Get the free Return of Organization Exempt From Income Tax - Travel Unity

Get, Create, Make and Sign return of organization exempt

Editing return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form: A Comprehensive Guide

Understanding the Return of Organization Exempt Form

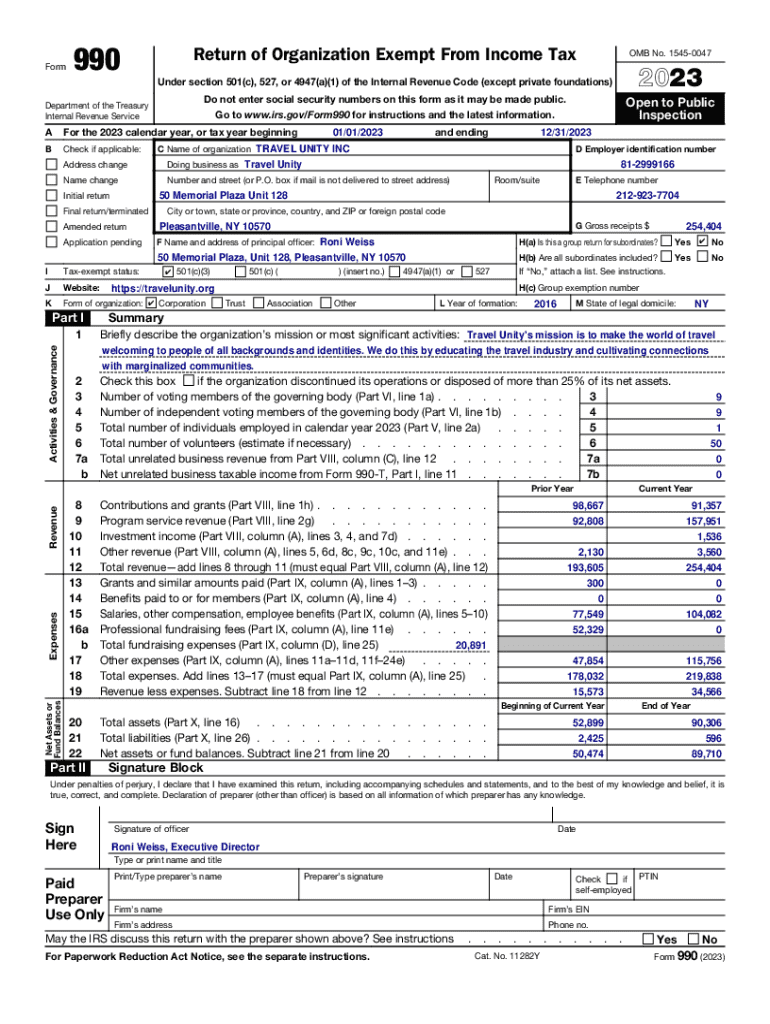

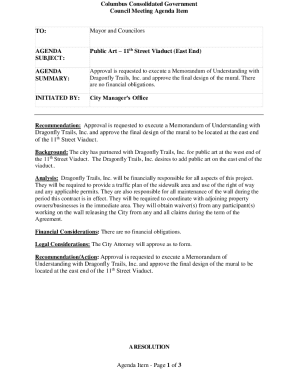

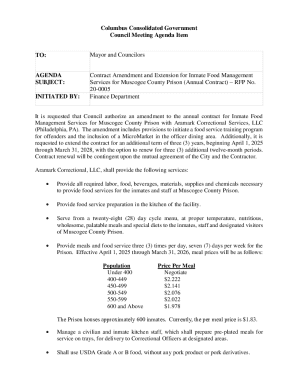

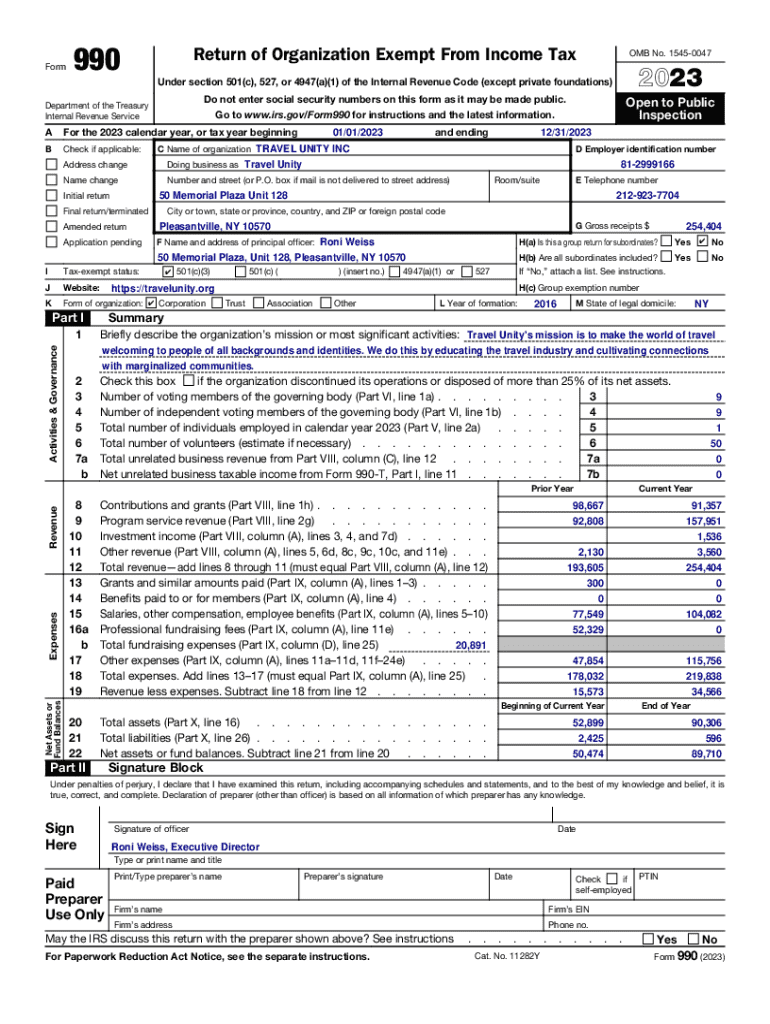

The Return of Organization Exempt Form, commonly known as Form 990, is an essential document for nonprofit and charitable organizations. This form enables tax-exempt organizations to report their financial information, including revenue, expenses, and activities, to the Internal Revenue Service (IRS). By providing transparency, this form maintains accountability and allows the IRS to assess the organization's compliance with federal tax regulations.

The importance of the Return of Organization Exempt Form lies in its role in maintaining tax-exempt status for nonprofits. It serves not only as an application for exemption but also a means of ongoing compliance verification. This ensures that organizations adhere to appropriate regulations while demonstrating their contributions to public benefit and charitable activities.

Eligibility criteria for exemption

Eligibility for filing the Return of Organization Exempt Form derives from the type of organization applying for tax exemption. Charitable organizations, educational institutions, and religious entities can qualify for this status. Each entity type must align its goals and activities with the IRS's stipulated criteria for tax exemption.

To maintain tax-exempt status, organizations must consistently engage in qualified activities. For instance, excessive engagement in political campaigning or substantial non-exempt activities can jeopardize their status. Additionally, entities are bound by specific reporting requirements to ensure they continue to operate within the guidelines established by the IRS.

Filing the Return of Organization Exempt Form

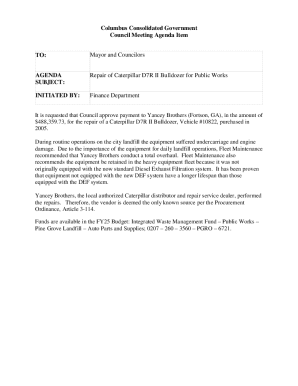

Completing the Return of Organization Exempt Form requires careful attention to detail and a clear understanding of your organization’s finances. Start by gathering all necessary documentation. This includes your organization’s financial statements, operational budget, and a list of board members and key staff. Knowing important deadlines is also crucial since late submissions can lead to penalties.

Once you have compiled your documentation, proceed by carefully completing each section of the form. This includes providing detailed financial information, descriptions of your programs, and disclosures regarding compensation for officers and directors. Common pitfalls include typographical errors and inadequate explanations of your organization’s activities, which can confuse the IRS reviewers.

Annual requirements for exempt organizations

Tax-exempt organizations are required to fulfill annual reporting obligations to maintain their status. Generally, organizations must file Form 990 or its simplified versions, such as Form 990-EZ or Form 990-N, depending on their gross receipts and assets. Knowing the specific requirements for your organization type is important, as forms vary across different categories.

Effective record-keeping is also vital in this process. Best practices include maintaining detailed files of financial records, minutes from board meetings, and grant documents. These records not only facilitate easier reporting each year but are also essential in case of an IRS audit, showcasing compliance with established guidelines.

Filing deadlines and timelines

Filing deadlines for the Return of Organization Exempt Form are non-negotiable and typically occur on the 15th day of the 5th month after the close of your organization's tax year. Organizations that fail to meet this timeline may face penalties, including fines that increase over time. In certain situations, obtaining an extension may be possible, extending your deadline to the 15th day of the 11th month.

Failing to fulfill these obligations can lead to repercussions such as loss of tax-exempt status or delayed filings, which require remediating actions. Organizations are encouraged to set up internal systems for tracking compliance deadlines to avoid the consequences of late submissions.

Understanding the penalties for non-compliance

Non-compliance with filing requirements can result in significant penalties, including financial consequences and potential loss of tax-exempt status. Fines can vary based on how long the organization has failed to file, escalating from nominal fees to substantial penalties that reflect ongoing non-compliance.

If your organization incurs penalties, it’s essential to take immediate action. Consider reaching out to legal professionals who specialize in nonprofit law to understand your options for appealing penalties and remedying any compliance issues quickly. Proactive steps can mitigate damage and help restore your organization's standing.

Resources for assistance

Nonprofit organizations seeking guidance on filing the Return of Organization Exempt Form can benefit from various expert help resources. Professional tax advisors who specialize in nonprofits can provide tailored advice that aligns with your organization's specific needs. Engaging with these experts can minimize compliance issues and empower you to stay on track with filing requirements.

Additionally, a number of online tools and software solutions are available to simplify the filing process. pdfFiller offers robust features that enhance document management, making it easier for organizations to prepare and submit necessary forms. Utilizing community networks, local chapters, and associations can also provide invaluable support.

Interactive tools for managing your forms

Using platforms like pdfFiller for form management enables organizations to edit PDFs, eSign documents, and collaborate efficiently all from a cloud-based environment. With features that simplify filling out forms, organizations can spend less time managing paperwork and more time focusing on their missions.

pdfFiller enhances your filing experience through a range of templates and presets tailored for the Return of Organization Exempt Form, allowing organizations to streamline their submission processes. The convenience of access-from-anywhere benefits helps tackle the urgency of compliance deadlines, ensuring forms are completed accurately and submitted on time.

Best practices for document management

Adhering to best practices for document management year-round can significantly enhance a nonprofit's compliance with IRS requirements. Setting calendar reminders for filing deadlines ensures that organizations do not miss critical dates. Keeping organizational records updated and promptly filing required documentation can safeguard against future complications.

Preparing for audits and reviews should be part of your organization’s operational routine. Equipping staff with checklists for audit readiness, including financial reporting and compliance adherence, can transform potential audit stressors into manageable tasks.

Real-life examples and case studies

Many organizations successfully navigate the Return of Organization Exempt Form process, bolstering both their reputation and operational success. For example, charitable organizations that actively maintain their compliance not only enjoy their tax-exempt status but also gain stronger support from donors who prioritize transparency.

Conversely, there are cautionary cases where organizations lost their tax-exempt status due to repeated failures to file. These stories teach valuable lessons about rigorous record keeping and the necessity of adhering to established deadlines. By understanding both types of outcomes, organizations can better strategize their compliance efforts.

Frequently asked questions (FAQs)

Several common inquiries arise regarding the Return of Organization Exempt Form among nonprofit organizations. Key questions often include which organizations must file, what penalties exist for non-compliance, and how to navigate updates to the filing process. Addressing these queries can ensure that organizations are prepared and informed as they manage their filing responsibilities.

Additional clarifications on complex topics such as reporting requirements and electronic filing procedures may also be areas of concern. By providing comprehensive answers to these inquiries, organizations can fortify their understanding and compliance practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the return of organization exempt in Chrome?

Can I edit return of organization exempt on an iOS device?

How can I fill out return of organization exempt on an iOS device?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.