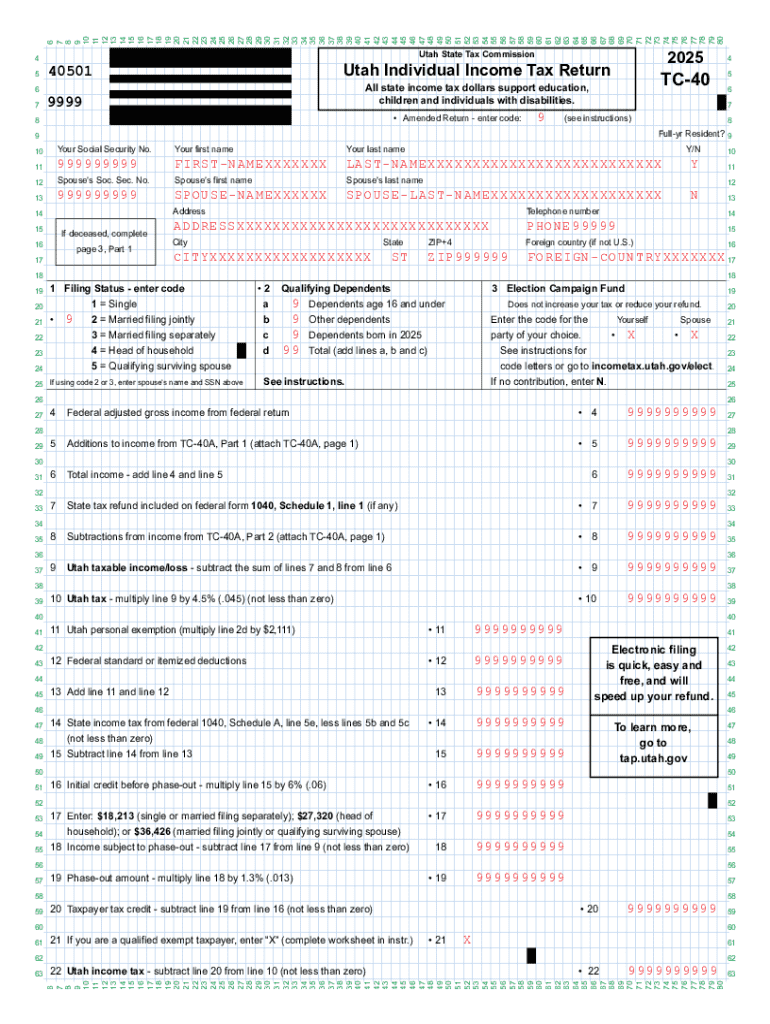

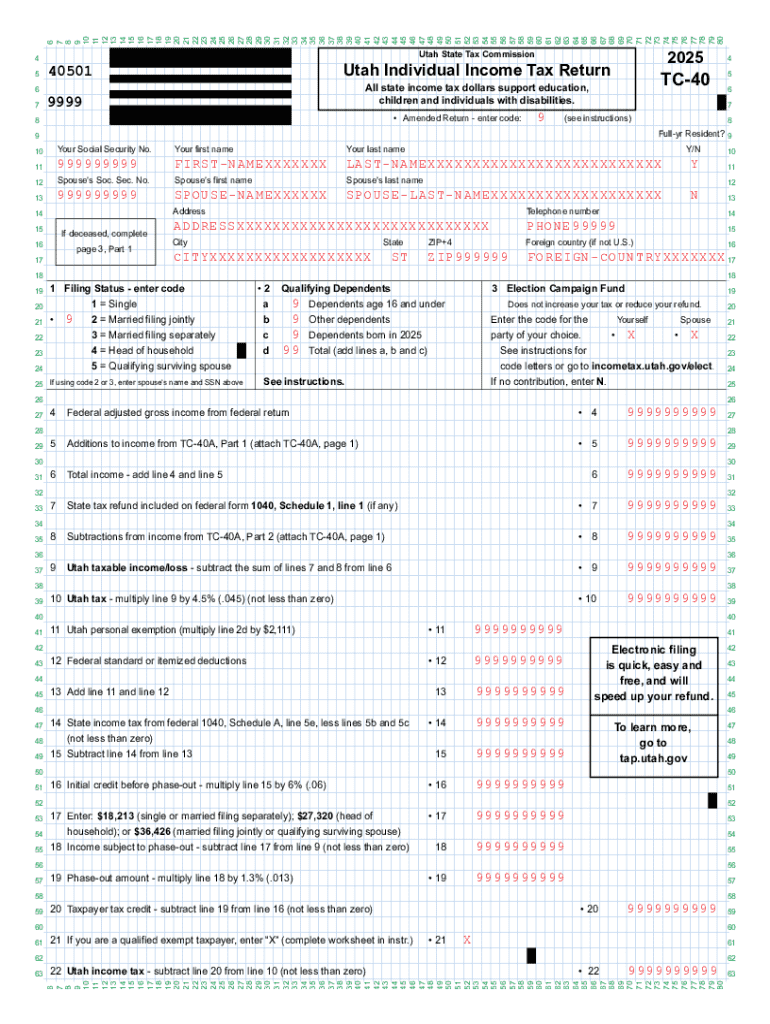

Get the free Utah Individual Income Tax Return. Forms & Publications

Get, Create, Make and Sign utah individual income tax

How to edit utah individual income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out utah individual income tax

How to fill out utah individual income tax

Who needs utah individual income tax?

Utah Individual Income Tax Form: A Comprehensive How-to Guide

Understanding the Utah individual income tax form

Utah residents and non-residents must navigate the intricacies of the state’s individual income tax. The state imposes a flat income tax rate of 4.95%, and therefore knowing which form to use is crucial. Correctly filing your taxes is essential to avoid potential fines and ensure compliance with Utah tax laws.

The individual income tax form is meant for various filers, including residents, part-year residents, and non-residents. It’s important to use the right form for your specific situation, as it impacts your tax liability. Residents are taxpayers who have maintained domicile in the state for the entire calendar year, while non-residents earn income sourced in Utah but reside elsewhere.

Certain income thresholds also dictate whether an individual must file. For example, in 2023, single filers under 65 must file if they have a gross income of at least $12,400.

Types of Utah individual income tax forms

Utah offers several forms tailored to different taxpayers’ situations. Understanding these forms is vital for accurate filing.

The primary forms include Form 140 for residents, Form 140N for non-residents, and Form 140S for part-year residents. Here's a brief overview of each:

Identifying the right form avoids complications such as incorrect tax assessments or potential audits. It’s crucial to ascertain your filing requirement based on residency status before proceeding.

Many taxpayers make common mistakes such as filing with the wrong form, leading to possible penalties. Always double-check to ensure you are using the appropriate form based on your residency status.

Step-by-step instructions for filling out the Utah individual income tax form

Filling out your Utah individual income tax form can seem daunting, but a structured approach can simplify the process. Begin by gathering all necessary documents.

Key documents typically include W-2 forms from your employers, 1099 forms for other income sources, proof of deductible expenses, and records of any credits you plan to claim. Accuracy here is vital, as discrepancies can lead to audits or refund delays.

Once you have your documents ready, proceed to fill out the form. Pay attention to sections such as:

Utilizing services like pdfFiller can greatly enhance your experience. Their platform allows for the seamless upload and editing of the form, with interactive tools that make filling out information much easier. By leveraging these features, you can ensure a more efficient learning curve.

Filing your Utah individual income tax form

After completing your form, you have a few options for submission. Online filing through the Utah State Tax Commission is one of the quickest methods available. Their e-services facilitate a user-friendly interface, guiding you from start to finish.

If you prefer traditional methods, you can submit your form by mail. Be mindful when addressing your envelope to avoid delays. Use proper postage and check for any requirements that may affect submission times.

Important deadlines are crucial to remember. Typically, the filing deadline is April 15 of each year. If you require more time, you can file for an extension, but ensure you follow through with any payment submissions by the original deadline to avoid penalties.

Understanding refunds and payments

After filing, many taxpayers are eager to track their tax refunds. Utah provides a straightforward way to check the status of your refund on the state tax commission's website. Generally, refunds take about 4-6 weeks to process, but specific circumstances can accelerate or delay this timeframe.

Organizing your payment options is equally important, especially if you end up owing taxes. Electronic payment methods offer convenience and speed. Furthermore, Utah initiatives allow for payment plans should you require more time to fulfill your tax obligations.

Handling tax audits in Utah

Understanding what triggers a tax audit is a crucial step in ensuring compliance. Common red flags include large inconsistencies in reported income versus documented income sources or claims of excessive deductions that don’t correlate with your income level.

If you receive an audit notice, respond promptly and provide all requested documentation. The importance of maintaining organized records cannot be overstated, especially in stressful situations like audits.

Special considerations for specific groups

Retirees and seniors can take advantage of additional tax credits in Utah, especially those for low-income retirees. These credits can significantly alleviate tax burdens for eligible seniors, making it essential to research available options.

Military personnel also have unique considerations. Active-duty members may have certain exemptions regarding income earned outside Utah. Understanding these rules prevents pitfalls when filing.

Additionally, protecting your tax information from identity theft is paramount. Regularly monitor your financial documents and ensure you are aware of your tax-related activities.

Utilizing pdfFiller’s resources

pdfFiller goes beyond just helping fill out forms; it provides a suite of interactive tools tailored for document management. Their platform enhances your experience, especially when filling out tax forms, enabling you to handle your documents seamlessly.

Features that support collaboration and editing allow individuals or teams to work together effectively on tax forms. By utilizing these tools, all volunteers or participants in tax preparation can contribute safely and efficiently.

The eSigning feature streamlines submission, ensuring legal compliance while maintaining document security through cloud-based access. A step-by-step guide on how to eSign your tax form securely is easily accessible on their platform.

Frequently asked questions (FAQs)

Many individuals have common queries regarding the Utah individual income tax form. Understanding your filing status is foundational. Usually, single taxpayers, head of household, and married filing jointly or separately have different implications.

Clarification on deductions is another common query. Taxpayers often wonder if state taxes paid can be deducted and whether contributions to Utah-specific retirement funds impact their tax liabilities.

Contact information for assistance

If you encounter challenges or need personalized help, the Utah State Tax Commission is your go-to source. Their phone number is readily available for inquiries, and they have multiple office locations across the state, including Salt Lake City.

Additionally, pdfFiller offers robust support services to assist with document preparation. Accessing their help resources can significantly ease the process of filling out and managing your tax documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my utah individual income tax in Gmail?

How do I complete utah individual income tax online?

How can I fill out utah individual income tax on an iOS device?

What is utah individual income tax?

Who is required to file utah individual income tax?

How to fill out utah individual income tax?

What is the purpose of utah individual income tax?

What information must be reported on utah individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.