Get the free Unaudited results of the Group for nine months ended 30 ...

Get, Create, Make and Sign unaudited results of form

Editing unaudited results of form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unaudited results of form

How to fill out unaudited results of form

Who needs unaudited results of form?

Understanding unaudited results of form: A comprehensive guide

Understanding unaudited results

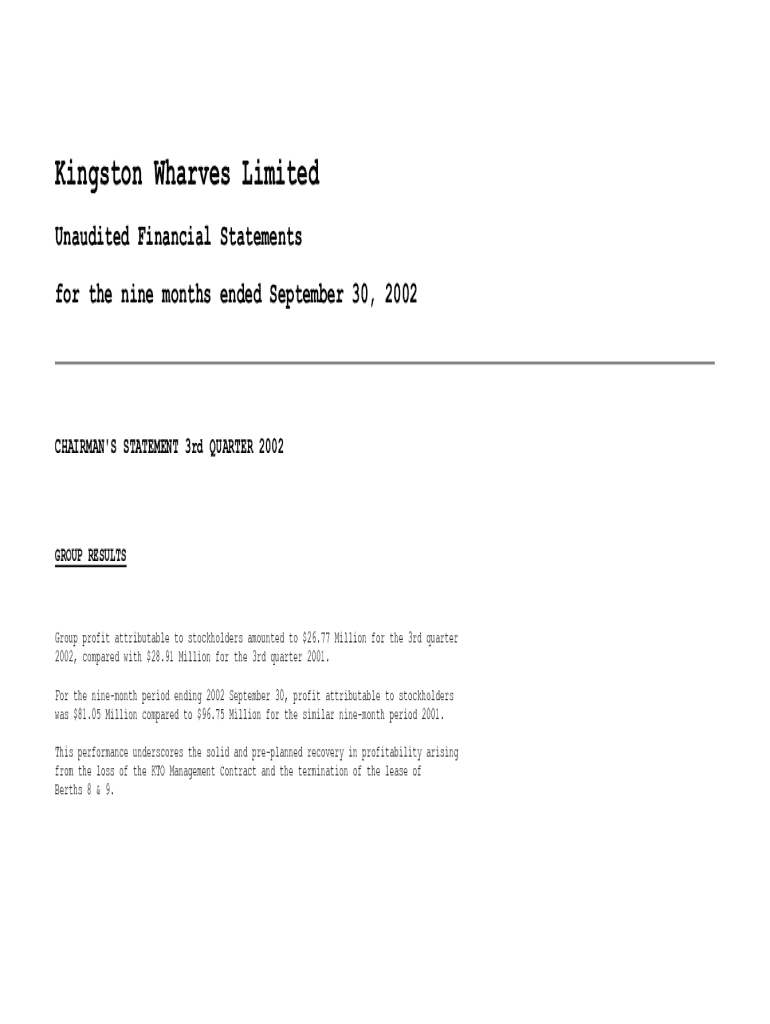

Unaudited results refer to financial statements or records that have not undergone an external verification process by independent accountants. These reports are often utilized internally by organizations to gain an understanding of their financial health without the formal endorsement that comes from audited results. The primary purpose is to provide timely information that can aid in decision-making, particularly during periods of financial analysis and assessment.

The distinction between unaudited and audited results plays a significant role in financial reporting. While audited results come with a stamp of reliability due to independent verification, unaudited results offer a preliminary view that can be crucial in fast-paced environments. Investors and management often rely on both types, but they approach their importance differently, focusing on the accuracy and completeness of the data presented.

Key components of unaudited results

Unaudited results typically consist of a few key components that outline a company's financial position. These include a balance sheet summary, highlights from the income statement, and an overview of cash flows. Each element serves to provide insights into various dimensions of company performance.

Differences between audited and unaudited results

The differences between audited and unaudited results are stark. Audited reports, verified by external entities, typically carry a higher degree of trustworthiness and reliability, making them essential for attracting investors and fulfilling regulatory requirements. In contrast, unaudited results may lack that endorsement, leading to hesitance from stakeholders to act solely based on them.

Furthermore, the influence of these two types of reports on decision-making varies. Investors might weigh audited results more heavily when assessing stock performance, while management may find unaudited results useful for internal assessments and preliminary financial decisions. The discrepancies also extend to regulatory bodies that often require audited results for compliance, underscoring the importance of having both types of reports readily available.

When to use unaudited results

Unaudited results are especially beneficial in specific scenarios including internal assessments and preliminary financial reporting. For example, companies might use them during strategic planning meetings to swiftly evaluate financial performance without the delays associated with audits. Such timely insights can lead to proactive decision-making, especially in rapidly changing business environments.

Moreover, for startups and smaller companies, relying on unaudited results can save both time and resources while still providing a clear image of financial health. This flexibility allows businesses to act quickly, secure funding, and adapt strategies in response to prevailing market conditions.

How to interpret unaudited financial statements

Interpreting unaudited financial statements requires careful analysis of various metrics. Focus on key ratios such as the current ratio, debt-to-equity ratio, and profit margins, as they provide insights into liquidity, leverage, and profitability. It's crucial to understand the implications of these indicators to draw meaningful conclusions about a company's performance.

Be cautious of common pitfalls during analysis. Misinterpreting trends or overlooking important notes that accompany financial statements can lead to misguided conclusions. Case studies of companies that relied on unaudited results illustrate the consequences of both diligent and careless analysis. For example, firms that closely monitored operational ratios when reviewing unaudited results often navigated market challenges more adeptly.

Filling out unaudited financial forms

Completing unaudited results forms involves a systematic approach to ensure accuracy. Start by gathering and preparing necessary data, such as sales figures, expenses, and inventory costs. Organize this data into clear sections; this will streamline the reporting process.

Editing and managing unaudited results using pdfFiller

pdfFiller serves as a valuable tool for editing financial documents, including unaudited results. Its user-friendly interface provides a variety of features tailored to enhance collaborative reviews, making it easy for teams to access and refine their documents simultaneously.

Additionally, pdfFiller's eSignature capabilities streamline the finalization process, allowing necessary parties to sign off on documents digitally. Once completed, unaudited results can be saved securely and shared with stakeholders, ensuring data integrity without the stress of cumbersome lifting or paperwork.

Best practices in reporting unaudited results

When reporting unaudited results, emphasizing transparency and thorough disclosures is crucial. Ensure that all relevant information regarding accounting policies, estimates, and management assumptions is clearly stated. This openness helps mitigate any concerns about the reliability of the results and fosters trust with stakeholders.

Common mistakes to avoid in unaudited results

Reporting unaudited results can present challenges, particularly when it comes to common errors that may compromise accuracy. Misclassifying expenses and revenues or providing incomplete disclosures can distort the true financial picture of a business. These pitfalls often arise from rushed timelines or lack of clarity in documentation.

The role of technology in reporting unaudited results

Technology plays an increasingly vital role in enhancing the efficiency and accuracy of reporting unaudited results. Tools like pdfFiller allow users to leverage cloud-based solutions that simplify document management tasks, making it easier for teams to work collaboratively and be adaptive in their reporting processes.

As financial reporting evolves, the integration of advanced technologies such as artificial intelligence and machine learning could further refine how companies generate and analyze unaudited results, paving the way for more insightful performance evaluations.

Real-world applications of unaudited results

Numerous businesses effectively rely on unaudited results to inform their strategies and funding decisions. For instance, tech startups may present unaudited performance metrics to potential investors to quickly signal their growth potential and attract needed financing. Demonstrating a clear picture of business activities through unaudited results can be vital for securing investments and building credibility in the marketplace.

Moreover, companies that regularly assess performance through unaudited results can adjust strategies in response to market trends, enhancing competitiveness. This adaptability becomes crucial during economic fluctuations that demand quick strategic shifts.

Navigating challenges with unaudited results

Despite their advantages, unaudited results come with limitations that businesses must acknowledge. The lack of third-party validation can lead to skepticism from stakeholders, particularly investors. Companies must strive to provide comprehensive context around their results and vigilantly correct any misinterpretations that may arise.

To mitigate risks associated with unaudited reporting, firms should implement robust internal controls to ensure accurate data collection and reporting. Regular training for employees involved in financial reporting can further strengthen the integrity of unaudited results, enabling teams to navigate both challenges and opportunities effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit unaudited results of form from Google Drive?

How do I edit unaudited results of form in Chrome?

Can I edit unaudited results of form on an Android device?

What is unaudited results of form?

Who is required to file unaudited results of form?

How to fill out unaudited results of form?

What is the purpose of unaudited results of form?

What information must be reported on unaudited results of form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.