Get the free Form W-2 and 1099-R - Incorrect or Not Received

Get, Create, Make and Sign form w-2 and 1099-r

How to edit form w-2 and 1099-r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form w-2 and 1099-r

How to fill out form w-2 and 1099-r

Who needs form w-2 and 1099-r?

Form W-2 and 1099-R Form: A Comprehensive How-to Guide

Understanding Form W-2 and Form 1099-R

Form W-2 is a tax document that employers must send to each of their employees, detailing the annual wages earned and the taxes withheld throughout the year. It's crucial for employees because it provides the necessary information for accurately calculating tax obligations. Key components of the W-2 include personal information such as the employee's name and Social Security number, wage details, federal income tax withheld, and contributions to programs like Social Security and Medicare. Each of these elements plays a pivotal role in ensuring compliance with federal tax regulations.

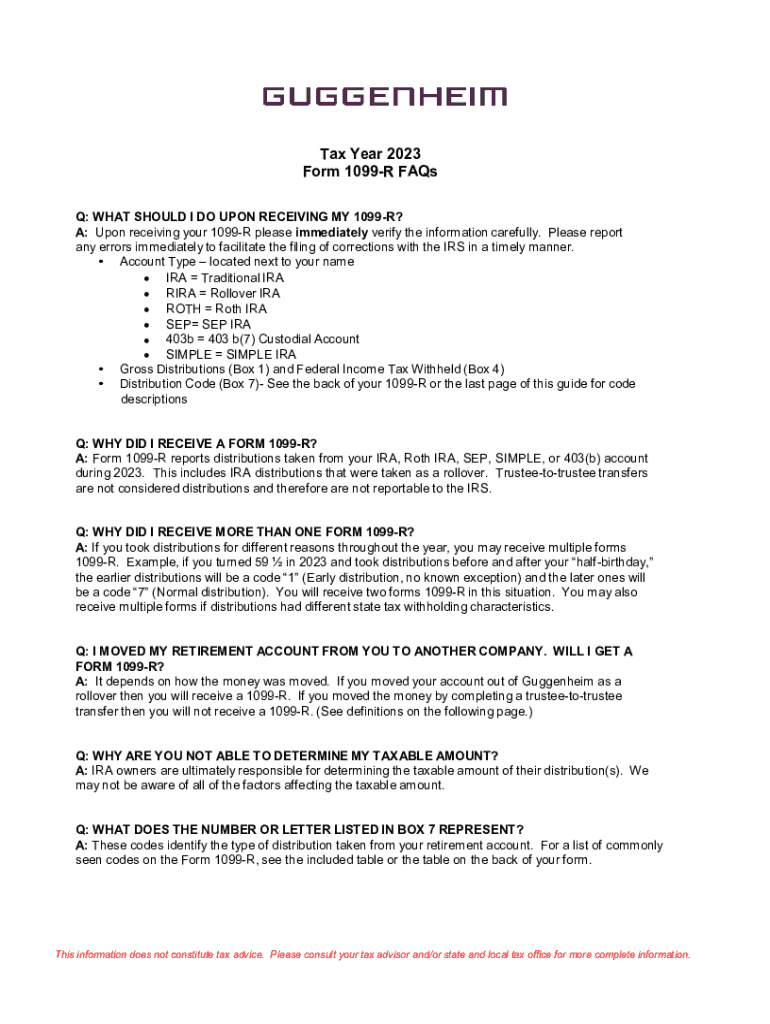

In contrast, Form 1099-R is issued to individuals who receive distributions from retirement accounts, including pensions, annuities, and IRAs. This form is vital for retirees and beneficiaries since it helps report income that may be subject to taxation. The 1099-R contains essential details including the gross distribution amount, taxable amount, and any federal income tax withheld. Understanding the distinctions and uses of both forms is fundamental for anyone navigating tax season, whether as an employee or a retiree.

The role of W-2 and 1099-R forms in tax filing

W-2 forms are primarily focused on reporting wages and withholdings. When filing your tax return, the information contained in your W-2 is critical as it verifies income and prevents tax fraud. You will use this form to complete your income tax return, specifically on forms like 1040 or 1040-SR. With accurate reporting, employees can avoid common pitfalls such as underreporting income, which can lead to penalties or audits from the IRS.

On the other hand, the 1099-R form significantly impacts tax responsibilities related to retirement distributions. Depending on your total annual income and tax bracket, distributions reported on the 1099-R could affect your overall tax liability. This form must also be reported accurately on your tax return, and failing to report such income can lead to severe financial consequences. Understanding how to interpret the information on both forms allows individuals to file more effectively, minimizing their tax burden while ensuring compliance with tax laws.

Accessing your W-2 online

To obtain your W-2 form, most employees can access it through their employer's payroll portal. Steps to access your W-2 typically involve logging into your employer's HR management system, locating the payroll section, and viewing or downloading the form as a PDF. Employers are required to provide this document by January 31st of each year, ensuring compliance with IRS deadlines. It's important to note that not all employers use the same system, so details may vary based on organizational practices.

Securing your W-2 online is critical to protecting your identity. Always ensure that the connection you use is secure and that you are on an official site. Implementing strong, unique passwords and enabling two-factor authentication when available can help protect your sensitive information. If you suspect that your W-2 has been compromised, it's vital to notify your employer and take steps to monitor your credit for signs of identity theft.

How to get your 1099-R tax form

Obtaining your 1099-R form can be achieved through several avenues. The simplest method is to use the 1099-R request tool available from most financial service providers. This tool usually does not require logging in and involves entering some personal details to access your forms. Depending on the provider, the process may differ slightly, but the goal is to ensure you receive your 1099-R in a secure manner.

Another method is logging into your account with the service provider and locating the relevant tax forms in the document library or under account statements. Should you encounter difficulties accessing your account, ensure you have the correct login credentials and try resetting your password if necessary. Additionally, if online access is not feasible, you can request a mailed copy of your 1099-R directly from your service provider. Be aware that this may take additional time, so it's wise to initiate this request early in the tax season for timely receipt.

Filling out and editing Form W-2 and 1099-R

Filling out your W-2 correctly is essential for accurate tax reporting. Each section of the form must be completed thoroughly. Personal information should be filled out in the respective boxes, and be sure to review figures like wages and tax withholdings carefully. Common mistakes to avoid include transposing numbers or neglecting to sign the form. Keeping documentation organized throughout the year can help streamline this process and prevent errors during completion.

For the 1099-R, accuracy is equally vital. Financial institutions may send incorrect amounts, and ensuring you're reporting the right information is critical to avoid complications with the IRS. If you discover inaccuracies after receiving your 1099-R, contact your retirement plan provider to make corrections. Ensuring these forms have the correct details will simplify the filing process and reduce the likelihood of facing challenges with compliance.

eSigning and sharing your tax forms securely

Signing your documents digitally has never been easier with tools such as pdfFiller. This platform allows users to eSign their W-2 and 1099-R documents with ease. The features offered by pdfFiller include customizable eSignature options, integration capabilities with various cloud storage services, and a user-friendly interface that makes signing documents swift and efficient. Ensuring that your documents remain secure while utilizing these features is paramount, so adopting strong passwords and secure sharing methods is essential.

Additionally, collaborating with your tax team becomes hassle-free with pdfFiller. Individuals or small businesses can leverage this platform to share documents, manage versions, and track changes made to important tax forms. This collaborative approach not only simplifies teamwork but also enhances accountability, ensuring that every participant is aware of the most up-to-date information.

Frequently asked questions about W-2 and 1099-R forms

Interactive tools and resources available on pdfFiller

pdfFiller offers a range of document templates, including editable W-2 and 1099-R formats. Accessing these templates allows users to customize forms according to specific needs, enhancing the filing experience. This adaptability is especially useful for small businesses and HR departments within organizations that need to standardize their forms while ensuring compliance with IRS guidelines.

Moreover, utilizing calculators and checklists provided by pdfFiller can streamline tax preparation and record-keeping. These tools are essential for individuals to maintain organized documentation throughout the year, ensuring compliance and optimizing tax situations. Keeping accurate records will not only simplify filing but potentially lead to beneficial tax deductions.

Conclusion and next steps

Preparation for tax season involves understanding the critical roles of Form W-2 and 1099-R. Both forms provide essential information for accurate reporting and compliance with tax regulations. It's vital to review these documents carefully and ensure that any discrepancies are resolved swiftly. Leveraging resources like pdfFiller can help simplify the processes of filling out, securing, and managing tax forms efficiently.

By adopting best practices in document management and utilizing interactive tools for collaborative work, individuals and teams can effectively streamline their tax preparation efforts. These proactive steps not only lead to smoother tax filing experiences but also build a stronger foundation for future financial planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my form w-2 and 1099-r in Gmail?

How do I fill out form w-2 and 1099-r using my mobile device?

Can I edit form w-2 and 1099-r on an Android device?

What is form W-2?

What is form 1099-R?

Who is required to file form W-2?

Who is required to file form 1099-R?

How to fill out form W-2?

How to fill out form 1099-R?

What is the purpose of form W-2?

What is the purpose of form 1099-R?

What information must be reported on form W-2?

What information must be reported on form 1099-R?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.