Get the free mers in mortgage

Show details

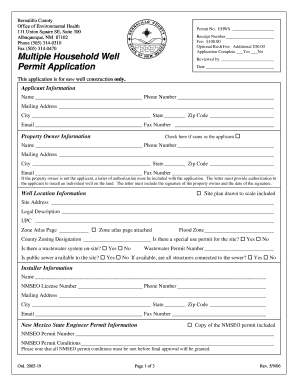

MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. RIDER (MERS Rider) THIS MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, INC. RIDER (MERS Rider) is made this day of, and is incorporated into and amends and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mers in mortgage

Edit your mers in mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mers in mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mers in mortgage online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mers in mortgage. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mers in mortgage

How to fill out MERS in mortgage:

01

Obtain the required documents: To fill out the MERS (Mortgage Electronic Registration System) in a mortgage, gather all the necessary paperwork such as the mortgage loan agreement, borrower's information, property details, and any other relevant documents.

02

Understand the MERS form: Familiarize yourself with the MERS form, which may vary depending on the jurisdiction and specific mortgage lender or servicer. Review the instructions provided on the form to ensure accurate completion.

03

Enter the borrower's information: Start by providing the borrower's full name, address, contact details, and any other required personal information in the designated sections of the MERS form.

04

Input the mortgage details: Fill out the mortgage-specific information, such as the loan type, loan amount, interest rate, loan term, and any other relevant details. This information helps identify the specific mortgage being registered in the MERS system.

05

Include property information: Specify the property details associated with the mortgage, including the address, legal description, county, and any other necessary information that accurately identifies the property being mortgaged.

06

Sign and date the form: Once you have completed all the required fields accurately, sign and date the MERS form. Ensure that all signatures are legible and that the dates are correct.

Who needs MERS in mortgage?

01

Lenders and servicers: MERS is primarily beneficial for mortgage lenders and servicers as it helps streamline and simplify the mortgage recording process. It allows them to track and transfer mortgage loans electronically, reducing the need for physical paperwork and minimizing costs.

02

Investors and stakeholders: Mortgage-backed securities investors and other stakeholders in the mortgage industry may require the use of MERS as it provides an efficient means to track and verify mortgage assignments and ownership rights. MERS helps maintain a transparent and accurate record of mortgage transactions.

03

Government agencies and regulators: MERS can be valuable to government agencies and regulators by offering a centralized system for monitoring mortgage loans and ensuring compliance with relevant laws and regulations. It helps in auditing mortgage transactions and maintaining an accurate record for investigative purposes.

04

Homeowners and borrowers: While homeowners and borrowers are not required to directly use MERS, they may indirectly benefit from its use by experiencing a streamlined mortgage loan process. MERS can facilitate quicker and more efficient mortgage transfers, which may result in smoother loan servicing for borrowers.

Note: It is essential to consult with legal and financial professionals for specific guidance regarding MERS and its usage in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the mers in mortgage in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your mers in mortgage in seconds.

Can I create an eSignature for the mers in mortgage in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your mers in mortgage right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit mers in mortgage on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share mers in mortgage on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is mers in mortgage?

MERS (Mortgage Electronic Registration Systems) is an electronic system that tracks mortgage ownership and servicing rights.

Who is required to file mers in mortgage?

The lender or servicer is required to file MERS in mortgage.

How to fill out mers in mortgage?

MERS is typically filled out electronically through the MERS system.

What is the purpose of mers in mortgage?

The purpose of MERS in mortgage is to streamline the mortgage process by tracking ownership and servicing rights electronically.

What information must be reported on mers in mortgage?

Information such as the mortgage lender, borrower, loan amount, and servicing rights must be reported on MERS in mortgage.

Fill out your mers in mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mers In Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.