Get the free Tax Organizer for Individuals & Businesses

Get, Create, Make and Sign tax organizer for individuals

Editing tax organizer for individuals online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax organizer for individuals

How to fill out tax organizer for individuals

Who needs tax organizer for individuals?

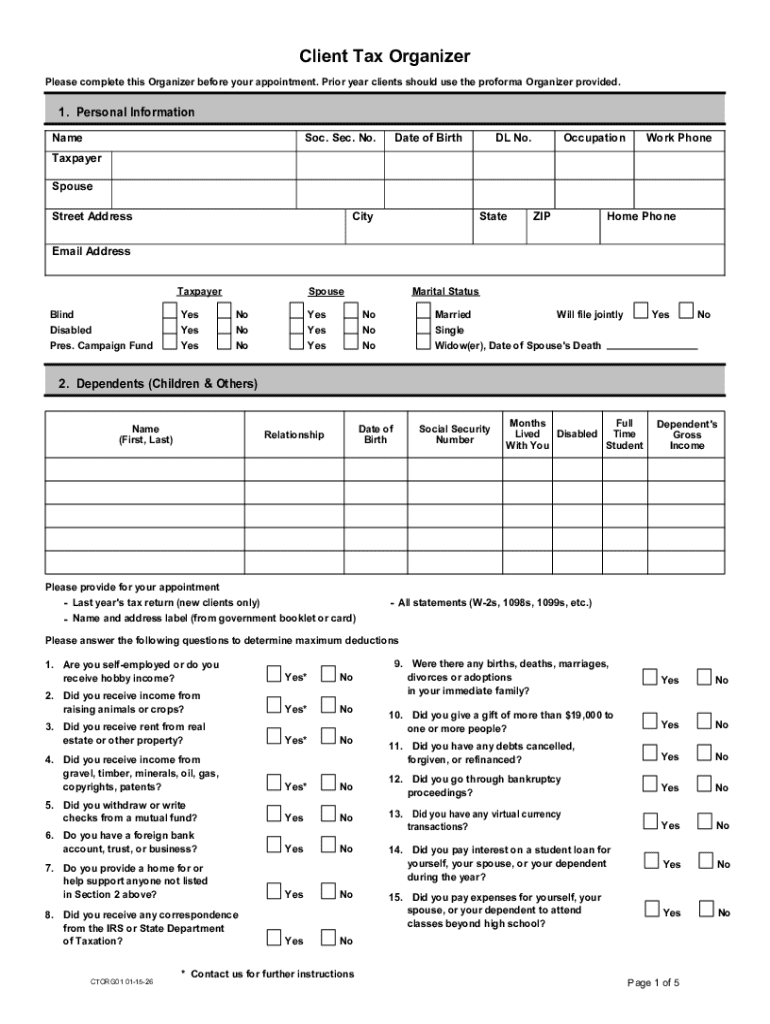

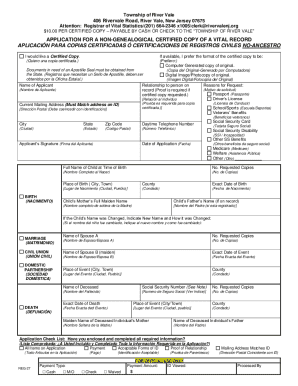

Understanding the Tax Organizer for Individuals Form

Understanding the tax organizer for individuals

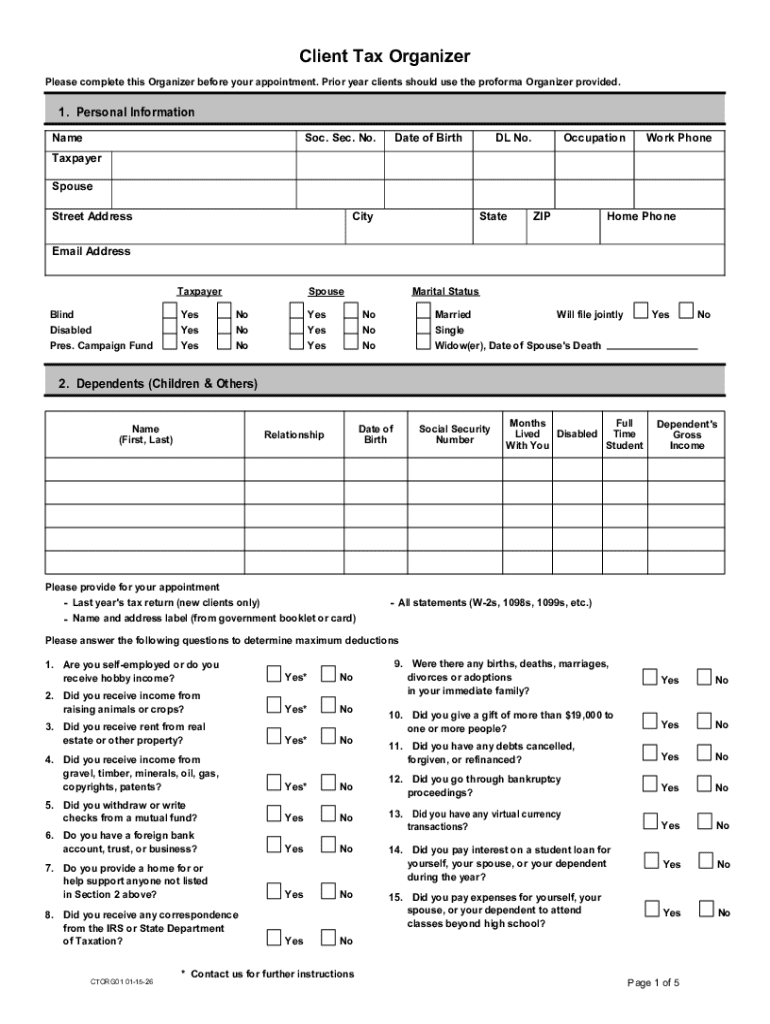

A tax organizer for individuals is an essential tool that helps taxpayers effectively prepare for their income tax returns. It serves as a structured framework where individuals can collate all necessary information and documentation related to their finances over the year. This comprehensive collection not only simplifies the task of filing an income tax return but ensures that taxpayers don't miss any crucial details that could impact their tax obligations.

Utilizing a tax organizer can drastically streamline the tax preparation process, presenting individuals with a clear outline of what they need to report. By organizing income, deductions, and credits in one place, taxpayers can reduce errors and omissions that might otherwise trigger audits or penalties. pdfFiller's Tax Organizer specifically caters to individuals, providing an accessible and user-friendly way to ensure every detail is accounted for.

Key features of pdfFiller's tax organizer

pdfFiller's Tax Organizer boasts a variety of features designed to enhance user experience and efficiency. One of the standout features is its cloud-based accessibility, allowing users to access their documents from any device, anywhere, at any time. This flexibility is essential for individuals who may need to gather information on the go or consult with professionals without being tied to a single location.

The interactive tools available within the tax organizer, such as importing income and expense data and automatic calculations, ensure that users can quickly and accurately populate their forms without the hassle of manual entry. Users can edit existing forms, add notes, and even utilize eSignature functionality to sign documents legally. Additionally, collaboration tools allow individuals to work seamlessly with tax professionals or team members, streamlining communication and document management.

Step-by-step guide to completing the tax organizer form

Completing the tax organizer form on pdfFiller is a straightforward process that can be broken down into manageable steps. First, access the tax organizer template on the pdfFiller website by downloading it from their template library. The interactive platform allows you to quickly familiarize yourself with the layout and essential fields.

Next, fill out your personal information accurately. This section typically includes your name, address, Social Security number, and filing status—be meticulous, as inaccuracies may lead to complications. After entering personal information, turn your attention to documenting all income sources, such as wages, dividends, or rental income. Be sure to include various income types to accurately portray your financial situation.

After recording income, focus on tracking deductions and credits you’re eligible for. Popular deductions for individuals include mortgage interest payments, student loan interest, and certain medical expenses, which can significantly lower your taxable income. Utilize the interactive tools effectively, including data importing from previous returns to save time. Finally, as you complete the form, review all sections thoroughly to ensure completeness and accuracy before submission.

Common mistakes to avoid when using a tax organizer

Filing your tax return can become stressful if you’re not vigilant. Common mistakes can lead to underreporting income, overlooking potential deductions, and failing to save your work. Underreporting income, whether unintentionally or due to an incomplete review of your financial records, can trigger audits and lead to fines. Ensure that you take the time to gather all relevant documents, including W-2s, 1099s, and other income reports from various sources.

Another frequent error is neglecting deductions. Many individuals miss out on substantial savings due to oversight of what deductions they're eligible for, impacting the overall tax burden. Additionally, it's crucial to periodically save your progress while working on the form to avoid loss of critical information. Lastly, collaborating with tax professionals can provide insights and assist in avoiding mistakes that may result from a lack of specialized knowledge.

Advanced tips for maximizing your tax organizer experience

Maximizing the functionality of pdfFiller’s tax organizer goes beyond merely filling in forms. Integrate the organizer with accounting software, which can significantly streamline your financial data management, allowing for easy importation of existing figures directly from your software. Additionally, setting up reminders for key tax deadlines ensures that you stay on top of your filing responsibilities.

Implementing best practices for document sharing and security is also crucial. Ensure that any shared documents are explicitly labeled and encrypted to protect sensitive information. Utilize pdfFiller's built-in features for password protection and limit access accordingly. This way, you can confidently collaborate with professionals or share forms without compromising the security of your financial data.

FAQs about the tax organizer for individuals

As you embark on using the tax organizer for individuals, various FAQs can arise. One common question is, 'What if I can't find the required document to fill out?' In such instances, it's advisable to gather any alternative documentation that may still verify income or deductions. Should you be unsure about your current organizer, consider updating it regularly to reflect any changes in financial status and documentation.

Another frequent inquiry pertains to collaboration opportunities: 'Can I collaborate with my tax advisor through pdfFiller?' Yes, pdfFiller offers collaborative features that allow seamless interaction with tax professionals to ensure an accurate submission. Lastly, a valid concern regarding security arises, leading to questions like, 'Is my data secure when using pdfFiller?' pdfFiller employs advanced encryption and security measures, proving a safe environment for managing sensitive tax information.

Related topics and resources

When considering the tax organizer for individuals, it's also beneficial to explore related topics. Understanding the different types of tax forms for individuals can help broaden your knowledge and ensure compliance with local regulations. Best practices for document management during the tax season can significantly ease the stress that comes with filing. Additionally, educating yourself on how to choose the right tax software for your needs aids in efficient tax planning.

Customer testimonials and success stories

Real-life experiences using pdfFiller's tax organizer showcase the impact of a structured approach to tax filing. Users often share how its intuitive design helped streamline their tax preparation process, ensuring efficiency and accuracy. Take one user's feedback: 'The tax organizer transformed my approach to filing taxes—everything was in one place, and I could easily collaborate with my CPA without a hitch!' This kind of satisfaction emphasizes the platform's value.

Users appreciate the peace of mind that comes with knowing every detail is captured, resulting in fewer corrections and greater confidence in their filings. Overall, testimonials highlight how pdfFiller's commitment to innovation and user experience translates into successful outcomes for both individuals and teams managing their tax obligations.

Additional tools and templates available on pdfFiller

Beyond the tax organizer, pdfFiller offers an array of other related forms and templates. Whether you need additional tax-related documents, invoice templates, or general document management tools, the platform has something for everyone. Exploring the extensive library of templates can help simplify diverse document requirements—making your tax season swift and stress-free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax organizer for individuals without leaving Google Drive?

Where do I find tax organizer for individuals?

How do I edit tax organizer for individuals straight from my smartphone?

What is tax organizer for individuals?

Who is required to file tax organizer for individuals?

How to fill out tax organizer for individuals?

What is the purpose of tax organizer for individuals?

What information must be reported on tax organizer for individuals?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.