Get the free Required Disclosures to Buyers of Resale Condominium Units ...

Get, Create, Make and Sign required disclosures to buyers

Editing required disclosures to buyers online

Uncompromising security for your PDF editing and eSignature needs

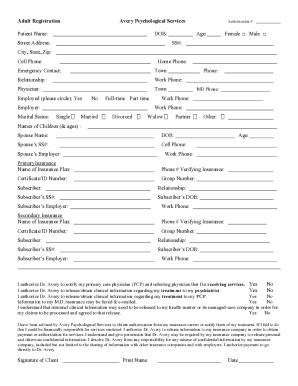

How to fill out required disclosures to buyers

How to fill out required disclosures to buyers

Who needs required disclosures to buyers?

Understanding the Required Disclosures to Buyers Form

Understanding required disclosures to buyers

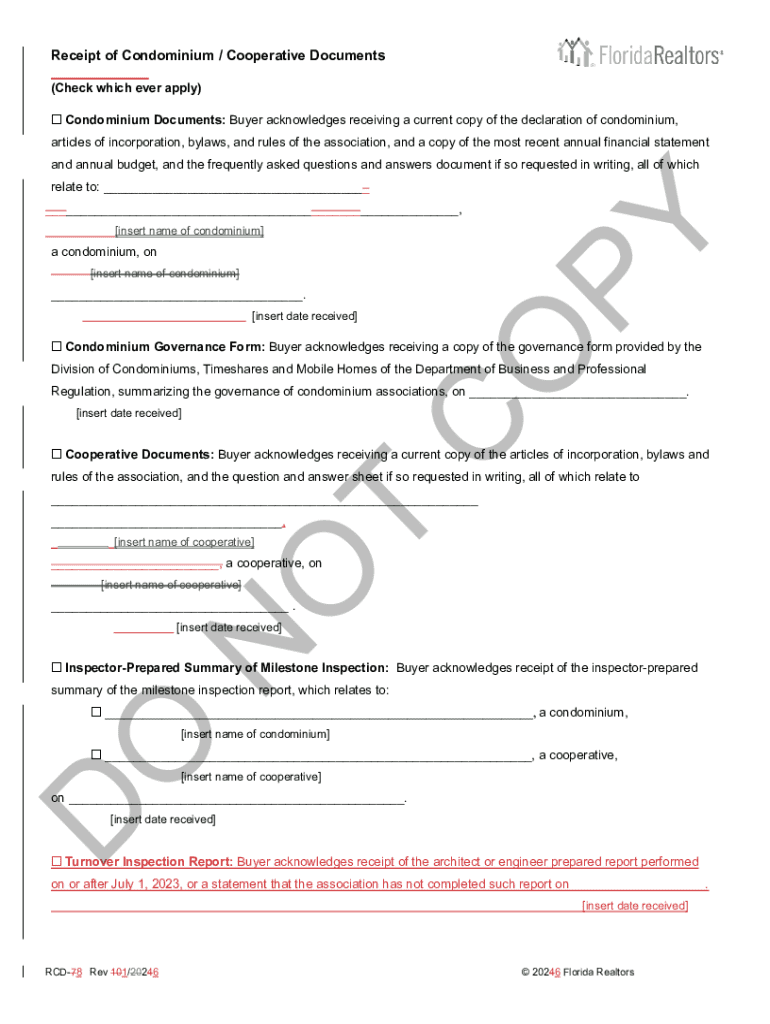

Required disclosures to buyers form is an essential document in real estate transactions, guaranteeing transparency between sellers and buyers. These disclosures include specific information that sellers must provide about the condition of their property, addressing various potential issues that could affect the buyer's decision.

The importance of these disclosures cannot be overstated. They not only help in fostering trust but also protect sellers from potential legal claims after the sale. This legal obligation ensures that buyers are fully aware of any material defects or hazards associated with the property they are looking to purchase.

Key differences exist between required and optional disclosures. While required disclosures are mandated by law, optional disclosures depend on the seller's discretion and may vary based on situational factors.

Types of required disclosures

There are several common categories of required disclosures that sellers must be aware of when completing the required disclosures to buyers form. These include property condition disclosures, environmental hazard disclosures, and the lead-based paint disclosure, particularly for properties built before 1978.

Each category addresses different facets of the property’s condition. For example, property condition disclosures outline aspects such as structural integrity and any previous renovations. Environmental hazard disclosures cover toxic substances like mold or asbestos, while the lead-based paint disclosure is critical for older homes.

Varying requirements by state

It's important to recognize how state laws influence required disclosures. States vary significantly in terms of the specific information that sellers are required to disclose, which can lead to confusion. For example, California has a robust set of requirements aimed at ensuring buyers are aware of potential risks, while some other states may have less stringent rules.

Sellers should familiarize themselves with the nuances of their state’s requirements, particularly regarding timelines for disclosure and the types of information that must be shared. A comprehensive understanding of local regulations is essential to avoid legal complications.

When to provide required disclosures

Timing of the required disclosures can significantly influence the transaction process. Sellers are typically obligated to provide these disclosures before any contractual agreements are signed. This might occur as part of the pre-contract obligations or at least in the early stages of negotiations.

Once an offer is accepted, it may also be appropriate to revisit and confirm these disclosures to ensure accuracy. Failure to disclose property issues can have serious consequences, including legal action by buyers who may discover undisclosed problems after the purchase, which could lead to significant financial ramifications.

What to include in your required disclosures

When completing the required disclosures to buyers form, sellers should include essential information about the property. This involves documenting any structural issues, detailing the property’s history regarding repairs, and noting any neighborhood issues such as pending zoning changes or developments nearby that could affect property value.

Organizing these disclosures effectively is key. Sellers are encouraged to utilize recommended templates that streamline the documentation process. Tools such as pdfFiller can greatly enhance the organization and management of these disclosures, ensuring that all necessary information is clearly presented and accessible.

Common mistakes when filling out the required disclosures

Sellers must be cautious when completing the required disclosures form, as there are common pitfalls to avoid. One frequent mistake is overlooking essential details — even seemingly minor issues can have significant implications if not disclosed.

Using ambiguous language is another critical error; clear and precise language should be used to avoid misinterpretation. Moreover, failing to update disclosures after property improvements can lead to issues down the line, as buyers may assume they are purchasing a property in its initial condition.

How to complete the required disclosures form using pdfFiller

Utilizing pdfFiller simplifies the process of completing the required disclosures to buyers form. Start by accessing the required form through pdfFiller's user-friendly interface. Users can easily edit and customize the form to align with their specific property details.

PdfFiller also allows users to add electronic signatures, making it convenient for both sellers and buyers to finalize disclosures swiftly. Additionally, the cloud-based storage feature ensures that all documents are securely managed and readily accessible when needed.

Frequently asked questions about required disclosures

Understanding the implications of required disclosures is crucial for sellers. For instance, what happens if buyers discover undisclosed issues post-sale? Generally, buyers may have legal recourse against sellers for failing to disclose known issues, leading to lawsuits seeking damages.

Sellers should also be aware of the penalties associated with incomplete disclosures. In many jurisdictions, failure to provide the necessary information could result in fines or legal action. To ensure their disclosures are compliant with legal standards, sellers can consult local real estate professionals for guidance and recommendations.

Enhancing your disclosure process with interactive tools

Integrating interactive tools into the disclosure process can significantly improve efficiency. PdfFiller’s collaborative features allow multiple team members to provide input seamlessly, ensuring that all aspects of the required disclosures to buyers form are addressed.

The e-signature capabilities further facilitate the signing process, allowing documents to be finalized with speed and clarity. Storing disclosures on a cloud-based platform not only enhances accessibility but also secures important documents from potential loss.

Case studies and best practices

Examining real-life examples can provide clarity on the significance of proper disclosures. Cases where sellers faced legal consequences due to inadequate disclosures illustrate the need for thoroughness when completing the required disclosures to buyers form.

Best practices include maintaining transparency and honesty throughout the disclosure process. Clear communication with buyers about property conditions, even if they may seem insignificant, fosters trust and reduces the risk of disputes after the sale.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my required disclosures to buyers in Gmail?

How can I modify required disclosures to buyers without leaving Google Drive?

Can I create an electronic signature for signing my required disclosures to buyers in Gmail?

What is required disclosures to buyers?

Who is required to file required disclosures to buyers?

How to fill out required disclosures to buyers?

What is the purpose of required disclosures to buyers?

What information must be reported on required disclosures to buyers?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.