AU AUS178AU 2014 free printable template

Show details

Bank Account Details Australia The Australian Government Department of Human Services needs to know your bank account details for paying your Australian pension. Your payment will be issued in Australian

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU AUS178AU

Edit your AU AUS178AU form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU AUS178AU form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AU AUS178AU online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AU AUS178AU. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU AUS178AU Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU AUS178AU

How to fill out AU AUS178AU

01

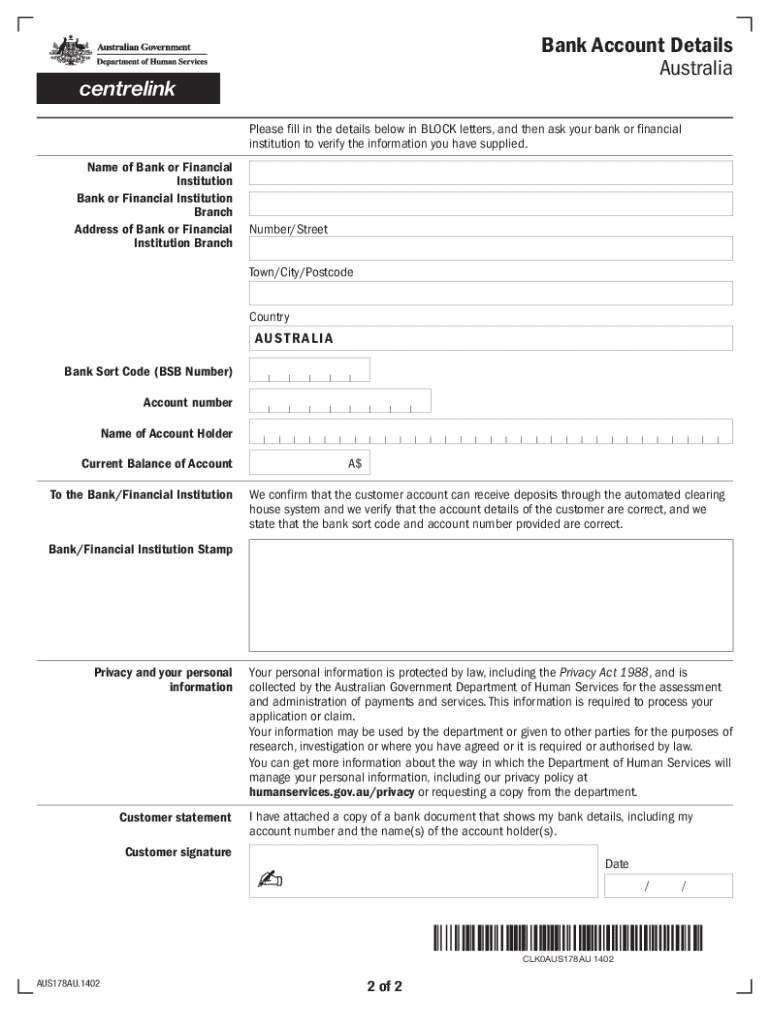

Obtain the AU AUS178AU form from the relevant authority or website.

02

Read the instructions carefully to ensure you understand the requirements.

03

Fill in your personal details, including your name, address, and contact information.

04

Provide any required identification numbers, such as your tax file number or business registration number.

05

Answer the questions in each section accurately, providing all requested information.

06

Review your entries for any errors or omissions.

07

Sign and date the form at the designated area.

08

Submit the completed form, either online or by mailing it to the appropriate office.

Who needs AU AUS178AU?

01

Individuals or businesses required to declare specific financial information or apply for government benefits.

02

Taxpayers seeking to resolve issues related to their tax affairs.

03

Entities needing to comply with regulations set by the Australian Taxation Office (ATO).

Fill

form

: Try Risk Free

People Also Ask about

Is IBAN the same as BSB?

BSB codes are not the same as IBANs (International Bank Account Numbers). IBANs are typically used by bank branches in Europe and certain other areas. However, BSB codes are sometimes formatted in a way that resembles an IBAN in order to allow compatibility between the two different systems.

What does an Australian bank account number look like?

The first six digits make up your BSB (like 306-089) and the next seven digits make up your account number (like 0001234).

What is the IBAN number for Australia?

Australia does not use IBAN numbers, but you could encounter them when sending money to an international recipient — specifying the IBAN number makes for faster transactions.

Does Australia use IBAN or Swift?

IBANs are not used in Australia. However, payers in certain countries may require you to provide one. In that case, your BSB and account number should be combined. Do not include any spaces or hyphens.

What is the IBAN number for Commonwealth bank of Australia?

IBANs aren't used here in Australia, but payers in certain countries may require you to provide one. If they do, your BSB and account number should be combined, but don't include any spaces or hyphens.

Do Australian banks use IBAN numbers?

IBANs are not used in Australia. However, payers in certain countries may require you to provide one. In that case, your BSB and account number should be combined. Do not include any spaces or hyphens.

Do Australian banks use a SWIFT code?

Sending or receiving a money transfer using your bank account? You'll need a SWIFT/BIC code for international bank transfers to and from Australia.

How long is a bank account number in Australia?

Account number is 6 to 10 digits. Australia bank state branch number: three digits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AU AUS178AU to be eSigned by others?

When you're ready to share your AU AUS178AU, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out the AU AUS178AU form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign AU AUS178AU. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit AU AUS178AU on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share AU AUS178AU on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is AU AUS178AU?

AU AUS178AU is a tax form used in Australia for reporting certain financial information to the Australian Taxation Office (ATO). It may pertain to a variety of tax obligations, including income and deductions.

Who is required to file AU AUS178AU?

Individuals and entities that meet specific criteria set by the ATO, such as those with particular income or deduction thresholds, are required to file AU AUS178AU.

How to fill out AU AUS178AU?

To fill out AU AUS178AU, taxpayers must provide accurate financial information as prescribed by the ATO, including income details, applicable deductions, and any other required data based on their tax situation.

What is the purpose of AU AUS178AU?

The purpose of AU AUS178AU is to ensure compliance with tax obligations and to provide the ATO with necessary information to assess tax liabilities accurately.

What information must be reported on AU AUS178AU?

The information that must be reported on AU AUS178AU includes total income, specific deduction claims, and any other relevant financial details as instructed by the ATO.

Fill out your AU AUS178AU online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU aus178au is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.