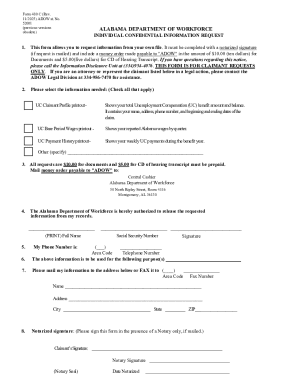

Get the free New customer credit Application Forms

Get, Create, Make and Sign new customer credit application

How to edit new customer credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new customer credit application

How to fill out new customer credit application

Who needs new customer credit application?

Your Complete Guide to the New Customer Credit Application Form

Understanding the new customer credit application form

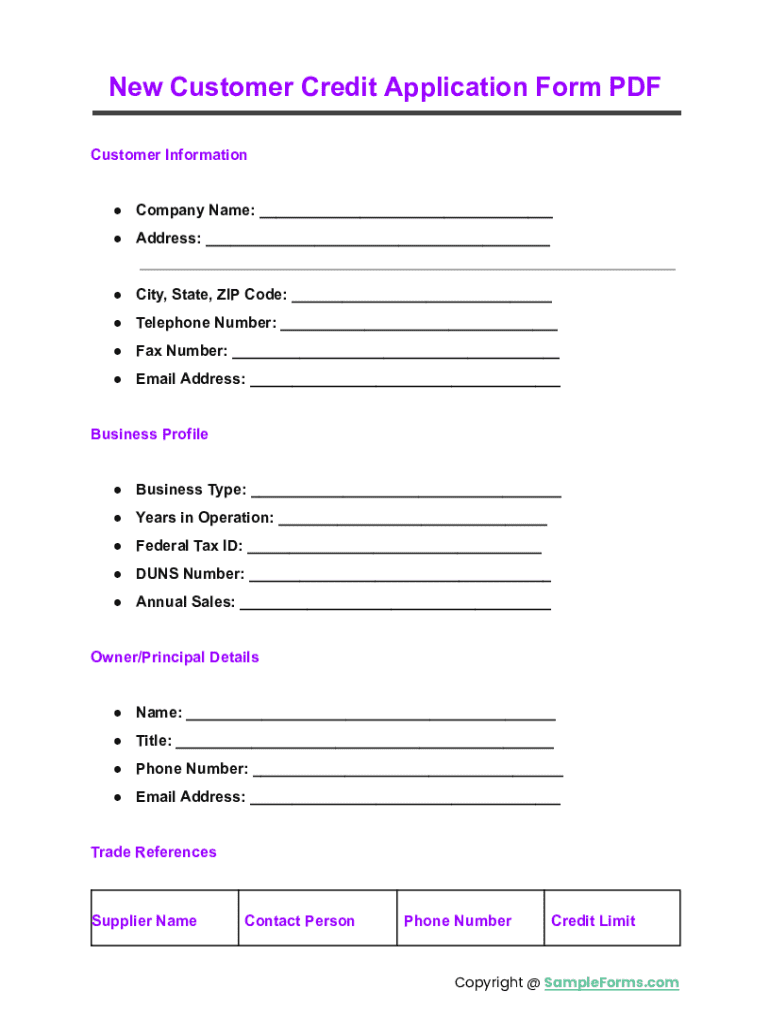

A new customer credit application form is a crucial document that business owners use to evaluate the creditworthiness of potential customers. This form goes beyond just collecting basic information; it helps businesses mitigate risks associated with lending or extending credit to new clients. A well-structured credit application provides insights into a customer's financial situation, payment history, and business authority, serving both the applicant and the lender by ensuring a transparent credit assessment process.

The importance of the credit application form cannot be overstated. Without this document, businesses may expose themselves to significant financial risks from customers who may not be able to meet their financial obligations. By collecting specific details regarding income, financial history, and references, companies can make informed decisions that protect their interests.

Legal and compliance considerations also play a key role in the credit application process. Laws such as the Equal Credit Opportunity Act (ECOA) require businesses to ensure fairness in lending, thus emphasizing the importance of transparent processes and documentation.

Overview of the pdfFiller platform

pdfFiller makes creating and managing the new customer credit application form a breeze. As a robust document management solution, pdfFiller allows users to create, edit, and store their documents in an organized and efficient manner. With its cloud-based platform, users can access their credit applications anywhere, making it suitable for dynamic workplaces that require flexibility.

Key features of pdfFiller relevant to credit applications include:

Utilizing a cloud-based solution like pdfFiller not only streamlines the application process but also enhances security and accessibility, allowing all users to stay organized and up-to-date without the chaos of paper files.

Step-by-step instructions for filling out the new customer credit application form

Filling out a new customer credit application form can be straightforward if approached methodically. Here's a breakdown of what to include in each section:

Editing and customizing the new customer credit application form

Customizing the new customer credit application form allows businesses to align it with their brand and specific information requirements. Using pdfFiller’s editing tools, users can add or remove fields effortlessly, ensuring that the form reflects any unique criteria necessary for their business.

Moreover, changing the format and layout can enhance the user experience. Highlighting key sections and providing examples can help guide applicants through the process effectively. Here are some tips for making the form user-friendly:

Collaborating with team members on the application process

Collaboration is vital when managing new customer credit applications, especially within larger teams. pdfFiller makes this easy by allowing users to invite team members to review and edit the application form. This collaborative approach ensures that multiple stakeholders can contribute their input from different departments, leading to a well-rounded and comprehensive application.

The platform’s commenting features enable team members to provide feedback directly on the document itself. Active discussions around potential edits or clarifications can expedite the development of an effective and clear credit application form. Importantly, pdfFiller also maintains version control and tracking history, allowing teams to monitor changes and revert to previous iterations if necessary.

Managing submitted applications effectively

Once a new customer credit application is submitted, effective management becomes essential for analyzing and organizing applications efficiently. pdfFiller offers various tools for this purpose, enabling users to store submitted applications in an orderly fashion, whether in folders designated by customer type or application status.

Tracking application status can also be simplified through pdfFiller. Users can set up reminders for follow-ups and use built-in analytics tools to gather insights on submission patterns and approval rates. This kind of data can inform business decisions and improve the credit application process over time.

Common mistakes to avoid when completing a credit application

Navigating the new customer credit application form can come with pitfalls if applicants are not vigilant. Some common mistakes include:

Frequently asked questions about new customer credit applications

Addressing common queries surrounding new customer credit applications ensures both businesses and applicants navigate the process smoothly. Here are key questions answered:

Interactive tools and resources available on pdfFiller

To further aid in the credit application process, pdfFiller offers various interactive tools and resources. Users can access templates and samples of credit application forms, ensuring that they start with a strong foundation. These templates can be tailored to individual needs, promoting efficiency in document preparation.

Additionally, interactive checklists help applicants and businesses navigate the application process smoothly, mitigating the risk of missing key information. Educational materials on credit application best practices also arm users with knowledge to improve their credit management strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the new customer credit application electronically in Chrome?

How do I fill out the new customer credit application form on my smartphone?

How do I fill out new customer credit application on an Android device?

What is new customer credit application?

Who is required to file new customer credit application?

How to fill out new customer credit application?

What is the purpose of new customer credit application?

What information must be reported on new customer credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.