Get the free DR 1217, 2025 Qualified Care Worker Tax Credit. If you are using a screen reader or ...

Get, Create, Make and Sign dr 1217 2025 qualified

Editing dr 1217 2025 qualified online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 1217 2025 qualified

How to fill out dr 1217 2025 qualified

Who needs dr 1217 2025 qualified?

Understanding the DR Qualified Form: A Comprehensive Guide

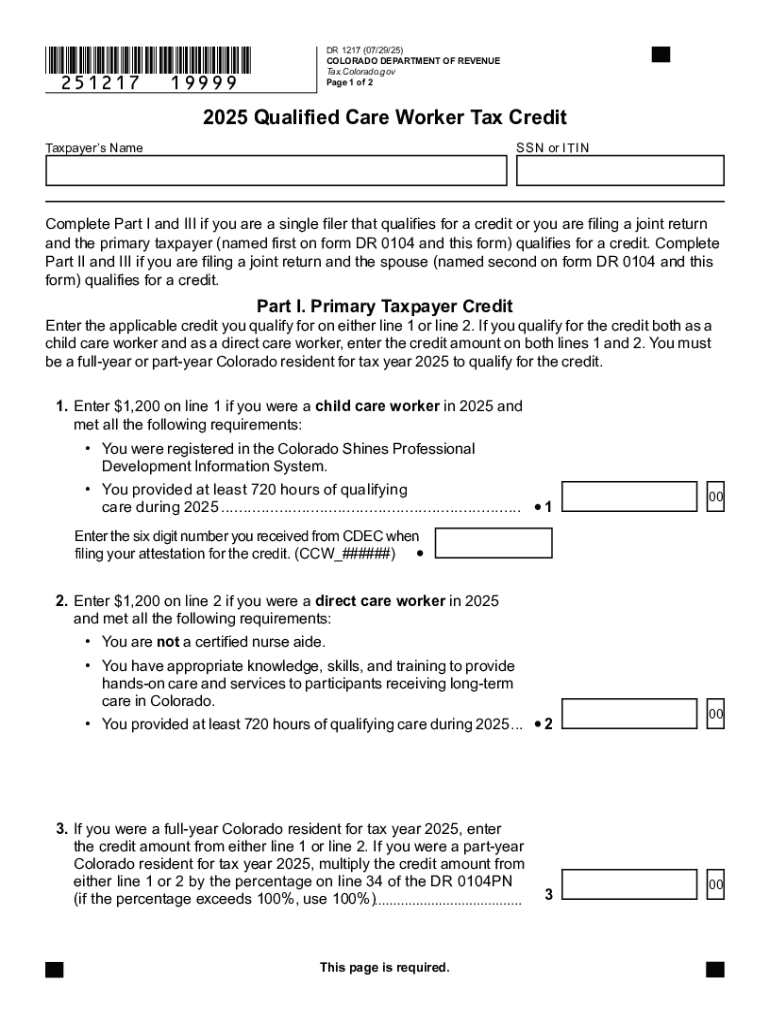

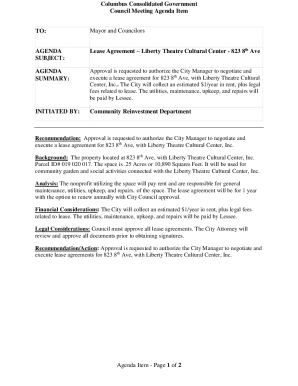

Overview of the DR 1217 Form

The DR 1217 form is a crucial document designed specifically for individuals and teams to claim the 2025 Qualified Care Worker Tax Credit. This form streamlines the process of documenting eligibility for tax credits extended to care workers, who play an essential role in society by providing vital services to various populations.

Understanding the importance of the DR 1217 form is vital, both for financial benefits and for recognizing the contributions of care workers. By utilizing this form, eligible workers can access tax credits that can significantly alleviate their financial burden and incentivize their essential work.

Understanding the 2025 Qualified Care Worker Tax Credit

The Qualified Care Worker Tax Credit is a financial incentive designed to support individuals who work in caregiving roles, particularly those in direct service positions. This tax credit provides eligible workers the opportunity to offset some of their taxes based on their income earned while providing essential health and personal support services.

This initiative is aimed at increasing financial accessibility for care workers, many of whom are employed in low-wage positions. The tax credit serves as a recognition of their hard work and is particularly beneficial for those who are navigating the costs associated with caregiving, leading to improved overall financial stability.

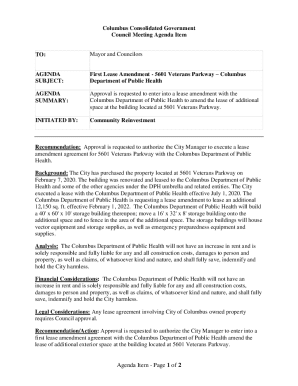

Eligibility requirements for the DR 1217 form

To qualify for the DR 1217 form, care workers must meet specific criteria. These include having a particular employment status, meeting income thresholds, and providing recognized types of care work. Employment status typically requires the caregiver to be working directly in a qualified role, such as home health aide or similar positions within accredited organizations.

Income thresholds vary but generally align with regional minimum wage practices. Identifying the type of care work is equally essential; qualified roles typically include those who support individuals with disabilities, the elderly, or those recovering from illness. To support eligibility claims, caregivers must provide documentation such as employment verification letters, pay stubs, and any relevant certifications.

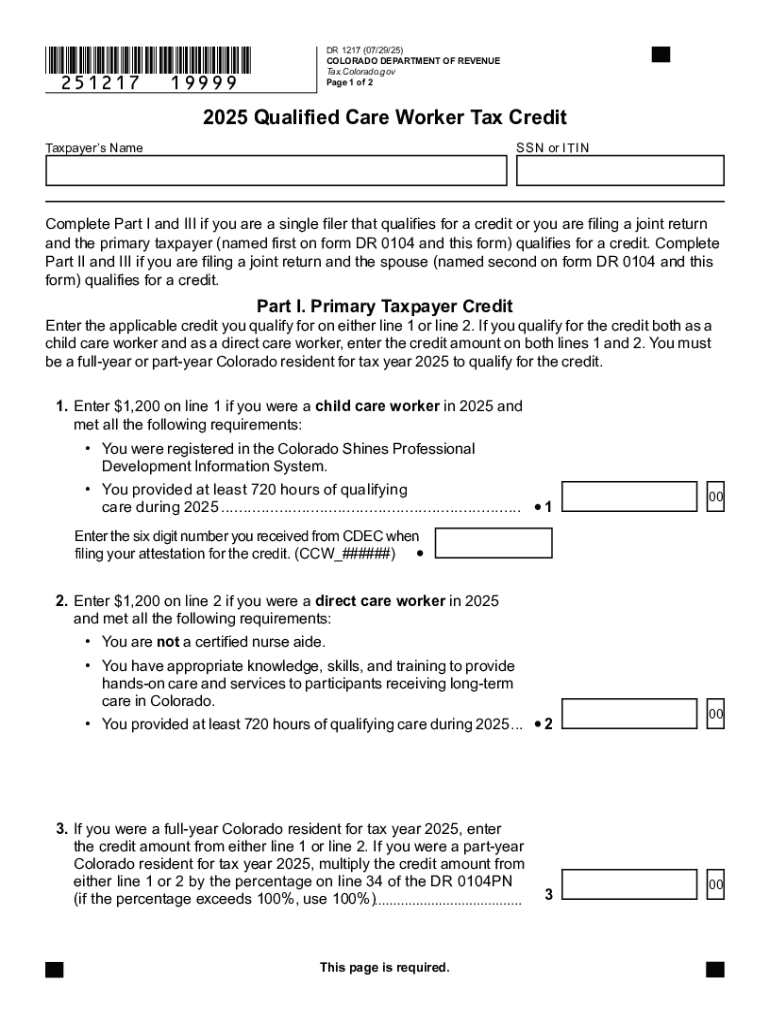

Step-by-step instructions for completing the DR 1217 form

Completing the DR 1217 form can seem daunting, but breaking it down into sections can simplify the process. Here's how to efficiently fill out each part.

Section A: Personal Information

In Section A, you will need to enter personal details, including your name, address, contact information, and Social Security number. It's critical to ensure all details are accurately inputted, as discrepancies can lead to processing delays.

Section B: Employment Information

Section B requires information about your employment. This includes the name of your employer, job title, and specifics about your work schedule. Accurate employment records are essential here to validate your role as a caregiver.

Section : Tax Credit Claim Information

Section C asks for the calculation of your claim for the tax credit. You will need to provide details such as your total income from caregiving work and any relevant deductions. It may be helpful to consult a tax professional to understand how to optimize your credit claim.

Section : Signatures and Submission

In Section D, ensure you sign and date the form. For submission, you have options to either email the form or send it via postal service. While postal submission can take longer, it may provide additional security for sensitive information.

Interactive tools for filling out the DR 1217 form

Utilizing interactive tools can enhance your experience with the DR 1217 form. Online calculators may assist in estimating potential tax credits based on your income and caregiving status, helping you prepare for what to anticipate come tax season.

Templates and example forms provide practical reference points, streamlining the completion of your DR 1217 form. Furthermore, engaging with interactive FAQs can clarify common questions or uncertainties, providing reassurance as you navigate the documentation process.

Editing and managing the DR 1217 form

Once the DR 1217 form is completed, you may want to make edits or adjustments. Utilizing a cloud-based solution like pdfFiller allows for easy editing of PDFs, ensuring that any changes can be made quickly without starting over.

Collaboration is also simplified through pdfFiller, where multiple team members can review and contribute to the final submission. Ensuring security when sharing sensitive information is critical, and pdfFiller offers secure sharing options to protect your data.

Common mistakes and how to avoid them

Though it may feel straightforward, mistakes on the DR 1217 form are common and can lead to delays or rejections. Frequent errors include incorrect income reporting and missing signatures. Ensuring to double-check all sections before submission is critical to mitigate these mistakes.

Notably, ensure that any numbers are calculated correctly and that all necessary documentation is provided alongside the form. Additionally, keeping a copy of your submission can be helpful for future references.

Follow-up steps after submission

After submitting the DR 1217 form, it's essential to understand the next steps. Typically, you can expect a confirmation of receipt from the processing agency within a few weeks. Tracking the status of your submission can often be done online, allowing you to stay informed regarding any decisions made on your tax credit application.

Should your claim be approved, you will see the tax credit reflected in your tax filings. Conversely, if denied, understanding the reasons behind the denial can help you adjust future submissions and gather necessary documentation for resubmission.

Case studies: Successful claims using the DR 1217

Analyzing real-life examples can provide insight into strategies for success in claiming the Qualified Care Worker Tax Credit through the DR 1217 form. One case involved a home health aide who accurately reported all income and carefully detailed the services provided, securing a substantial tax credit.

Another example shows a team of caregivers who collaborated on filling out the form through pdfFiller, sharing insights that enhanced their submission's accuracy and completeness. This collaborative approach can often yield more favorable outcomes.

Additional considerations and tips

Timing is crucial when submitting the DR 1217 form. Understanding deadlines is essential to ensure that claims are processed in a timely manner, allowing for the benefits of the tax credit to be realized during the annual filing period.

Furthermore, integrating the DR 1217 process with other tax filings might present additional advantages that can further enhance the financial benefits for caregivers. For any uncertainties, seeking help from certified tax professionals is always recommended.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit dr 1217 2025 qualified in Chrome?

Can I sign the dr 1217 2025 qualified electronically in Chrome?

How do I complete dr 1217 2025 qualified on an Android device?

What is dr 1217 2025 qualified?

Who is required to file dr 1217 2025 qualified?

How to fill out dr 1217 2025 qualified?

What is the purpose of dr 1217 2025 qualified?

What information must be reported on dr 1217 2025 qualified?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.