Get the Get the free Form MO1040: Missouri Individual Income Tax Return - dor mo

Get, Create, Make and Sign form mo1040 missouri individual

Editing form mo1040 missouri individual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form mo1040 missouri individual

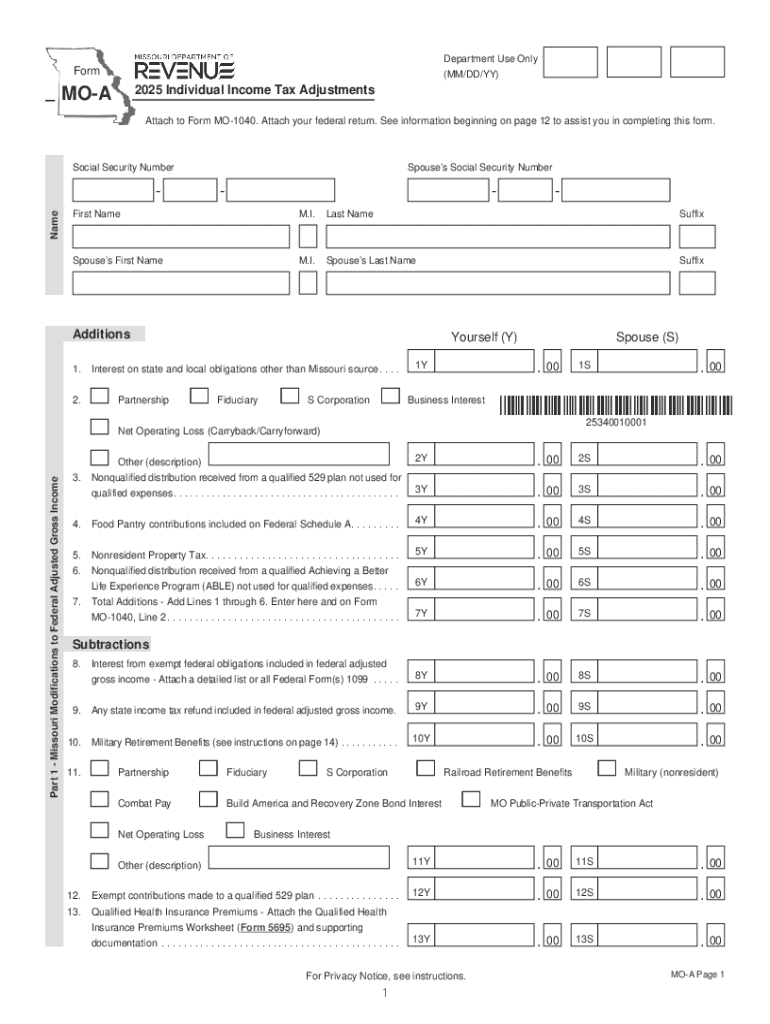

How to fill out form mo-a - 2025

Who needs form mo-a - 2025?

Understanding and Completing Form MO-A - 2025: A Comprehensive Guide

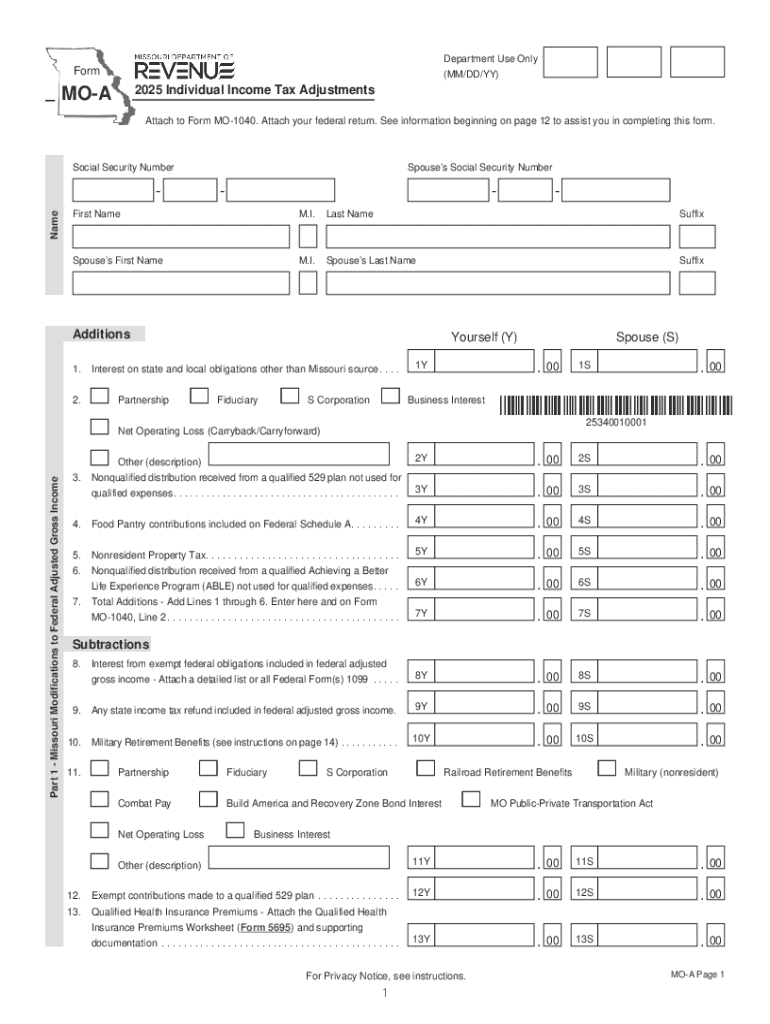

Understanding the form MO-A - 2025

Form MO-A is a tax form specific to the state of Missouri, utilized by residents to report their income and calculate their state tax obligations. Understanding this form is crucial, especially for the tax year 2025, as it dictates how various income types and deductions are applied to determine liabilities. As tax season approaches, ensuring accurate completion of Form MO-A can significantly affect tax return outcomes.

The purpose of Form MO-A is to ensure that all taxable income is reported and to provide a mechanism for applying any allowable credits and deductions, thus influencing the final amount of tax owed or the refund due. For many individuals and families, accurately completing this form is a milestone that can either alleviate or exacerbate financial burdens.

Typically, anyone filing taxes in Missouri, including individuals and businesses, would need to complete Form MO-A if they earn reportable income, whether it's wages, tips, or self-employment income. Understanding whether you fall into this category will help you avoid unnecessary penalties or delays in processing your tax return.

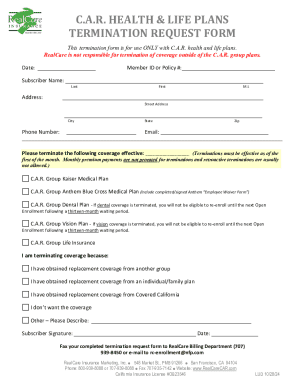

How to access form MO-A - 2025

Accessing Form MO-A for the 2025 tax year is straightforward, with a variety of options available for your convenience. You can download the form directly from official state revenue websites or utilize online platforms like pdfFiller, which offers additional tools for editing and managing your forms seamlessly.

Using pdfFiller not only provides access to the form but also allows for enhanced viewing options and tools that can save time and reduce errors during the filing process.

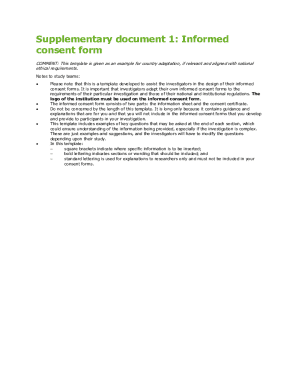

Step-by-step guide to filling out form MO-A

Filling out Form MO-A may seem daunting at first, but breaking it down into manageable sections simplifies the process. Here’s a detailed overview of each section you’ll encounter.

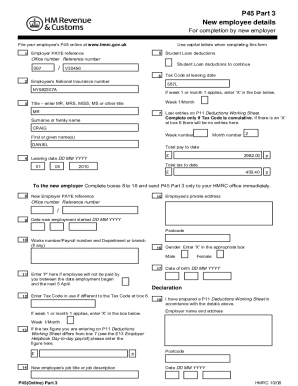

Section 1: Personal information

This section requires basic personal details such as your name, address, and Social Security number. Ensuring that all fields are filled accurately is crucial to prevent processing delays. Double-check the spellings and numbers to avoid common mistakes, such as typos in your Social Security number, which is a frequent issue.

Section 2: Income information

In this section, you will report all sources of income. This includes, but is not limited to, wages, retirement distributions, rental income, and self-employment earnings. Gather documentation like W-2s, 1099s, or other income proof before filling this out to ensure accuracy.

Section 3: Deductions and credits

Form MO-A allows for various deductions that can significantly lower your taxable income. For the 2025 tax year, understanding what you’re eligible for—such as the standard deduction, contributions to retirement accounts, and tuition credits—can dramatically change your tax outcome. Be sure to provide necessary documentation and receipts.

Section 4: Additional income adjustments

This section addresses any adjustments to your income regardless of its source. It’s essential to understand how to report income from investments, side jobs, and other non-traditional means. This information helps in conveying the full picture to the tax authorities.

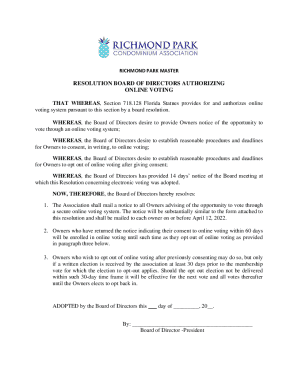

Section 5: Signature and submission guidelines

Completing the form is not just about filling out fields; your signature verifies the accuracy of the information provided. Submitting your form can be done electronically through portals like pdfFiller, which offers click-to-sign functions for ease of use.

Editing and customizing your form MO-A on pdfFiller

Once you have accessed Form MO-A through pdfFiller, the platform equips you with powerful tools to edit the form easily. Users can modify text, adjust formatting, or add annotations as necessary, creating a personalized document that suits their particular tax situation.

The platform also allows you to collaborate with team members or tax professionals, enabling on-the-fly adjustments and feedback, which enhances efficiency.

Frequently asked questions about form MO-A - 2025

Understanding commonly asked questions surrounding Form MO-A is vital in preparing for the upcoming tax season. Here are some FAQs to illuminate your filing process.

For first-time filers, gathering documentation in advance and using platforms like pdfFiller can make the process more manageable.

Accessing additional support for form MO-A

If you find yourself needing extra help while filling out Form MO-A, several resources are at your disposal. Utilizing support options through pdfFiller can provide immediate assistance, with the platform’s customer service team ready to address queries or concerns.

Best practices for managing your forms

Efficient document management can simplify your entire tax filing experience. By organizing all your personal and financial documents throughout the year, you’ll find tax time much less stressful. Store receipts, W-2s, and any additional financial documentation in a designated space.

These practices not only help during tax season but also support long-term financial record keeping.

Success stories: How pdfFiller streamlined form MO-A submissions

Utilizing platforms like pdfFiller has transformed the filing experience for many users. Case studies demonstrate how individuals and teams have adapted to using this digital solution. For instance, a small business owner reported significant time savings by using the platform to edit and submit Form MO-A efficiently.

These success stories underline the value of embracing technology for tasks that can otherwise be tedious, fostering a smoother tax filing experience.

Related forms and resources

Beyond Form MO-A, numerous other Missouri tax forms may be relevant based on your circumstances. Familiarizing yourself with these forms can streamline your overall tax preparation. Don’t hesitate to explore options that align with both state and federal tax requirements.

Leveraging these related resources can help you navigate the complexities of tax filing with ease.

Using pdfFiller to manage Form MO-A will simplify the filing process and reduce the stress associated with tax season. The platform’s extensive features empower users to fill out, edit, and submit forms accurately and on time. As we approach the tax year 2025, embracing these digital solutions will not only save time but also ensure you remain compliant and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form mo1040 missouri individual from Google Drive?

How do I make edits in form mo1040 missouri individual without leaving Chrome?

Can I sign the form mo1040 missouri individual electronically in Chrome?

What is form mo-a - 2025?

Who is required to file form mo-a - 2025?

How to fill out form mo-a - 2025?

What is the purpose of form mo-a - 2025?

What information must be reported on form mo-a - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.