Get the free DOR: Fiduciary Income Tax Forms - dor mo

Get, Create, Make and Sign dor fiduciary income tax

How to edit dor fiduciary income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dor fiduciary income tax

How to fill out form mo-1041 - 2023

Who needs form mo-1041 - 2023?

Form MO-1041 - 2023 Form: A Comprehensive How-To Guide

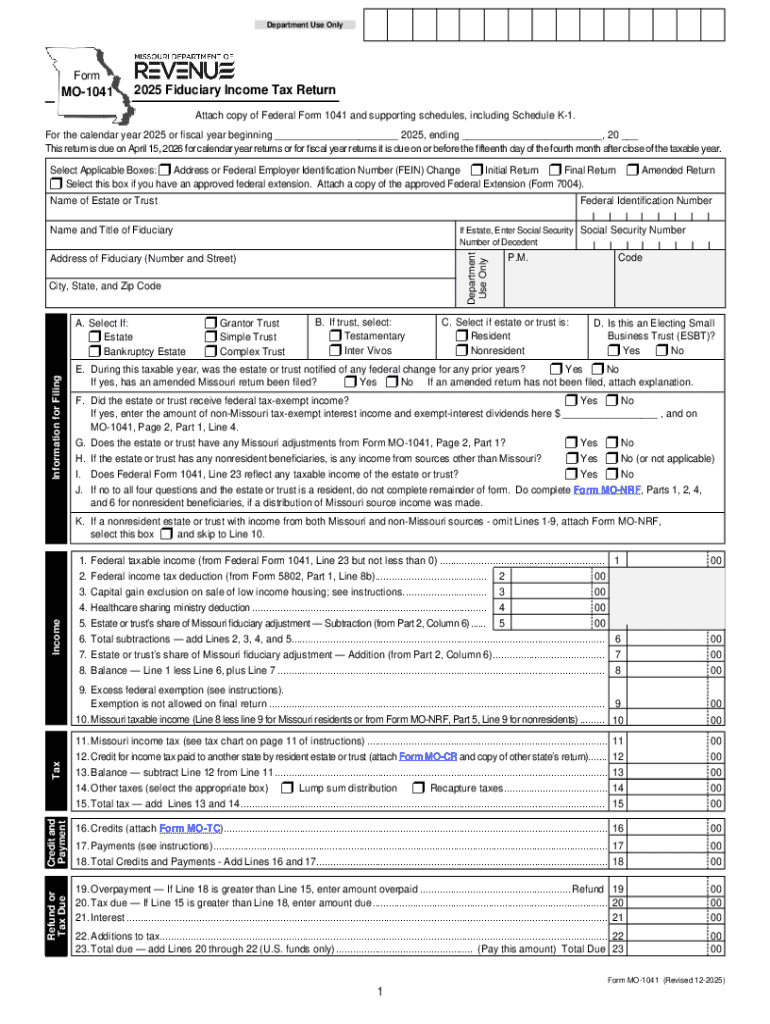

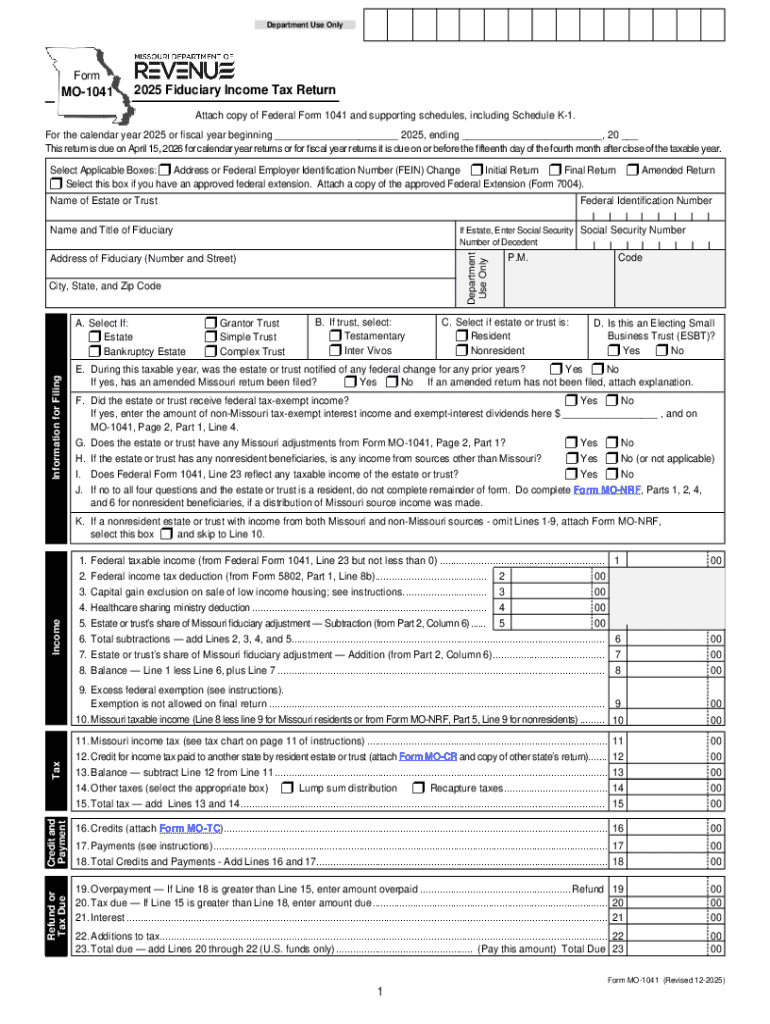

Understanding the MO-1041 form

The MO-1041 form, officially known as the Missouri Fiduciary Income Tax Return, is a critical document for various entities, including estates, trusts, and certain partnerships, that generates taxable income in the state of Missouri. This form is essential for reporting income earned by a fiduciary and helps ensure compliance with state tax laws.

Filing the MO-1041 is usually required when the taxable income of the estate or trust exceeds a specific threshold set by the state. Entities such as trusts or estates, which involve the management of assets on behalf of beneficiaries, or complex partnerships that qualify must file this form to correctly report their earnings and pay due taxes.

Key features and benefits

Filing the MO-1041 form online provides numerous advantages, including ease of access, quick submission, and comprehensive tracking. Digital completion means you can fill it out at any time from anywhere, significantly boosting convenience over traditional filing methods.

Timely filing is vital as it minimizes the risk of incurring financial penalties. Ensuring accuracy in your form can also provide benefits, such as faster processing times and fewer inquiries from tax authorities. With pdfFiller, you can streamline this process, making it user-friendly and efficient.

Navigating the form

To get started with the MO-1041 form, access the Missouri Department of Revenue website or use reliable online platforms such as pdfFiller. The MO-1041 form is usually available for download in various formats, including PDFs, suitable for both desktop and mobile devices.

If you prefer a printed version, you can find physical copies in tax offices or local libraries. Additionally, utilizing websites that offer PDF editing can provide a seamless experience when preparing your form.

Completing the MO-1041 form

Before you dive into the specifics of the MO-1041 form, ensure you gather all necessary documentation. This typically includes financial records, previous tax returns, and information regarding the estate or trust assets. Having all documents organized simplifies the filing process and reduces errors.

The MO-1041 consists of several sections, each designed to capture specific information: basic personal information of the fiduciary, income details, deductions, and the official signature. Each section requires careful attention to detail to ensure compliance.

Tips for accuracy and compliance

As you complete the MO-1041 form, avoid common pitfalls that many filers face. Issues such as transposing numbers or leaving sections incomplete can lead to delays or denials of your submission.

After completing your form, implement a double-check system. Review each section carefully, or consider having a colleague or tax professional review it for accuracy. Ensuring compliance with local tax regulations is crucial not only for peace of mind but also for protecting your financial interests.

Editing and managing your form

Utilizing pdfFiller, you can easily upload and edit your completed MO-1041 form. The platform allows for straightforward editing, enabling you to make adjustments, add signatures, or collaborate with others as needed. You can share the document directly with collaborators, making it easier to gather feedback.

Within pdfFiller, there are also integrated features for digital signatures. This feature provides a secure way to eSign documents, ensuring that your MO-1041 form is legally recognized without the hassle of printing. Digital signatures hold the same validity as handwritten ones under Missouri law.

Submitting the MO-1041 form

After completing your MO-1041 form, you can choose between several submission methods. Online submission is the quickest option, typically allowing for immediate processing through the Missouri Department of Revenue website. Always ensure you follow the instructions for online submissions carefully.

If you prefer traditional methods, mailing the completed form is still an option. Ensure you send it to the correct address and consider using a trackable mailing service to confirm receipt. After submission, you can check on the status of your form through the tax authority's online tools.

Troubleshooting common issues

If you discover an error after submitting your MO-1041, don't panic. Missouri state tax authorities offer clear procedures for amendments, allowing you to correct mistakes via amended returns. Immediate action can mitigate potential penalties.

Should you receive inquiries or notifications regarding your filing, it's essential to respond promptly. Utilize pdfFiller's support resources if needed, such as FAQs or live chat features, to resolve any challenges you may encounter during this process.

Additional considerations

After completing and filing the MO-1041 form, it's possible you may need to update your information in future tax periods, especially if there are changes to your estate or trust entities. Keeping meticulous records and revising previously filed forms can ensure continuity and clarity in your tax situation.

Keep an eye out for any updates to the MO-1041 form or associated regulations in upcoming tax years. Regularly visiting official state websites and utilizing resources like pdfFiller can keep you informed of necessary changes, helping you stay compliant and prepared.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get dor fiduciary income tax?

How do I execute dor fiduciary income tax online?

Can I create an eSignature for the dor fiduciary income tax in Gmail?

What is form mo-1041 - 2023?

Who is required to file form mo-1041 - 2023?

How to fill out form mo-1041 - 2023?

What is the purpose of form mo-1041 - 2023?

What information must be reported on form mo-1041 - 2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.