Get the free General Journal Form Example

Get, Create, Make and Sign general journal form example

How to edit general journal form example online

Uncompromising security for your PDF editing and eSignature needs

How to fill out general journal form example

How to fill out general journal form example

Who needs general journal form example?

Understanding the General Journal Form: A Comprehensive Guide

Understanding the general journal

A general journal is an essential component of the accounting process, serving as a primary record for documenting financial transactions. It provides a chronological and systematic account of business events that impact financial statements, ensuring transparency and accuracy in financial reporting. Unlike specialized journals that categorize transactions by type, such as sales or receipts, the general journal captures a wide range of transactions, making it a critical tool for comprehensive bookkeeping.

The importance of the general journal cannot be understated; it is the foundation on which businesses track their financial health. By maintaining a general journal, businesses can ensure that all transactions are recorded promptly, facilitating timely and accurate financial reporting. This form is instrumental in aligning various financial records and serves as a point of reference when reconciling accounts or preparing financial statements.

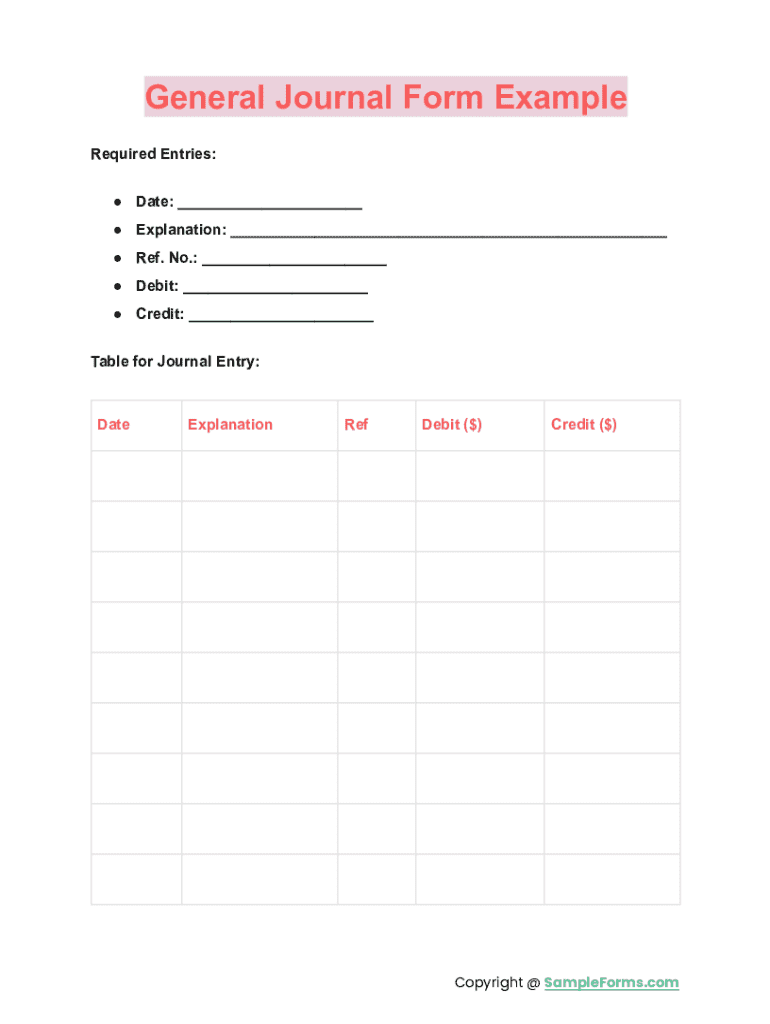

Key components of a general journal form

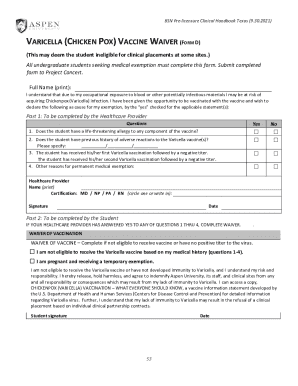

A typical general journal form consists of several fields essential for accurately documenting transactions. The most common fields include the date, account titles, descriptions, debit and credit columns, and a reference or document number. Each of these components plays a vital role in ensuring that the journal entries are complete and organized.

Understanding the significance of each component helps in maintaining accurate records, which is crucial for both internal audits and preparing financial statements. Each entry must support the overall financial picture of the business, making precision paramount in bookkeeping.

How to fill in a general journal entry

Filling in a general journal entry might seem daunting, but by following a structured approach, it can become a straightforward task. Start by determining the exact date of the transaction, as this sets the stage for an accurate chronological record. Next, identify which accounts will be impacted—typically one account will be debited and another credited. It's essential to ensure that the total debits equal the total credits to maintain the integrity of the accounting equation.

Common errors to avoid include misclassifying accounts, miscalculating amounts, and neglecting to reference supporting documentation. These mistakes can lead to inaccurate financial records, so double-checking each entry before finalizing is crucial for maintaining accuracy in your general journal.

Examples of general journal entries

To solidify understanding, let's illustrate some common business transactions as general journal entries. For instance, when a business makes a sale, the journal entry would typically debit Cash or Accounts Receivable and credit Sales Revenue. Similarly, for an expense paid in cash, the journal entry would debit the relevant Expense account and credit Cash.

Each of these entries reflects the impact of transactions on financial statements and illustrates why maintaining a correct general journal form is crucial for effective bookkeeping.

General journal adjusting entries

Adjusting entries are a vital part of the accounting process, ensuring that all revenues and expenses are recognized in the period they occur. These entries are particularly important at the end of an accounting period when finalizing financial statements. Adjustments may include accruals, deferrals, and estimates, all of which help in providing a true picture of a company's financial health.

For example, when services are provided but payment is received later, a journal entry would debit Accounts Receivable and credit Service Revenue. On the other hand, when prepaid expenses are incurred, you would debit the appropriate Expense account and credit Prepaid Expenses. Adjusting entries are crucial for ensuring that financial statements accurately reflect the business's activities.

General journal closing entries

Closing entries serve as the final step in the accounting cycle, ensuring that revenue and expense accounts are reset for the next accounting period. This process allows for clear tracking of income and expenses from one period to the next, facilitating accurate financial reporting.

For instance, to close the revenue account for the year, you would debit the revenue account and credit Retained Earnings. This final step consolidates financial activities and prepares the business for future transactions, maintaining continuity in financial reporting.

General ledger vs. general journal

While the general journal captures all transactions sequentially, the general ledger organizes these transactions by account. Each general ledger entry reflects accounts affected by transactions recorded in the journal. This systematic approach enables businesses to effectively monitor their financial position and simplifies financial analysis.

Essentially, the general journal acts as the initial record that feeds into the general ledger, making both documents indispensable in the accounting process. The synergy between the general journal and general ledger is vital for maintaining accuracy and coherence in financial statements.

Special considerations: General journal vs. special journal

In bookkeeping, understanding when to use a general journal versus a special journal is crucial for efficiency. Special journals, such as the sales journal or purchases journal, are tailored for high-volume transactions of a specific type, easing the recording process. In contrast, a general journal is required for less frequent or miscellaneous transactions that don't fit neatly into these categories.

Choosing the right journal can enhance bookkeeping efficiency. For example, a business might employ a special journal for regular sales activities, while relying on a general journal for complex transactions such as asset acquisitions or adjustments due to discrepancies.

Interactive tools and features for managing general journal forms

pdfFiller provides comprehensive tools for creating and managing general journal forms effortlessly. With features designed for document editing and collaboration, users can easily approach the complexity of financial reporting. The platform allows you to fill in, sign, and share general journal forms securely in the cloud, facilitating remote work for teams.

Using a platform like pdfFiller increases accessibility and efficiency in managing your general journal forms, ensuring that all parties involved have real-time access to the necessary documentation for effective bookkeeping.

Frequently asked questions about general journal forms

As businesses often grapple with the nuances of maintaining accurate general journal entries, several common questions arise. For instance, users often inquire about how to format entries correctly, troubleshoot errors, and the best practices for information retention. Addressing these questions helps businesses streamline their bookkeeping processes.

In addition to these inquiries, sharing insights based on user experiences, such as tips for efficiency and common pitfalls, can further enhance understanding of the general journal form. Engaging with those actively navigating the intricacies of bookkeeping can provide invaluable lessons that bolster accuracy and completeness in financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete general journal form example online?

How can I edit general journal form example on a smartphone?

How do I edit general journal form example on an Android device?

What is general journal form example?

Who is required to file general journal form example?

How to fill out general journal form example?

What is the purpose of general journal form example?

What information must be reported on general journal form example?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.