Get the free Form 8-K ESAB Corp For: Jan 31

Get, Create, Make and Sign form 8-k esab corp

How to edit form 8-k esab corp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k esab corp

How to fill out form 8-k esab corp

Who needs form 8-k esab corp?

Understanding Form 8-K for ESAB Corp: A Comprehensive Guide

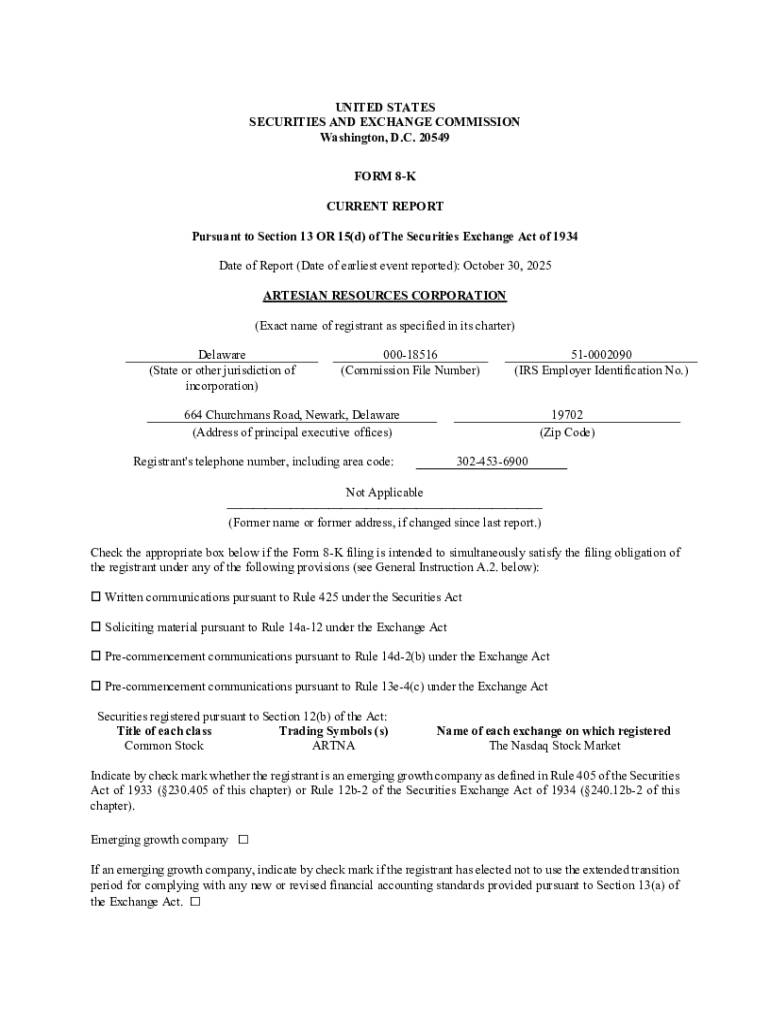

Understanding the Form 8-K: A comprehensive overview

Form 8-K serves as a crucial component of corporate filings for publicly traded companies. Mandated by the Securities and Exchange Commission (SEC), this form allows companies to communicate material events that may affect shareholders' decisions or the company's financial status. Its significance lies in the transparency it promotes within the financial market, helping ensure that all investors have access to the same information in a timely manner.

The key purposes of Form 8-K are to disclose major events that impact a company's performance or operations, including acquisitions, changes in management, and other important occurrences. Stakeholders rely heavily on these rapid disclosures, which helps maintain trust and integrity within the marketplace.

Who needs to file Form 8-K?

Publicly traded companies are required to file Form 8-K whenever they experience specific material events. This includes any entity that issues securities under the SEC registry. Various disclosure types necessitate an 8-K filing to keep stakeholders informed and retain compliance with regulations.

Events that typically trigger a filing include changes in control, management alterations, and major asset transactions. Special circumstances that call for immediate communication with stakeholders, whether individual or institutional investors, also fall under this filing requirement.

Navigating the 8-K filing process

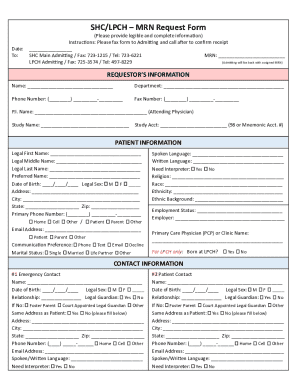

Preparing for Form 8-K filing involves gathering essential documentation. This may include financial reports, legal opinions, press releases, and minutes from meetings that relate to the specific events that necessitate a filing. Having these documents ready ensures a smooth process when filling out the form.

The filing process can be broken down into several manageable steps. First, collect all necessary information pertaining to the event. Next, carefully complete sections A through J of the form, ensuring accuracy and thoroughness. Finally, utilize checklists to ascertain that every detail is in order before submission.

Common scenarios that trigger an 8-K filing

Companies often encounter a range of scenarios that necessitate filing Form 8-K. A significant change in control, such as a merger or acquisition, represents a pivotal moment for a company and requires immediate reporting. Similarly, the departure of key executive officials or new appointments can lead to major shifts that warrant public disclosure.

In addition, assets' acquisition or disposal can have long-term ramifications on a company's financial health. Companies are also mandated to file if entering into material agreements, or in the dire context of bankruptcy or receivership proceedings, underscoring the importance of transparency in turbulent times.

Editing and reviewing your 8-K submission

Once Form 8-K has been completed, it is paramount to rigorously review it for compliance with SEC regulations. A careful proofreading process can mitigate the risk of errors or misrepresentations. Incorporating collaboration tools available in pdfFiller can enhance this review phase, as they allow team members to efficiently share comments, suggestions, and revisions.

Effective proofreading isn’t just about fixing typos; it involves critically assessing the clarity and accuracy of the information presented. Utilizing pdfFiller's collaborative features means that multiple stakeholders can ensure that the filing is accurate, concise, and compliant with regulatory standards before submission.

eSigning your Form 8-K for compliance

The use of eSignatures in Form 8-K submissions is not just a trend; it’s a necessity for ensuring compliance. Through pdfFiller, the eSigning process is streamlined, enabling a more efficient submission workflow. Engaging eSignatures assures regulators and stakeholders that the document has been verified and approved by the necessary parties.

Adding eSignatures securely via pdfFiller is straightforward. Step-by-step instructions simplify the process, empowering users to integrate this critical compliance measure effortlessly into their filing routine.

Filing timeliness and best practices

Filing Form 8-K in a timely manner is crucial, as the SEC imposes strict deadlines and penalties for late submissions. Companies must be acutely aware of these deadlines to remain compliant and avoid financial repercussions. Establishing best practices for tracking and managing these deadlines can make a significant difference in ensuring punctual filing.

Using tools designed for document management, such as the capabilities offered by pdfFiller, can help companies set reminders and maintain a proactive approach to their filing responsibilities. Developing a structured approach to managing forms not only leads to improved compliance but also fosters greater confidence among stakeholders.

Post-filing actions and transparency

After filing Form 8-K, companies must not overlook the importance of engaging with their stakeholders. Effective communication following a filing helps manage expectations and maintains trust. Monitoring and responding to shareholder feedback can offer valuable insights and reinforce a company’s commitment to transparency.

Moreover, keeping meticulous records of all filed documents is essential for compliance and reference in future filings. This organized approach contributes to a company's overall governance strategy, highlighting the dedication to accurate and timely disclosures.

Interactive tools and resources on pdfFiller

pdfFiller provides an array of tools tailored for creating, editing, and managing Form 8-K filings effortlessly. Its cloud-based capabilities enhance the collaborative approach, making it easier for teams to work together on filings from any location. This flexibility is particularly beneficial in today’s dynamic business environment, where time and accuracy are of the essence.

Through user testimonials and case studies, evidence of successful Form 8-K filings via pdfFiller showcases the platform's benefits. Companies can harness these capabilities to simplify their compliance processes and improve their overall filing accuracy.

FAQs about Form 8-K filings

As companies increasingly navigate the complexities of Form 8-K, several common concerns arise. New filers often have specific questions about the various sections and requirements of the form. Having a dedicated FAQ section can clarify key points and provide tips to enhance the filing process.

By addressing these common queries and offering concise clarifications, companies can empower those unfamiliar with Form 8-K to approach the filing confidently. This support not only aids compliance but also fortifies the organization’s commitment to transparency and accountability in all its operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k esab corp to be eSigned by others?

Where do I find form 8-k esab corp?

How do I make edits in form 8-k esab corp without leaving Chrome?

What is form 8-k esab corp?

Who is required to file form 8-k esab corp?

How to fill out form 8-k esab corp?

What is the purpose of form 8-k esab corp?

What information must be reported on form 8-k esab corp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.