiscal year-end reporting. Organizations should keep track of these deadlines not only for legal compliance but also to avoid penalties.

Preparing to use the Form Int-5

Preparing to fill out Form Int-5 involves gathering essential information and documents. You will need to list personal identification information, financial records, and any other relevant documentation that the specific guidelines outline.

Using tools like pdfFiller can significantly simplify the process of filling out the form. With features that allow for editing, e-signing, and document storage, pdfFiller makes it easier to manage all stages of the document process. This platform is compatible with various devices and operating systems, allowing users to access their forms from virtually anywhere.

Before starting, it's also recommended to organize all your information efficiently. Create a checklist of required documents, so you ensure nothing is overlooked when completing Form Int-5.

Detailed instructions for filling out Form Int-5 - 2025

Filling out Form Int-5 involves several key sections, each of which should be approached with careful attention to detail.

While filling out the form, avoid common mistakes such as incomplete sections, wrong financial figures, or unclear assumptions. Each entry must be precise to prevent delays in processing.

Editing and modifying your Form Int-5

Editing options available on pdfFiller simplify the process of reviewing and modifying your Form Int-5. If errors are discovered after the initial submission, you can easily make corrections without losing your original data.

Maintaining a version history is beneficial in case discrepancies arise. This ensures that you have clear documentation of changes made over time.

Collaborating with others

The collaborative features of pdfFiller enhance teamwork when filling out Form Int-5. Stakeholders or team members can be invited to review and contribute to the document, fostering an organized environment.

This efficiency promotes clarity throughout the process and allows timely resolution of queries that may arise during the document's creation.

Submitting the Form Int-5

Once Form Int-5 is finalized, various submission options are available to ensure your document reaches the appropriate authorities on time.

Utilizing pdfFiller allows you to track your submission status, reducing anxiety over whether your Form Int-5 has been received and processed correctly.

Managing and storing your Form Int-5 documents

Proper management and storage of your Form Int-5 documents are critical to maintaining organized records. Best practices include naming files clearly and categorizing them into relevant folders.

With pdfFiller, you can easily manage your documents, ensuring everything is stored securely and remains accessible when needed.

Troubleshooting common issues

While filling out Form Int-5, you may encounter various issues. Knowing how to address these can save time and stress.

Understanding these common concerns related to Form Int-5 will empower you to handle them effectively, ensuring a smooth documentation process.

Best practices for document management in 2025

As we move further into 2025, the landscape of document submission and management continues to evolve. Embracing digital tools like pdfFiller can enhance your capabilities in handling documents efficiently.

pdfFiller stands out by providing comprehensive solutions catering to users' needs in managing documentation effectively in 2025 and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form int-5 - 2025 to be eSigned by others?

How do I complete form int-5 - 2025 online?

How do I fill out form int-5 - 2025 on an Android device?

What is form int-5 - 2025?

Who is required to file form int-5 - 2025?

How to fill out form int-5 - 2025?

What is the purpose of form int-5 - 2025?

What information must be reported on form int-5 - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.