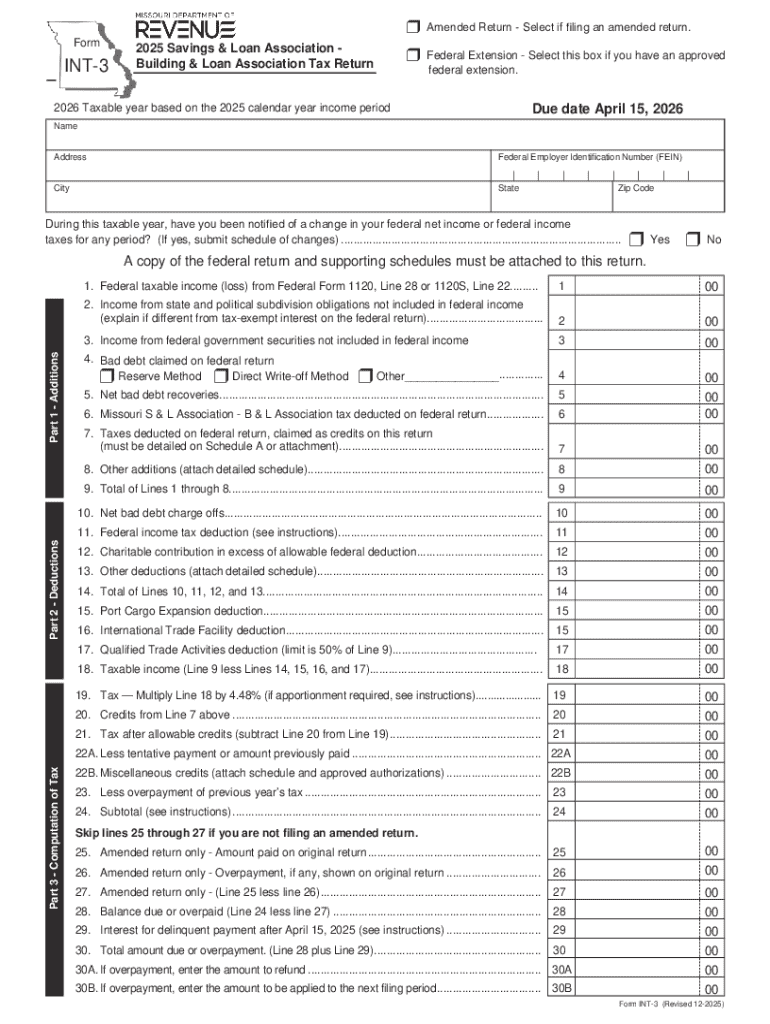

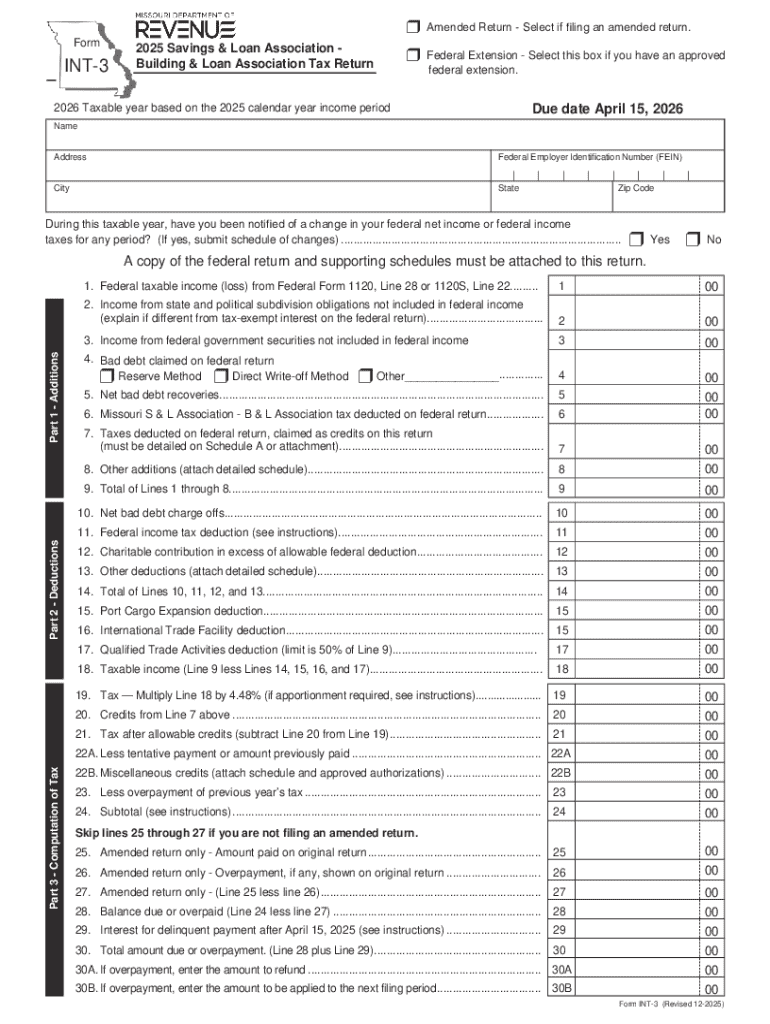

Get the free Form INT-3 - 2025 Savings & Loan Association - Building & Loan Assoc...

Get, Create, Make and Sign form int-3 - 2025

How to edit form int-3 - 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form int-3 - 2025

How to fill out form int-3 - 2025

Who needs form int-3 - 2025?

Understanding the form int-3 - 2025 Form: A Comprehensive Guide

Overview of the int-3 - 2025 form

The form int-3 - 2025 serves as a vital document in various administrative and financial processes, ensuring that essential data is accurately captured and reported. This form is particularly significant for individuals and businesses that need to meet updated regulatory requirements set forth for the year 2025. As regulations evolve, so does the necessity for precise documentation, making the int-3 form a key player in compliance and operational efficiency.

With a series of updates introduced for 2025, the form includes new features designed to streamline the completion process while enhancing data accuracy. Understanding these changes is crucial for users to avoid delays or errors that could impact their operations.

Specific requirements for filling out the int-3 - 2025 form

Filling out the form int-3 - 2025 necessitates certain essential information that must be accurately provided. Users should prepare for the process by gathering all relevant personal and financial data. This proactive approach helps mitigate common errors that could disrupt submission and compliance.

Understanding specific requirements entails knowing what information is strictly necessary, including personal identifiers, financial records if applicable, and any other supplemental documentation that can support your submission. It is vital to grasp these requirements fully to ensure the registration process proceeds efficiently.

Detailed instructions for completing the int-3 - 2025 form

Completing the int-3 - 2025 form is straightforward when approached methodically. Starting with the preparation of your information is essential. This step ensures that once you begin the form completion, all critical data is at your fingertips.

The next phases involve filling in basic sections, reviewing mandatory fields carefully, and deciding whether additional details are necessary. These systematic steps not only simplify the process but also enhance the accuracy of the submitted information.

Editing and customizing the int-3 - 2025 form

Editing the int-3 - 2025 form can be done efficiently using PDF editing tools. It’s crucial to find a method that allows you to change existing fields or add comments without losing the integrity of the document. Tools like pdfFiller are particularly beneficial in this context.

When collaborating with team members, it’s crucial to establish a version control system to keep track of changes made to the document, ensuring that your team is working with the most current information.

Signing the int-3 - 2025 form

Signing the int-3 - 2025 form can be done through traditional means or electronically. The choice between e-signing versus traditional signing often hinges on convenience and the requirements of the entity receiving the form. Many organizations prefer digital signatures for their efficiency and security.

When utilizing e-signatures, ensuring that your signature holds legal validity is paramount. Using a trusted platform like pdfFiller minimizes risks associated with signature authenticity.

Submitting the int-3 - 2025 form

The submission of your form int-3 - 2025 can typically be done via multiple channels, including online submissions or traditional mail-in options. Understanding the preferred submission method of the receiving entity can save time and reduce complications.

Once the form has been submitted, tracking the submission status is essential. Being aware of your submission status will help you respond to any requests or follow-ups promptly.

Troubleshooting common issues with the int-3 - 2025 form

Despite thorough preparation, issues can still arise when completing the int-3 - 2025 form. Addressing these potential issues head-on is critical to ensure compliance and to prevent any unnecessary delays.

Common errors often stem from misinterpretation of form requirements or technical difficulties during submission. Being aware of frequently encountered issues can empower users to address them effectively.

Interactive tools and features for enhanced form management

Interactive tools provide significant advantages in managing the form int-3 - 2025 effectively. Utilizing cloud-based solutions, users can experience enhanced flexibility in editing, sharing, and storing documents crucial for team collaboration.

Tools like those offered by pdfFiller, which include advanced features such as real-time collaboration and data analytics, are invaluable for users seeking to optimize their document management process.

Case studies: Success stories using the int-3 - 2025 form

Case studies highlight real-world applications of the form int-3 - 2025, showcasing how various individuals and teams have effectively utilized the document to enhance their workflows. Feedback from users demonstrates the practical benefits of understanding and using the form efficiently.

Insights from these users provide best practices that can guide new users in navigating similar processes, thus streamlining operations further.

Future changes and updates to the int-3 form series

Looking ahead, the evolution of the int-3 form series will reflect ongoing changes in regulatory requirements and user feedback. A proactive approach will enable users to stay ahead of these changes, ensuring continued compliance and efficiency within their processes.

Organizations like pdfFiller stay attuned to emerging trends in form management and prioritize adaptations that simplify user experience and data integrity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form int-3 - 2025 in Gmail?

How do I make changes in form int-3 - 2025?

How can I fill out form int-3 - 2025 on an iOS device?

What is form int-3 - 2025?

Who is required to file form int-3 - 2025?

How to fill out form int-3 - 2025?

What is the purpose of form int-3 - 2025?

What information must be reported on form int-3 - 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.