Get the free Nebraska Homestead Exemption Application or Certification ...

Get, Create, Make and Sign nebraska homestead exemption application

Editing nebraska homestead exemption application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska homestead exemption application

How to fill out nebraska homestead exemption application

Who needs nebraska homestead exemption application?

Navigating the Nebraska Homestead Exemption Application Form

Overview of the Nebraska Homestead Exemption

The Nebraska Homestead Exemption is a vital program designed to assist homeowners by reducing their property tax burdens. It provides significant tax relief, specifically structured to support qualifying individuals such as senior citizens, disabled residents, and surviving spouses of veterans. Homestead exemptions can vary depending on the value of the property and the financial situation of the homeowner, making this exemption a crucial aspect of financial planning for many Nebraska residents.

Eligibility requirements

To qualify for the Nebraska Homestead Exemption, applicants must meet specific criteria. Firstly, age is a significant factor; individuals must be at least 65 years old, or if disabled, meet the state's definition of disability. Additionally, residency plays a critical role; the property must be owned and occupied as the primary residence within Nebraska. The program also stipulates that applicants must demonstrate financial need, with income limits adjusted annually by the state.

Eligible categories include senior citizens, individuals with disabilities, and surviving spouses of U.S. veterans. These groups are given priority in the exemption process, ensuring that those most in need receive assistance. To ensure a successful application, individuals should familiarize themselves with these criteria and prepare the necessary documentation in advance.

Understanding the application process

The application process for the Nebraska Homestead Exemption is straightforward, yet it's essential to adhere to certain deadlines. The official submission period typically commences on February 1st and concludes on June 30th of each year. Timely submissions are critical because submitting your application late may result in loss of benefits for that year. It’s a good idea to keep track of these timelines and potentially set reminders to avoid missing out on savings.

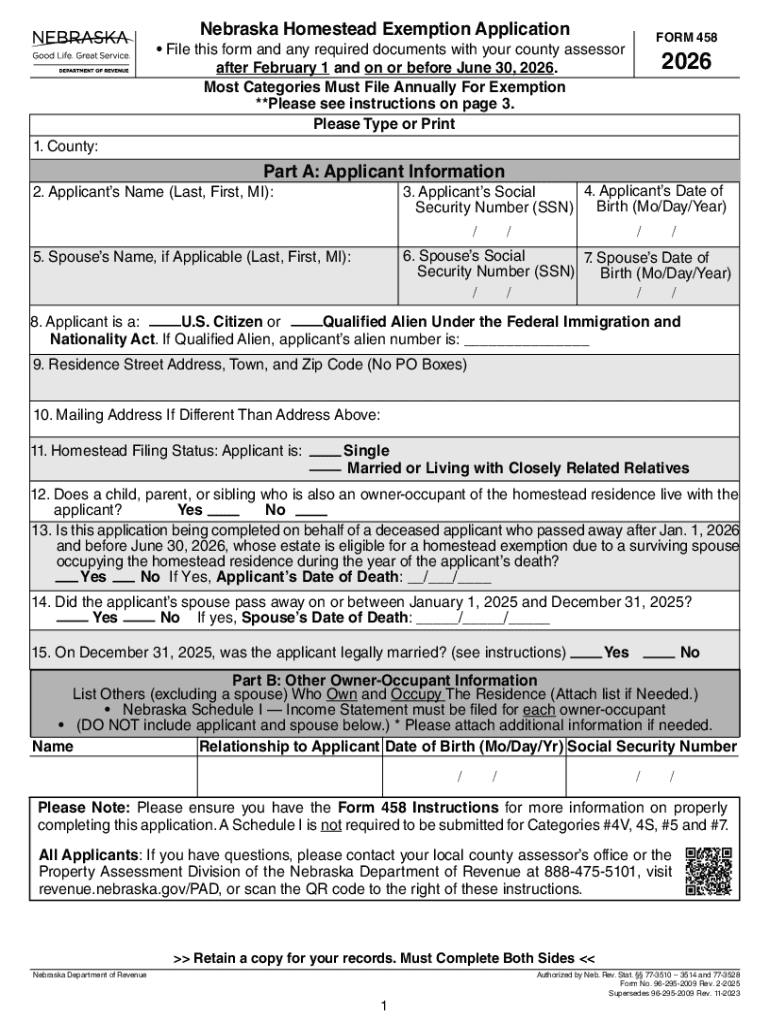

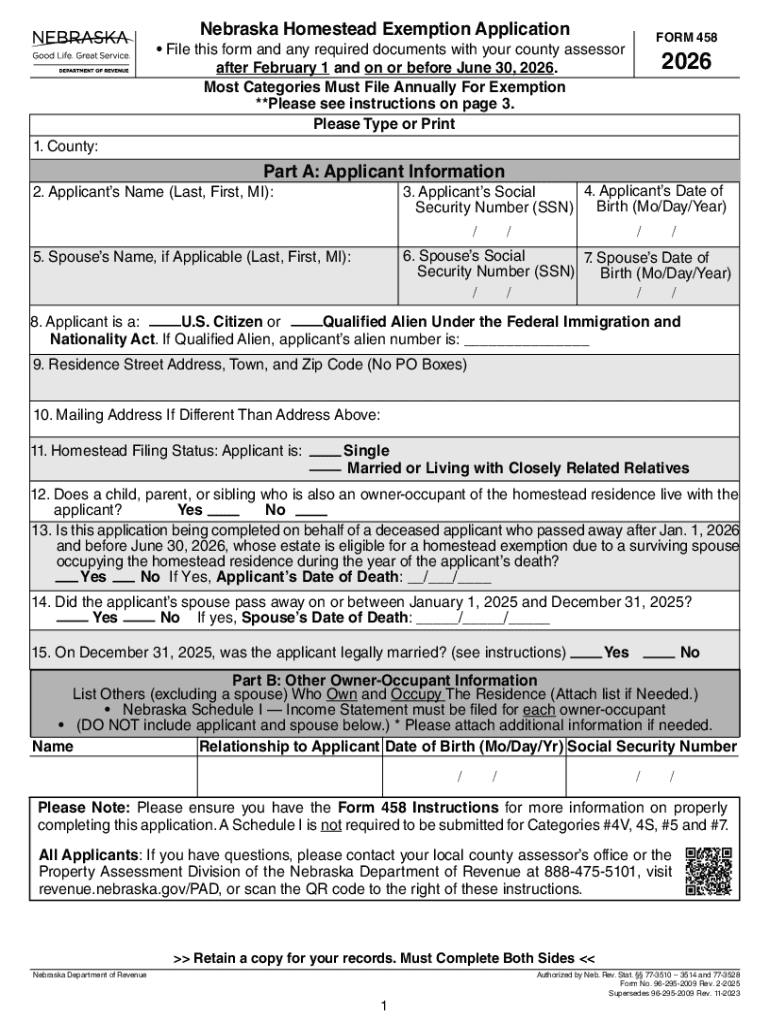

Detailed breakdown of the application form

The Nebraska Homestead Exemption application form can be divided into several key sections. Applicants need to provide personal identification details such as name, address, and social security number. Additionally, a description of the property is required, including its location, size, and assessed value. Each detail is crucial to verify eligibility and ensure accurate processing of the exemption.

Common questions regarding the form generally revolve around how to correctly fill out sections related to income and household size. Accurately documenting these elements is vital, as they directly influence the degree of exemption granted. Be prepared to provide supporting financial documents such as pay stubs, tax returns, and other relevant materials.

Steps to complete the homestead exemption application

Completing the Nebraska Homestead Exemption application requires careful preparation and attention to detail. Here’s a step-by-step guide to assist you in the process.

Resources for assistance

PDFfiller provides various tools and templates that can streamline the Nebraska Homestead Exemption application process. Their interactive digital forms make it easy to navigate through the application, allowing users to fill in information effortlessly. Customization options also enable applicants to create unique applications that meet their precise needs.

For local assistance, individuals can reach out to their county assessor’s office. These offices offer expert guidance on filling out forms correctly and understanding eligibility criteria. Having access to these resources is invaluable, especially for first-time applicants.

Submitting your application

Once the application is complete, you must select an acceptable submission method. Your options include online submission via pdfFiller, which is efficient and enables tracking, or traditional methods such as mail or in-person delivery to your county assessor’s office. Each method has its advantages, but electronic submissions often reduce processing times significantly and provide confirmation of receipt.

Tracking your application status is equally paramount; pdfFiller offers tools to monitor changes and updates, ensuring you stay informed throughout the process.

Handling application rejections or appeals

Should your application for the Nebraska Homestead Exemption be rejected, understanding the common reasons is crucial. These can range from incomplete information to income exceeding the limits. If rejection occurs, applicants have the right to appeal the decision. The appeals process typically involves re-evaluating your documentation and filing additional forms, which can often be facilitated through pdfFiller, simplifying resubmissions.

An organized approach to handling potential rejections will not only ease the appeal process but will also help you present your case more convincingly.

FAQs about the Nebraska homestead exemption

Many applicants have questions regarding the Nebraska Homestead Exemption, particularly concerning how changes in property ownership impact exemption status. Taxable values can fluctuate based on local assessments, making it essential to stay informed about reassessment laws. Common inquiries also revolve around the impact of life events, like divorce or death, on eligibility, which should always prompt a review of an individual’s status.

User testimonials and success stories

Hearing from Nebraskans who have successfully navigated the Homestead Exemption application can be inspiring. Many homeowners report that the exemption has substantially aided them in managing their property tax bills, allowing them to allocate funds toward other essential live activities, such as healthcare or education.

Such success stories underline the importance of the exemption program, reinforcing the supporting role it plays in families and communities statewide. It's also a testament to the value of thorough preparation and seeking available resources, such as those offered through pdfFiller.

Tips for maximizing your homestead exemption benefits

To ensure you're receiving the maximum benefit from the Nebraska Homestead Exemption, consider these strategies. Begin by maintaining accurate records related to your income and dates of property ownership. Comprehensive documentation can help streamline re-evaluations and future applications. Additionally, staying informed about state changes—such as adjustments in income limits—may present further opportunities for increased exemptions.

Interactive tools and calculators

Utilizing interactive tools such as financial calculators can significantly aid in estimating potential property tax reductions through the Nebraska Homestead Exemption. Links to these calculators can provide immediate insights based on your financial input, making the process less laborious and more transparent.

Additionally, utilizing tools to track eligibility criteria over time can serve as a proactive measure to ensure you remain qualified as your circumstances change, which is vital for continuous benefits.

Final thoughts on managing your homestead exemption

Managing your Nebraska Homestead Exemption effectively requires diligence in keeping documentation current. By regularly reviewing your status, you can ensure continued benefits and be well-prepared for any future changes in law or assessment criteria. Understanding the exemption process thoroughly provides not just peace of mind but also empowers you to maximize the financial support offered by Nebraska state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nebraska homestead exemption application without leaving Google Drive?

How do I complete nebraska homestead exemption application online?

How can I edit nebraska homestead exemption application on a smartphone?

What is nebraska homestead exemption application?

Who is required to file nebraska homestead exemption application?

How to fill out nebraska homestead exemption application?

What is the purpose of nebraska homestead exemption application?

What information must be reported on nebraska homestead exemption application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.