Get the free About Form 8826, Disabled Access Credit - dor mo

Get, Create, Make and Sign about form 8826 disabled

How to edit about form 8826 disabled online

Uncompromising security for your PDF editing and eSignature needs

How to fill out about form 8826 disabled

How to fill out mo-8826 disabled access credit

Who needs mo-8826 disabled access credit?

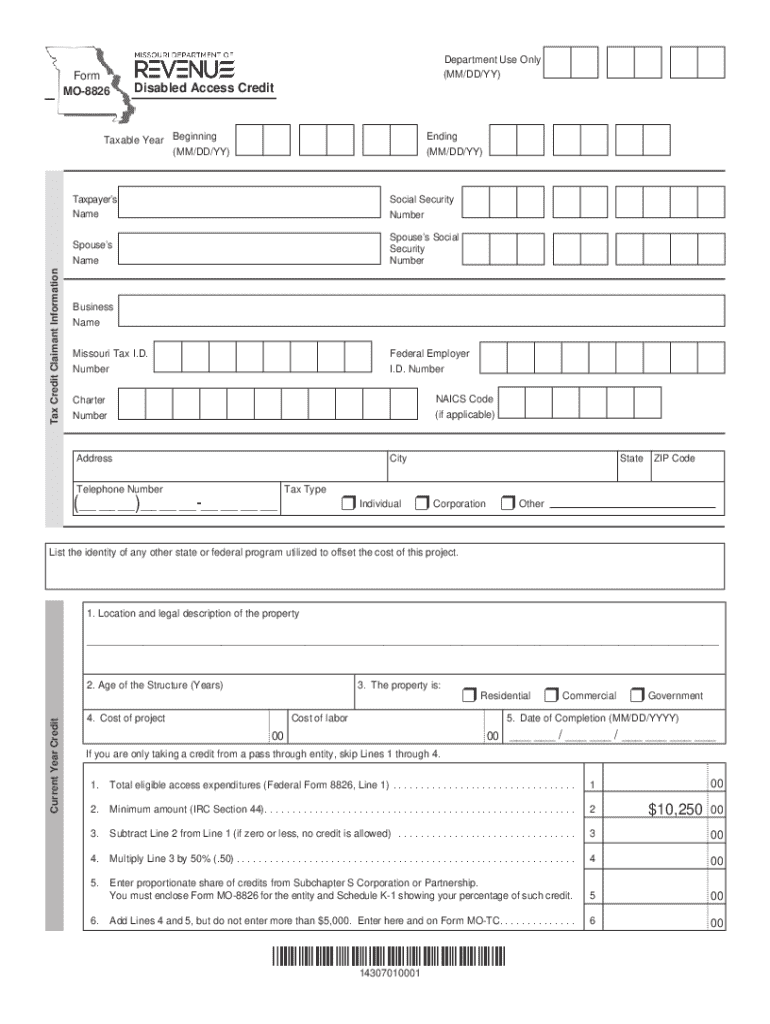

MO-8826 Disabled Access Credit Form: A Comprehensive Guide

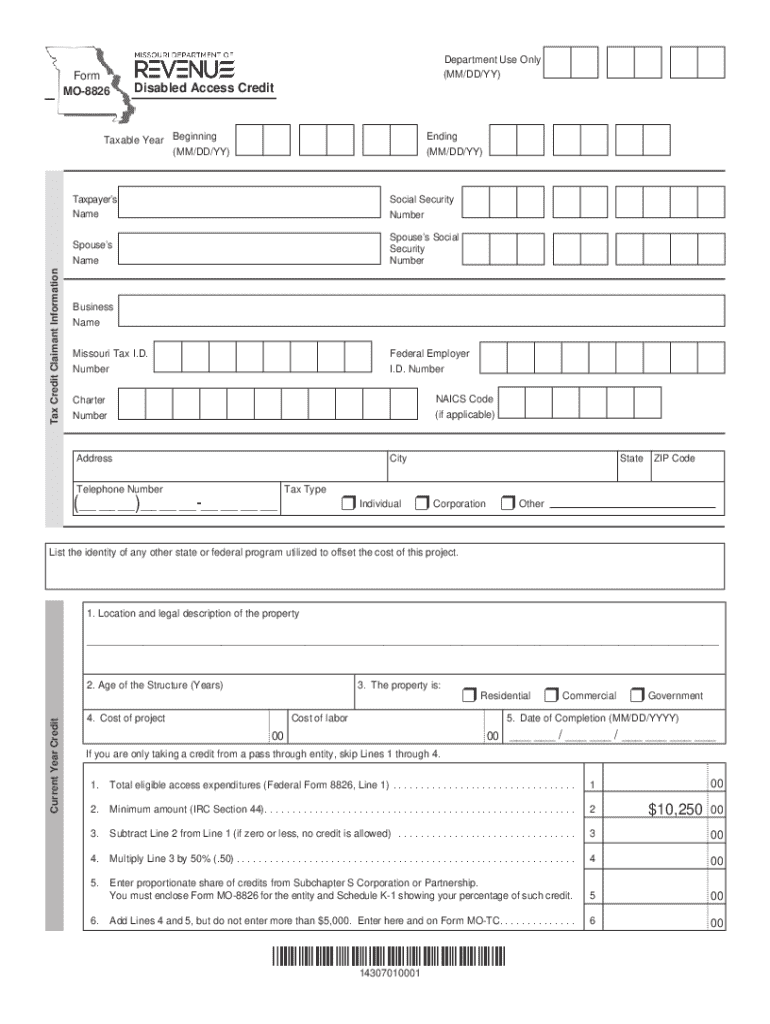

Understanding the MO-8826 Disabled Access Credit Form

The MO-8826 Disabled Access Credit is a vital form in the realm of accessibility for individuals with disabilities, specifically designed to incentivize businesses to enhance their facilities and services. This credit can significantly alleviate the financial burden on small businesses or nonprofit organizations investing in necessary adaptations to promote inclusivity.

Its importance lies not only in the financial assistance it provides but also in its role in promoting equal opportunities for disabled individuals. By making facilities accessible, businesses can attract a broader clientele, demonstrate social responsibility, and create a more inclusive environment.

Purpose of the MO-8826 Disabled Access Credit

The primary purpose of the MO-8826 Disabled Access Credit is to enhance accessibility for individuals with disabilities across various sectors. By making changes to a business's physical environment, such as installing ramps or modifying restrooms, facilities can welcome everyone, regardless of their abilities.

Furthermore, this credit supports small businesses by easing the financial burden of making necessary improvements. These adjustments may include purchasing accessible equipment or implementing services that cater specifically to individuals with disabilities. Ultimately, the aim is to encourage companies to invest in these critical accessibility improvements, creating a more inclusive society.

Who is eligible for the MO-8826 Disabled Access Credit?

Eligibility for the MO-8826 Disabled Access Credit primarily revolves around small businesses and nonprofit organizations. According to IRS criteria, a small business is typically defined as having fewer than 30 employees and gross receipts under a specified threshold. Nonprofit organizations also qualify, providing they meet the same financial requirements.

In addition to the organization type, specific requirements must be adhered to for eligibility. Qualifying expenses may include the cost of purchasing or upgrading accessible facilities or equipment that supports independence for individuals with disabilities. Moreover, businesses that employ individuals with disabilities may find additional support through this credit.

How the MO-8826 Disabled Access Credit works

Understanding how the MO-8826 Disabled Access Credit works is essential for potential claimants. The credit is typically calculated as a percentage of qualifying expenses, with specific caps based on the total expenditures in a given year. For businesses investing in significant changes to enhance accessibility, this can lead to substantial savings.

Qualifying expenses can cover various enhancements, including building modifications, the installation of accessible equipment, or the purchase of services that facilitate equal access. The percentage of credit is often set at a standard rate, but there may also be annual caps that limit the maximum credit available. This structured approach encourages businesses to ensure they are investing adequately in improving accessibility.

Step-by-step procedures to claim the MO-8826 Disabled Access Credit

To claim the MO-8826 Disabled Access Credit, follow these essential steps to ensure a successful submission. Proper documentation and form completion are crucial to safeguarding your claim against rejection and potential audits.

Step 1: Determine if your business qualifies for the credit. Review the eligibility criteria mentioned above and assess your organization’s size and previous expenses related to accessibility improvements.

Step 2: Collect documentation of qualifying expenses. Gather all relevant invoices, contracts for work completed, and receipts for materials purchased to substantiate your claim.

Step 3: Complete Form MO-8826 by following detailed instructions for each section. Pay close attention to commonly made mistakes, such as incorrect calculations or missing signatures.

Step 4: Submit the form to the appropriate tax authority, ensuring that you meet the specified deadlines for submission. Review your options for electronic versus paper filing to choose the most efficient method for your organization.

Tips for maximizing your MO-8826 Disabled Access Credit claim

To optimize your claim for the MO-8826 Disabled Access Credit, maintaining meticulous records is paramount. By organizing your documentation and ensuring everything is accounted for, you can lay the groundwork for a solid submission. This proactive step not only simplifies the claiming process but also prepares the business for potential future claims.

Additionally, consider utilizing resources such as pdfFiller to streamline documentation management. The platform’s powerful tools can assist you in editing, signing, and efficiently collaborating on forms. Should your claim situation become complex, seeking professional advice is wise. Tax professionals can provide tailored insights and guidance essential for navigating unique circumstances.

FAQs about the MO-8826 Disabled Access Credit Form

Understanding the nuances of filing for the MO-8826 Disabled Access Credit can raise various questions. One common inquiry is: What happens if I misfile my claim? Misfiling can lead to delays or even rejection of the claim, so it is crucial to double-check all entries and adhere to the guidelines strictly.

Another prevalent concern involves penalties for claiming non-eligible expenses. Accurately categorizing your expenses is essential, as inaccuracies can result in penalties or loss of credits. Lastly, many claimants wish to track the status of their submitted forms. Keeping communication open with the tax authority and using their online tracking tools can assist you in staying updated.

Interactive tools and resources on pdfFiller

pdfFiller provides a wealth of interactive tools and resources that enhance the document creation and management process for users. One significant advantage of pdfFiller is the ability to access essential forms and documents from anywhere, making it a versatile solution for busy professionals managing multiple tasks simultaneously.

The platform’s step-by-step editing and signing tools are tailored specifically for forms like the MO-8826. These features streamline the preparation process, ensuring all required information is captured accurately. Furthermore, collaboration features allow teams to work together effectively, making it easy to share information and finalize submissions swiftly.

Conclusion of insights

The MO-8826 Disabled Access Credit holds significant importance in promoting accessibility and inclusivity within the business landscape. By providing financial support to small businesses and nonprofit organizations, this credit empowers them to create environments conducive to all individuals, including those with disabilities.

Leveraging tools like pdfFiller not only simplifies the documentation processes involved in claiming the credit but also contributes to efficient management of essential forms. By utilizing comprehensive resources such as these, organizations can ensure they effectively navigate the complexities of the MO-8826 Disabled Access Credit while fostering a more inclusive community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit about form 8826 disabled online?

Can I create an electronic signature for the about form 8826 disabled in Chrome?

Can I create an eSignature for the about form 8826 disabled in Gmail?

What is mo-8826 disabled access credit?

Who is required to file mo-8826 disabled access credit?

How to fill out mo-8826 disabled access credit?

What is the purpose of mo-8826 disabled access credit?

What information must be reported on mo-8826 disabled access credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.