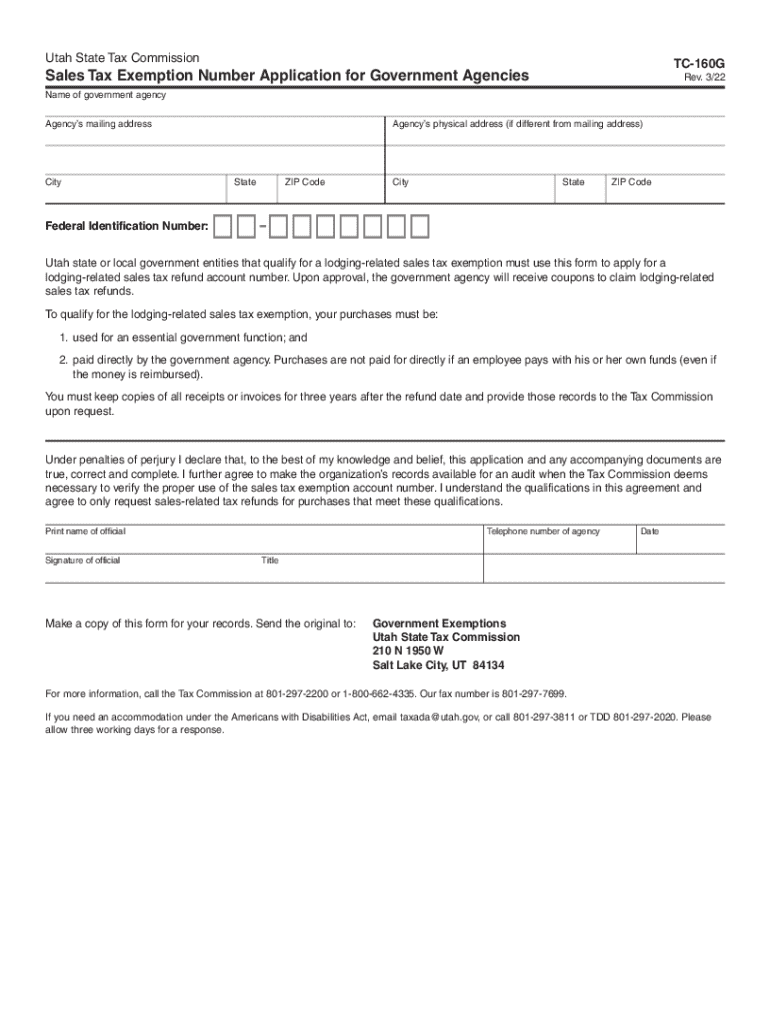

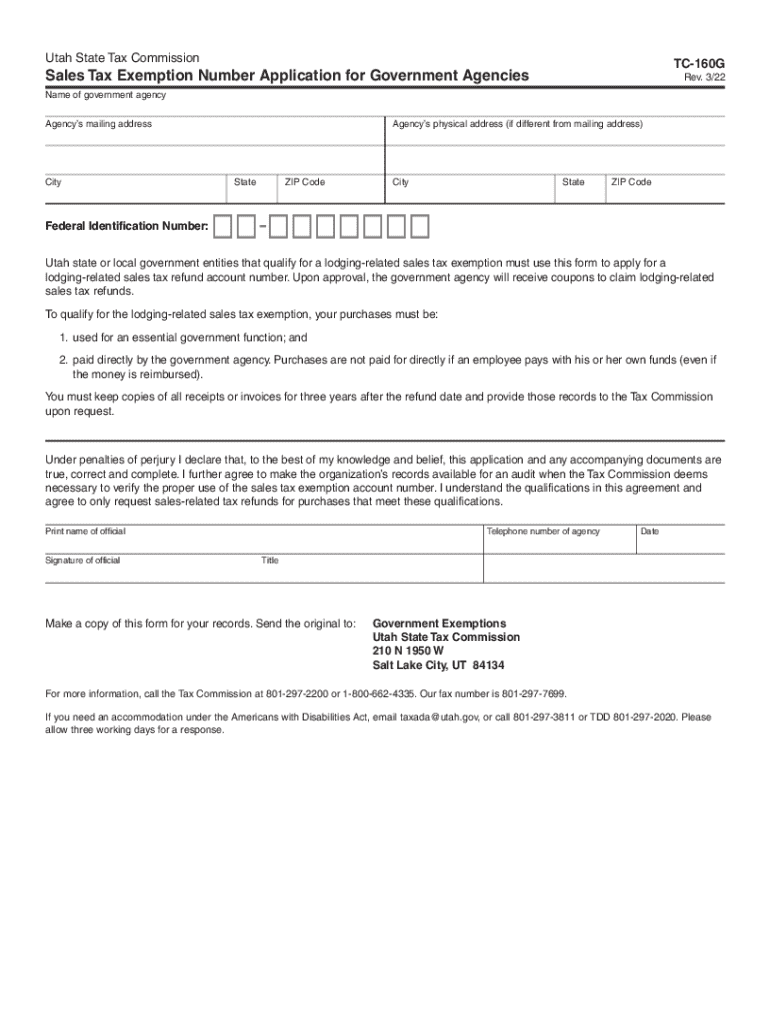

Get the free TC-160G, Utah Sales Tax Exemption Number Application for Government Agencies. Forms ...

Get, Create, Make and Sign tc-160g utah sales tax

Editing tc-160g utah sales tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-160g utah sales tax

How to fill out tc-160g utah sales tax

Who needs tc-160g utah sales tax?

Understanding the tc-160g Utah Sales Tax Form: A Comprehensive Guide

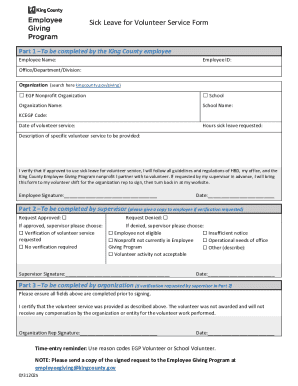

Overview of the tc-160g Utah Sales Tax Form

The tc-160g Utah Sales Tax Form is a critical document for individuals and businesses engaged in sales transactions within the state of Utah. This form serves the purpose of reporting and remitting state sales tax on taxable sales. Compliance with the regulations requisitioned by the Utah government is essential, and utilizing the tc-160g ensures that taxpayers are aligned with state tax responsibilities.

For businesses, properly completing the tc-160g is paramount; it not only facilitates an orderly tax payment process but also helps prevent any potential penalties for non-compliance. Individuals may also use this form in particular scenarios, such as claiming sales tax exemption for eligible purchases, making it a versatile tool for various taxpayers.

Understanding sales tax in Utah

Utah's sales tax system comprises a base state tax rate of 4.85%, augmented by additional county and local taxes depending on the jurisdiction. Purchases of tangible personal property, certain services, and lodging in hotels or motels are generally subject to sales tax. However, understand that there are exemptions applicable to specific items and situations.

Certain items like food staples may qualify for state exemptions, while others may be subject to local county rates instead of the state base rate. Thus, awareness of local laws is crucial. For example, sales tax rates might differ between metropolitan areas and rural counties. Always check with local tax authorities to ensure compliance with county-specific regulations. This nuanced approach to sales tax underscores the importance of carefully filling out the tc-160g form.

Detailed walkthrough of the tc-160g form

Filling out the tc-160g form requires careful attention to detail to ensure accuracy and compliance. Here’s a breakdown of its sections:

It's important for specific business types, such as those in lodging or sales of intangible goods, to be mindful of any additional requirements or documentation needed while filling out the tc-160g.

Common mistakes to avoid

Completing the tc-160g form accurately is imperative, as mistakes can lead to significant penalties. Here are the top errors to avoid:

By staying organized and thoroughly reviewing the form before submission, taxpayers can minimize errors and ensure successful compliance with Utah tax laws.

Managing changes to the form

Tax forms are subject to updates and modifications based on changes in tax laws. Therefore, regularly checking for revisions to the tc-160g form is necessary to avoid submitting outdated documents. Staying informed on these changes helps maintain compliance with any adjustments to tax rates, exemption criteria, or form structure.

Utilizing resources from the Utah State Tax Commission and subscribing to updates can be beneficial. Always ensure that you’re using the most current version of the tc-160g when filing, as utilizing an obsolete form can result in delays or compliance issues.

Filing and payment procedures

Taxpayers have the option to submit the tc-160g form either online or via paper filing. Online filing is generally faster and ensures that submissions are received promptly. Those who choose to file by mail should allow for sufficient processing time, especially close to tax deadlines.

Payment options available for tax due can typically include electronic payments, checks, or money orders. It's essential to familiarize yourself with submission deadlines, as late payments can incur unnecessary penalties. Moreover, maintaining clear records of all submitted forms and transactions will provide a robust defense should any questions arise regarding your sales and use tax obligations.

Exemptions and adjustments

Understanding exemptions is also crucial for accurate sales tax reporting in Utah. Common exemptions that may be applicable include those for certain non-profit organizations, governmental entities, and specific types of goods that qualify under state law such as sales of food. When claiming adjustments on your tc-160g, it's necessary to be well-versed in the types of purchases that fall under exempt categories.

To determine eligibility for exemptions, consult resources available through the Utah State Tax Commission. Additionally, ensuring all necessary documentation is included with your submission aids in supporting claims for tax exemption status.

Frequently asked questions about the tc-160g form

Inquiries about the tc-160g form often arise in various contexts. Here are clarifications for some common queries:

For additional assistance, don't hesitate to reach out to the state tax assistance line where professionals are available to answer your questions.

Utilizing interactive tools for enhanced compliance

Leveraging online tools like pdfFiller can significantly enhance the experience of filling out the tc-160g Utah Sales Tax Form. With features that facilitate editing PDFs, users can seamlessly complete their forms without cumbersome paperwork. The platform also supports eSign options, making the submission process faster and more efficient.

Moreover, utilizing a cloud-based platform such as pdfFiller for document management ensures that all related files are easily organized and accessible from anywhere. This functionality proves invaluable during tax season when quick access to documents is paramount.

Collaborating on sales tax filing within teams

For businesses employing multiple team members in tax filing, collaboration tools are key. Utilizing platforms like pdfFiller allows team members to share access to the tc-160g form, promoting efficient communication and accuracy. Clear task assignments and collaborative review processes provide an added layer of scrutiny to ensure compliance.

Creating a cohesive approach helps streamline the filing process, allowing each member to contribute effectively. Regular check-ins and updates among team members can ensure that everyone remains aligned with changing tax regulations, minimizing the risk of errors.

Advanced tips for business owners

Effective sales tax management is crucial for any business owner. Instituting systems to track sales and sales tax collected can alleviate the stress of tax filing. Consider setting up automated reminders for upcoming tax deadlines to avoid last-minute rushes that could lead to errors.

Additionally, exploring advanced features in document management platforms can streamline your process even further. For example, automation can simplify data entry tasks, allowing business owners to focus more on strategic decision-making rather than administrative hurdles.

Keeping up with Utah tax compliance

Continuous education on sales tax compliance is essential for business longevity. Regularly visiting the Utah State Tax Commission’s website or attending workshops and training sessions can keep business owners informed about changes affecting sales tax laws.

Networking opportunities with fellow Utah business owners provide invaluable support and insights. Participating in local business associations or groups focused on tax compliance can enhance knowledge and foster collaboration among peers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tc-160g utah sales tax to be eSigned by others?

Can I sign the tc-160g utah sales tax electronically in Chrome?

Can I create an eSignature for the tc-160g utah sales tax in Gmail?

What is tc-160g utah sales tax?

Who is required to file tc-160g utah sales tax?

How to fill out tc-160g utah sales tax?

What is the purpose of tc-160g utah sales tax?

What information must be reported on tc-160g utah sales tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.