Get the free LD-2 Disclosure Form - LDA.gov

Get, Create, Make and Sign ld-2 disclosure form

How to edit ld-2 disclosure form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ld-2 disclosure form

How to fill out ld-2 disclosure form

Who needs ld-2 disclosure form?

-2 Disclosure Form: A Comprehensive How-to Guide

Understanding the -2 Disclosure Form

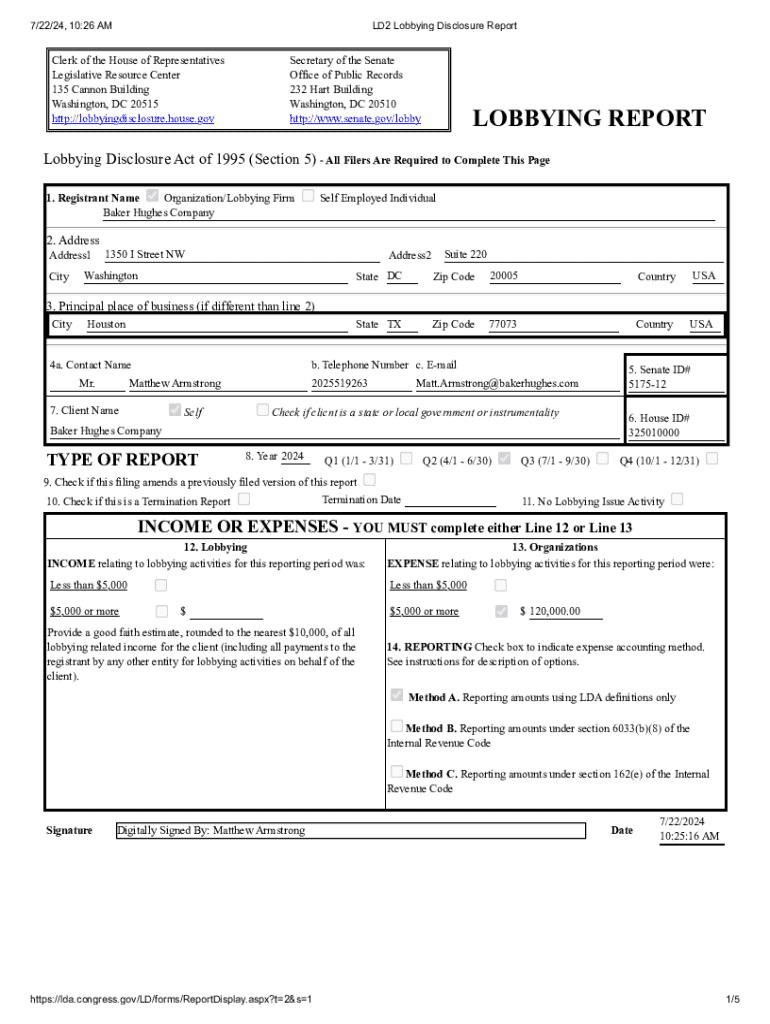

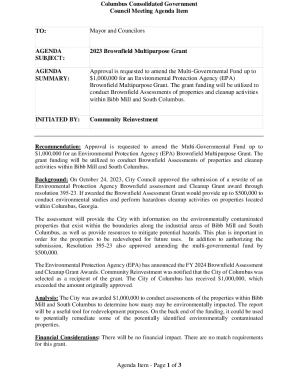

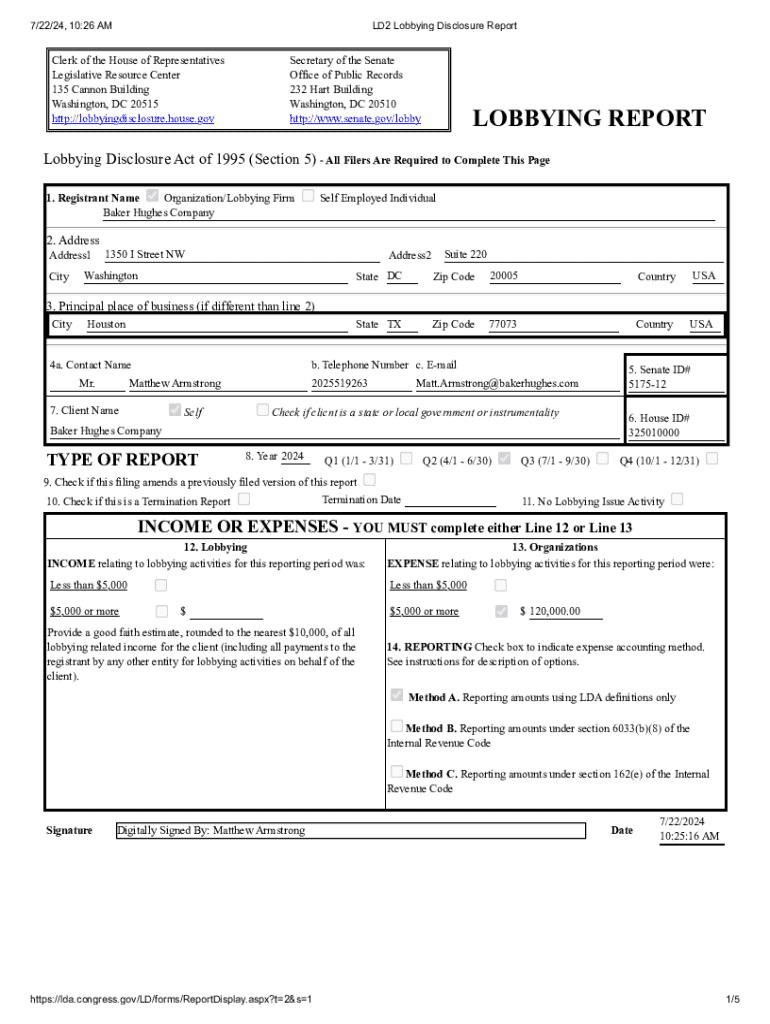

The LD-2 Disclosure Form serves as a crucial tool in the landscape of lobbying activities within the United States. Essentially, it is designed to document and report the lobbying efforts of registrants and their expenditures, promoting transparency in the influence exerted on government officials. By requiring detailed disclosures about lobbying activities, the LD-2 enhances the public's ability to analyze who is lobbying for what interests in Washington, D.C.

To file this form, it is imperative to understand who is deemed a registrant. This typically includes lobbying firms, corporations, non-profit organizations, and other entities engaging in the practice of lobbying. Knowing whether you need to file this form is the first step toward compliance with lobbying disclosure requirements.

Key components of the -2 Disclosure Form

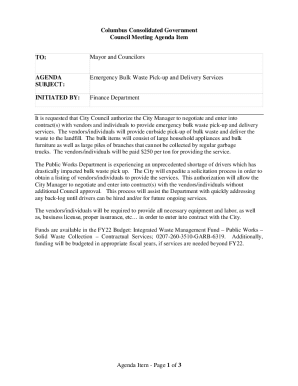

The LD-2 form encompasses various sections, each essential to capturing comprehensive information regarding lobbying activities. It starts with 'Identifying Information,' which collects registrant details, including the name and address of the lobbyist or organization and their clients. This section establishes the stakeholder involved, linking them directly to the lobbying efforts reported.

Following this, the 'Lobbying Activities' section requires a description of the specific lobbying initiatives undertaken. It's critical to outline who was contacted, and what government officials were involved, as this creates a transparent record of interactions between lobbyists and government entities. The final major section pertains to 'Financial Disclosure,' detailing payment amounts and their sources, along with any political contributions made.

Filing deadlines for the -2 Disclosure Form

Filing the LD-2 is subject to strict deadlines, which are primarily quarterly. Understanding these mandatory reporting timelines ensures that you fulfill your legal obligations on time. Missing these deadlines can lead to severe consequences, including civil penalties that can add financial strain on your organization or firm.

Punctual filing not only demonstrates good faith compliance with lobbying regulations but also fosters a reputation of accountability. Furthermore, staying on top of your filing schedule avoids the potential for scrutiny or investigation by regulatory bodies.

Step-by-step process for filing the -2 form

Before you begin, gather essential information and documentation to facilitate a smooth filing process. This includes details such as prior filing numbers, client information, and a summary of lobbying activities. It’s advisable to maintain an organized file to minimize errors during the data entry process.

When completing the LD-2 form, navigate through each section carefully. Watch out for common errors like incorrect names, dates, or financial figures, as these can lead to compliance issues. Once all sections are completed accurately, focus on signing and submitting the form. The electronic submission guidelines provide a streamlined method for filing, while ensuring you have the required signatures for verification.

Tips for efficiently managing the -2 disclosure process

Managing your LD-2 disclosures can be simplified with the use of templates and tools like pdfFiller, which offers robust features for editing and signing documents. This platform allows you to interactively edit your LD-2 form, ensuring that all necessary information is accurate before submission.

Using the collaborative tools in pdfFiller results in a more efficient preparation process, ultimately minimizing the chances of errors.

Common FAQs about the -2 disclosure form

As you navigate the LD-2 form, you may encounter queries regarding its requirements. One common question is: What happens if I miss a deadline? Failing to submit your form on time can incur penalties, so it's crucial to stay vigilant about due dates.

Addressing errors in previously submitted forms is another frequent concern. To amend your filing, ensure you submit a corrected version detailing the changes made and providing any additional required information. Understanding these common questions helps alleviate concerns as you go through your lobbying disclosure obligations.

Best practices for compliance with lobbying disclosure requirements

To maintain effective compliance with lobbying disclosure requirements, establish a routine review process. This should include regular audits of lobbying activities and financial disclosures throughout the year instead of waiting until the filing deadline. Keeping thorough records of every lobbying activity—including meetings and discussions—helps ensure you remain transparent and accountable.

Furthermore, continuous education regarding changes in legislation related to lobbying can significantly reduce the risk of non-compliance. By staying informed, organizations can adapt their practices to meet evolving legal standards.

Related forms and resources

Aside from the LD-2 Disclosure Form, other important forms include the LD-1 Registration Form, which is a prerequisite for lobbying activities, and various LD-2 Supplementary Forms that provide additional insights when necessary. Familiarizing yourself with these forms is vital for full compliance.

In addition, several government resources are available to guide lobbyists through their disclosure obligations. Accessing these resources equips you with the knowledge needed to maintain transparency while engaging in lobbying activities.

Conclusion and action steps

Successfully navigating the LD-2 Disclosure Form process requires understanding your obligations, thorough preparation, and regular review. By leveraging tools like pdfFiller to manage your document submissions, you can ensure compliance with federal lobbying disclosure requirements.

Make it a priority to stay organized and proactive in collecting and reporting data, thereby reducing the likelihood of errors or missed deadlines. With the right strategies and tools, you can efficiently manage your lobbying disclosures and maintain your commitment to transparency in the political process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ld-2 disclosure form without leaving Google Drive?

How do I edit ld-2 disclosure form on an Android device?

How do I fill out ld-2 disclosure form on an Android device?

What is ld-2 disclosure form?

Who is required to file ld-2 disclosure form?

How to fill out ld-2 disclosure form?

What is the purpose of ld-2 disclosure form?

What information must be reported on ld-2 disclosure form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.