Get the free 2022 Form 1040: File Your U.S. Individual Income Tax

Get, Create, Make and Sign 2022 form 1040 file

How to edit 2022 form 1040 file online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 form 1040 file

How to fill out 2022 form 1040 file

Who needs 2022 form 1040 file?

Your Comprehensive Guide to Filing the 2022 Form 1040

Understanding the 2022 Form 1040: Your Essential Tax Document

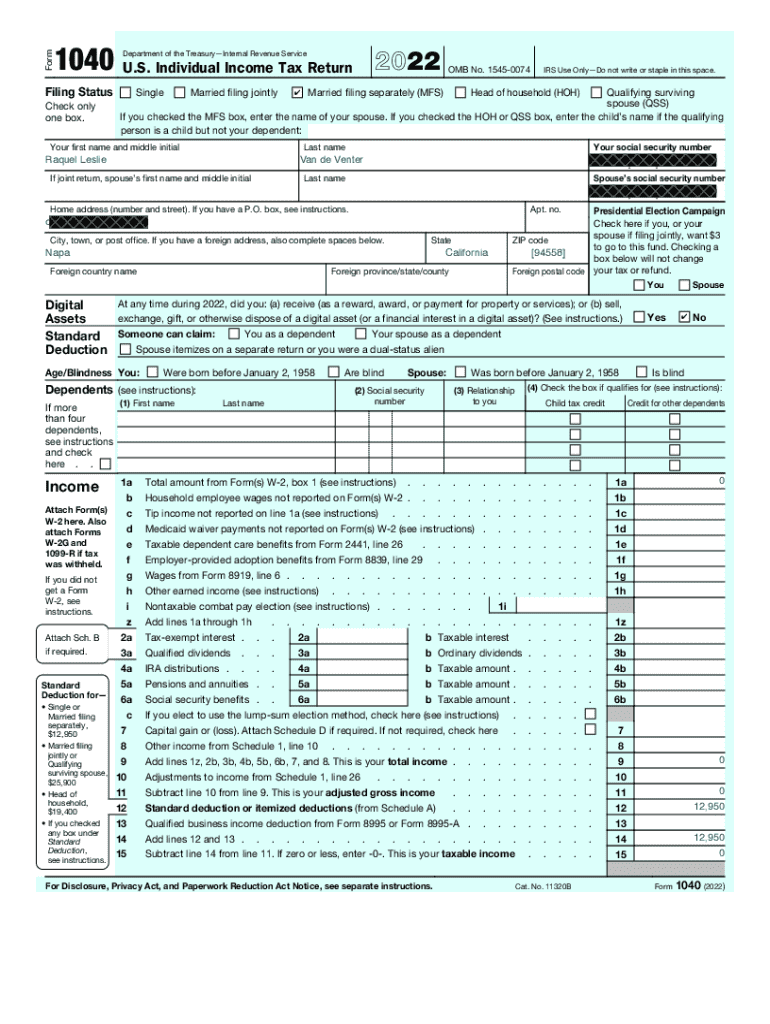

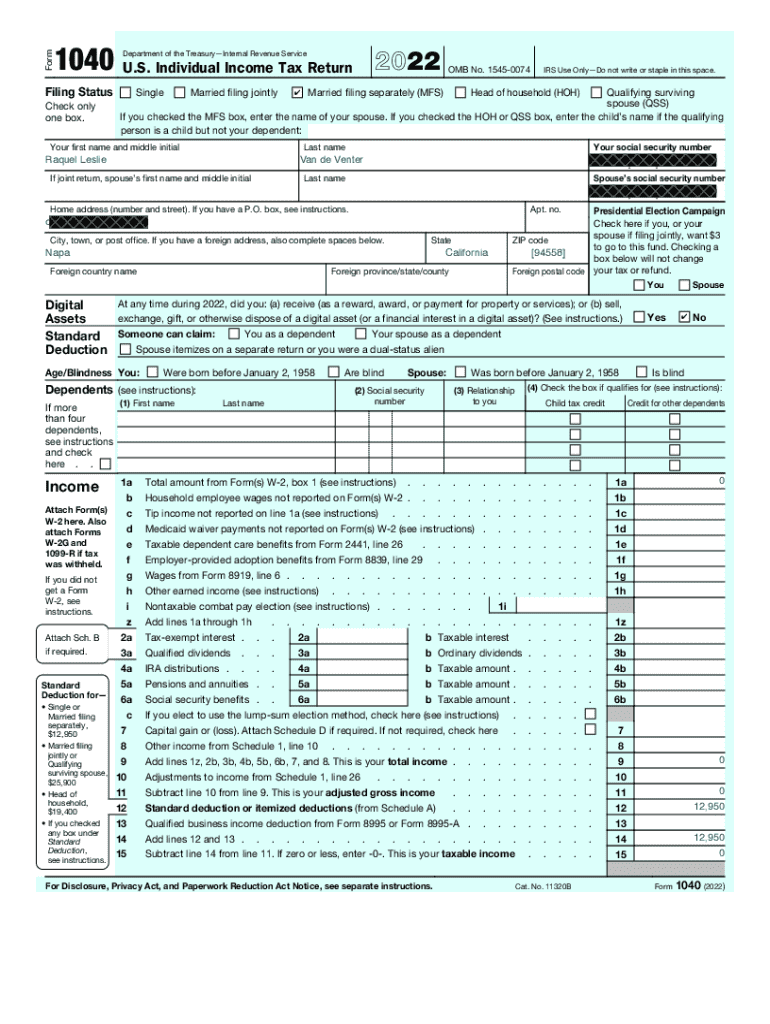

The 2022 Form 1040 stands as the crucial document for individual taxpayers in the United States, serving as the primary method to report income, claim deductions, and calculate taxes owed. Understanding its structure and requirements is vital to ensuring a smooth filing process.

This year's version has seen updates that reflect changes in tax laws and provide better clarity for taxpayers. Knowing the key features of the 2022 Form 1040 can help avoid common pitfalls and ensure accurate submissions.

Who needs to file Form 1040?

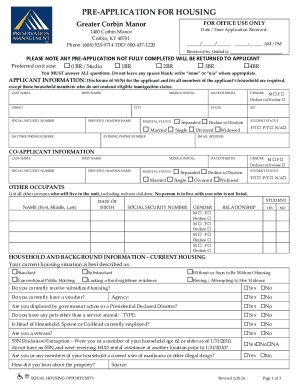

Not everyone is required to file Form 1040; however, understanding eligibility criteria is important. Generally, if your income exceeds the filing threshold for your respective filing status, you must file.

Preparing for your filing journey: Essential documents and information

Before initiating the filing process, collecting the necessary documentation is essential to ensure everything is in order. This includes not only income reporting forms but also documentation for deductions and credits you may qualify for.

Additionally, utilizing tools for organizing tax information can greatly improve your filing experience. Creating checklists for document collection and exploring digital document management options, such as online surveys and portals, enhances efficiency.

Navigating the 2022 Form 1040: Step-by-step instructions

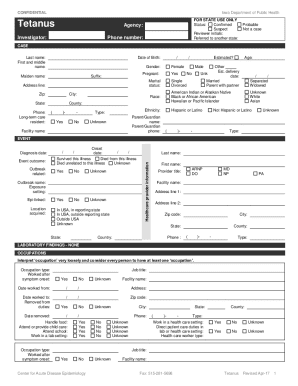

Completing Form 1040 requires careful attention to detail, beginning with filling out your personal information correctly. This includes ensuring accurate entries for your name, address, and Social Security Number to avoid processing delays.

When claiming deductions and credits, it’s crucial to distinguish between standard and itemized deductions. For 2022, the standard deduction figures are $12,950 for single filers and $25,900 for married couples filing jointly. Knowing which route offers the best tax benefit is essential.

To compute your tax obligations, refer to the IRS tax tables. This will guide you through the various tax brackets. Keep in mind that errors in calculations can lead to penalties, so double-check your math!

Digital tools for hassle-free filing

Using pdfFiller’s platform for filing Form 1040 offers significant advantages. Its seamless editing and eSigning features allow taxpayers to modify, sign, and share their forms quickly without the need for printing and mailing.

The collaborative tools enable teams to file together or share information securely, thus simplifying the often complex process of tax preparation.

eSignature: Making your filing fast and secure

The eSignature process for your 2022 Form 1040 is straightforward when using pdfFiller. Once your form is filled out, follow a few simple steps to apply your eSignature, ensuring that it meets legal standards while enhancing security.

Common filing issues and how to resolve them

Even with careful preparation, taxpayers may encounter common issues during the filing process. These usually stem from missing information or miscalculations that could delay processing.

If challenges arise that seem insurmountable, don’t hesitate to seek professional tax advice. This is especially pertinent for individuals with complex financial situations, such as business owners.

Filing beyond 1040: Other related forms to be aware of

In addition to Form 1040, various supplementary forms may be necessary, depending on your financial situation. Understanding when these forms apply is crucial for accurate reporting.

Be sure to review your eligibility for these documents carefully before submitting your Form 1040 to avoid disruptions.

Keeping yourself informed: Tax news and updates for 2022

For a seamless filing experience, staying updated with tax regulatory changes is essential. 2022 has introduced several alterations that could impact your tax return.

Utilizing free resources for ongoing tax education can be beneficial. The official IRS website offers updated guidelines and helpful tips, while tax-related blogs and forums allow community support during the filing season.

Making late filings: What to do if you miss the deadline

Taxpayers who miss the filing deadline should be proactive in understanding their options. Filing for an extension can provide additional time, but it’s vital to note that this doesn’t excuse any payment delays.

Frequently asked questions (FAQs) about 2022 Form 1040

As taxpayers navigate the complexities of the 2022 Form 1040, several common questions may arise, aiding in clarity and confidence in the filing process.

For personalized answers, consult with a tax professional or browse online resources for insights into frequently encountered scenarios.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 2022 form 1040 file in Chrome?

How do I fill out 2022 form 1040 file using my mobile device?

How do I fill out 2022 form 1040 file on an Android device?

What is 2022 form 1040 file?

Who is required to file 2022 form 1040 file?

How to fill out 2022 form 1040 file?

What is the purpose of 2022 form 1040 file?

What information must be reported on 2022 form 1040 file?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.