Get the free Certified Adopted State Budget

Get, Create, Make and Sign certified adopted state budget

How to edit certified adopted state budget online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certified adopted state budget

How to fill out certified adopted state budget

Who needs certified adopted state budget?

Understanding the Certified Adopted State Budget Form

Understanding the certified adopted state budget form

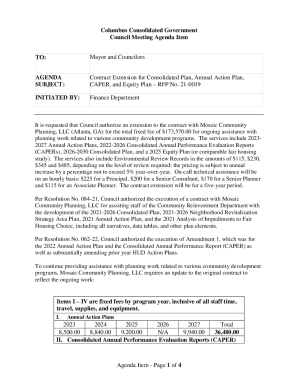

The certified adopted state budget form is a pivotal document in the realm of public finance, particularly for state and local governments. This comprehensive form includes a detailed financial plan for the fiscal year, outlining projected revenues and expenses, and serves as a critical tool for state financial management. The approval and adoption of this budget signify a commitment to fiscal discipline and transparency, enabling governments to allocate resources effectively and meet their obligations.

The importance of the certified adopted state budget cannot be overstated. By providing a clear framework for financial planning, it helps ensure that government entities remain accountable for their spending and financial priorities. This structured approach allows residents, officials, and stakeholders to track and understand their government’s financial health.

Key components of a state budget typically include revenue sources like taxes and grants, expenditure categories such as salaries and public services, and financial statements that justify the budgeted amounts. These elements work together to provide a cohesive picture of the financial operations of a state or municipality.

Who needs the certified adopted state budget form?

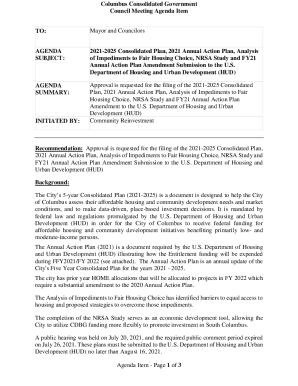

The certified adopted state budget form is essential for a varied audience. Key stakeholders include local and state government officials, financial officers, accountants, and members of community and educational institutions. These individuals all play a critical role in the preparation, approval, and execution of the budget, ensuring that financial plans align with strategic goals.

For government officials, the certified budget form represents a roadmap for executing public policies while managing taxpayers' money responsibly. Financial officers and accountants rely on this form to report on financial data, manage funds, and fulfill compliance obligations. Meanwhile, stakeholders in community and educational institutions benefit from understanding the budget process as it directly impacts funding for programs and services that serve their needs.

Requirements for completing the certified adopted state budget form

Completing the certified adopted state budget form requires a variety of documentation to ensure that all necessary information is accurately represented. This includes budget estimates from departmental heads, previous fiscal years' budget comparisons, and projections for future revenues and expenditures. By compiling this data beforehand, budget preparers can develop a realistic and comprehensive budget plan.

Certification of the budget typically comes with specific prerequisites, such as obtaining official approvals from relevant oversight bodies and fulfilling signature requirements from the chief financial officer and other key officials. Additionally, regulations can vary significantly from state to state; thus, understanding local requirements is vital for accurate completion.

Step-by-step guide to completing the certified adopted state budget form

Completing the certified adopted state budget form involves a careful, methodical approach. The first step is gathering the necessary resources and data, which entails collecting budget estimates from various departments, reviewing previous years’ budgets for comparisons, and identifying any new financial requirements.

The second step is drafting the budget. This will require revenue forecasts based on historical data and economic insights, followed by expenditure planning that aligns with the organization’s strategic goals. Next, the gathered data must be accurately inputted into the certified form, ensuring that every section is completed and that financial figures are properly categorized.

After entering data, it is crucial to review the form for accuracy. This involves checking mathematical calculations, verifying that all sections are properly filled out, and ensuring no data is overlooked. The final step entails the formal submission of the completed form, adhering to submission guidelines set forth by the jurisdiction, which may include electronic or paper submission options.

Common pitfalls in completing the certified adopted state budget form

While completing the certified adopted state budget form is essential, there are several common pitfalls that teams should be cognizant of. One frequent mistake involves omissions in critical data, such as not including essential revenue sources or expenditure categories. This oversight can lead to inaccurate budget proposals and misallocate resources.

Incorrect formatting is another challenge teams encounter, especially when adhering to specified guidelines. Many jurisdictions have unique formatting requirements, and failing to comply can result in delays or rejections of budget submissions. Moreover, missed deadlines can significantly hinder the budgeting process, impacting funding for various departments and services.

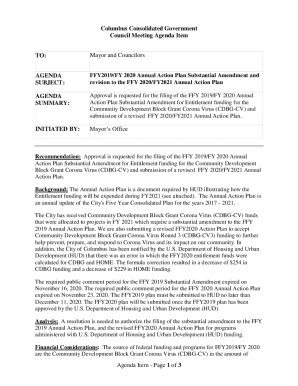

Utilizing technology to enhance budget management

The advent of technology has revolutionized how governmental bodies approach the certified adopted state budget form. Tools like pdfFiller streamline the process significantly by allowing officials to edit PDFs and utilize eSigning functionalities for rapid approvals. This tech-forward approach minimizes the chances of human error and accelerates budget submission timelines.

Further enhancing this process are interactive tools available in pdfFiller that enable collaborative team efforts on the budget form. This feature allows multiple stakeholders to review, suggest revisions, and provide input from anywhere, fostering a more comprehensive and collaborative budget creation process. Moreover, pdfFiller integrates seamlessly with existing budget management systems to synthesize data in real time.

Strategies for effective budget collaboration and approval

Effective collaboration and approval processes are critical to successfully managing the certified adopted state budget form. Implementing collaborative editing and review tools can significantly enhance communication, enabling team members to provide feedback and suggestions in real time. This level of transparency fosters a productive budgeting environment, leading to more robust proposals.

Another best practice involves setting clear timelines and expectations for budget approval. By establishing specific deadlines for draft submission, team reviews, and final approvals, all stakeholders can remain aligned and focused on the ultimate goal of a successful certification. Engaging stakeholders in the budgeting process through feedback sessions and discussions can also foster greater buy-in and support for the final budget.

Post-completion actions: managing the adopted budget

Once the certified adopted state budget form is completed and approved, active management of the budget is essential. Tracking budget performance involves regularly comparing actual spending against budgeted estimates, enabling teams to assess financial health and make necessary adjustments. Such monitoring is vital, as unexpected fiscal changes can occur, prompting budget amendments to reallocate resources appropriately.

Regular reporting and compliance checks should also be integrated into the budget management process, ensuring that financial practices align with established regulations and best practices. Maintaining open lines of communication with stakeholders regarding budget performance and changes will promote continued transparency and accountability.

Frequently asked questions (FAQs)

1. What if our state budget doesn’t get certified? If a state budget does not obtain certification, it may require revisions or additional approvals before it can be resubmitted. This may delay the execution of budgeted programs and services, necessitating alternative funding solutions in the interim.

2. How to contest a budget certification denial? To contest a denial, municipalities should gather supporting documentation and engage in dialogue with the certifying body to understand their concerns. This may involve submitting amended budget proposals or additional justifications for spending plans.

3. Can the budget be amended after certification? Yes, budgets can be amended post-certification to reflect unforeseen changes in revenues or expenditures. However, this process typically requires a formal approval pathway, depending on local regulations.

Success stories: effective use of the certified adopted state budget form

Numerous municipalities have successfully navigated the complexities of the certified adopted state budget form, showcasing effective budget submissions. For example, a district that systematically applied data analytics to inform its budget planning significantly improved its budget accuracy and stakeholder satisfaction. Testimonials from government officials who utilized pdfFiller for this process underline how technology has enhanced their efficiency.

Such success stories highlight the value of adopting best practices in budgeting and leveraging innovative tools that not only streamline operations but also engage community stakeholders throughout the budgeting lifecycle.

Quick links to additional tools and support

For those looking to dive deeper into the requirements and practices surrounding the certified adopted state budget form, direct links to state-specific resources as well as comprehensive budget management guides can be beneficial. Accessing these resources can enhance understanding of nuances in local regulations, terminology, and best practices. Additionally, pdfFiller support offers assistance for users navigating the complexities of budget submissions and form completion.

Conclusion

The certified adopted state budget form plays a critical role in governmental finance, serving as a foundational document for fiscal governance. Ensuring accuracy, compliance, and collaboration in the creation and management of this form can significantly impact the efficacy of public finance management. As officials embrace best practices and technology, they set the stage for more effective budget cycles that ultimately benefit the communities they serve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my certified adopted state budget in Gmail?

Can I sign the certified adopted state budget electronically in Chrome?

How do I fill out certified adopted state budget on an Android device?

What is certified adopted state budget?

Who is required to file certified adopted state budget?

How to fill out certified adopted state budget?

What is the purpose of certified adopted state budget?

What information must be reported on certified adopted state budget?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.