Get the free Donation Receipt. Donation Receipt - tour diabetes

Show details

Date Donor Name Amount Solicitor Name All donations are fully tax-deductible as allowed by law. Thank you for your. Generous donation! All donations are fully tax-deductible as allowed by law. Thank

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donation receipt donation receipt

Edit your donation receipt donation receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation receipt donation receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donation receipt donation receipt online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donation receipt donation receipt. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

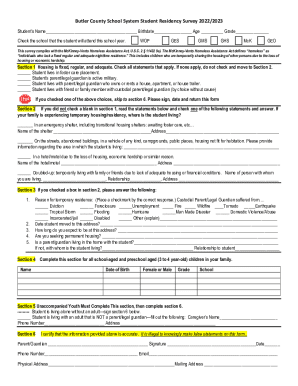

How to fill out donation receipt donation receipt

How to Fill Out a Donation Receipt Donation Receipt:

01

Start by including the date of the donation. This is important for record-keeping purposes.

02

Next, you should enter the name and contact information of the organization or individual receiving the donation. This could include their name, address, phone number, and email.

03

Provide a detailed description of the donated items or cash amount. Include any relevant information such as brand, model, or condition of the donated items.

04

Determine the fair market value of the donated items or cash contribution. This should be done in accordance with IRS guidelines or any other applicable tax regulations.

05

It is essential to issue a unique identification number or receipt number for each donation receipt. This helps with tracking and organization purposes.

06

Mention whether the donation was given as a one-time contribution or if it is part of a recurring donation.

07

If the donor wishes to claim a tax deduction for the donation, include a statement confirming that no goods or services were provided in exchange for the donation, or if any goods or services were provided, provide a description and their fair market value.

08

Finally, the receipt should be signed and dated by an authorized representative of the organization or individual receiving the donation.

Who Needs a Donation Receipt Donation Receipt?

01

Nonprofit organizations: Nonprofit organizations often rely on donations for their operations. They need donation receipt donation receipts to provide a record of the donation for both the donor and the organization's financial records.

02

Individual donors: Individuals who make charitable contributions may require a donation receipt donation receipt to claim a tax deduction. It serves as proof of their donation for tax purposes.

03

Companies and businesses: Many companies and businesses engage in corporate social responsibility by making charitable donations. They need donation receipt donation receipts to keep track of their donations for tax purposes and to demonstrate their philanthropic efforts.

In summary, filling out a donation receipt donation receipt involves providing details about the donation, including the date, description, fair market value, and unique identification number. Nonprofit organizations, individual donors, and companies all require these receipts for various reasons, such as financial records or tax deductions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is donation receipt donation receipt?

A donation receipt is a document provided to donors by charities or non-profit organizations to acknowledge donations made by individuals or businesses.

Who is required to file donation receipt donation receipt?

Charities or non-profit organizations are required to provide and file donation receipts for donations received.

How to fill out donation receipt donation receipt?

Donation receipts should include the donor's name, donation amount, date of donation, description of the donated item or service, and the charitable organization's information.

What is the purpose of donation receipt donation receipt?

The purpose of a donation receipt is to acknowledge the donation made by a donor, provide documentation for tax purposes, and comply with IRS regulations.

What information must be reported on donation receipt donation receipt?

Donation receipts should include the donor's name, donation amount, date of donation, description of the donated item or service, and the charitable organization's information.

How can I send donation receipt donation receipt to be eSigned by others?

donation receipt donation receipt is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete donation receipt donation receipt online?

pdfFiller has made filling out and eSigning donation receipt donation receipt easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in donation receipt donation receipt?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your donation receipt donation receipt to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Fill out your donation receipt donation receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donation Receipt Donation Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.