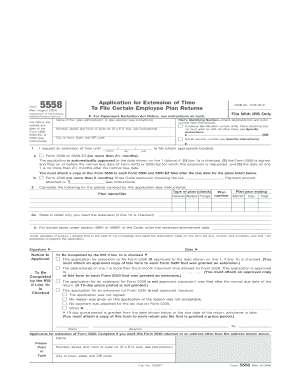

Get the free Business Process and Accounting Solutions BPS - Deloitte

Show details

Business Process and Accounting Solutions (BPS) How can we help you? Project SupportInterim Solutions assist you by undertaking project work in a wide range of areas such as:We provide interim replacements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business process and accounting

Edit your business process and accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business process and accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business process and accounting online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business process and accounting. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business process and accounting

How to fill out business process and accounting?

01

Understand the purpose: Before filling out any business process and accounting forms, it is crucial to understand the purpose behind them. Familiarize yourself with the specific requirements and objectives of the forms to ensure accurate and relevant information is provided.

02

Gather necessary documentation: To effectively fill out business process and accounting forms, gather all relevant documentation beforehand. This may include financial statements, invoices, receipts, contracts, and any other relevant paperwork that supports the information you need to provide.

03

Review instructions: Carefully read and understand the instructions provided with the business process and accounting forms. This will help you in identifying the type of information required, specific formats to follow, and any additional guidelines that need to be considered while filling out the forms.

04

Provide accurate information: Accuracy is crucial when filling out business process and accounting forms. Ensure that all the information provided is correct, up-to-date, and relevant to the purpose of the forms. Double-check all figures, calculations, and details before submission to avoid any potential errors or discrepancies.

05

Be consistent: Maintain consistency in the way you present information throughout the forms. Use standardized formats and follow consistent naming conventions to ensure clarity and ease of understanding for anyone reviewing the forms.

06

Seek professional assistance, if needed: If you encounter any complexities or uncertainties while filling out business process and accounting forms, do not hesitate to seek professional assistance. Consulting with an accountant, financial advisor, or business expert can provide valuable guidance and ensure the accuracy and completeness of the forms.

Who needs business process and accounting?

01

Small and medium-sized businesses: Business process and accounting are essential for small and medium-sized enterprises (SMEs) to effectively manage their financial transactions, record-keeping, and overall business operations. Implementing proper business process and accounting practices helps SMEs track income, expenses, and financial health while ensuring compliance with legal and regulatory requirements.

02

Large corporations: Large corporations also require business process and accounting to maintain accurate financial records, monitor performance, and make informed business decisions. Accounting helps large corporations manage complex financial operations, such as payroll, tax compliance, financial reporting, and auditing.

03

Startups and entrepreneurs: Startups and entrepreneurs can greatly benefit from implementing sound business process and accounting practices from the beginning. Proper accounting ensures transparency, helps attract investors, and provides valuable insights into the financial health of the business. This enables startups to make well-informed decisions and plan for growth effectively.

04

Non-profit organizations: Non-profit organizations also need business process and accounting to manage their finances responsibly and demonstrate accountability to donors and stakeholders. Implementing proper accounting practices ensures transparent financial reporting, strengthens donor confidence, and helps maximize the impact of the organization's activities.

05

Government agencies and institutions: Government agencies and institutions depend on accurate accounting and business process to track public funds, maintain financial transparency, and ensure compliance with legal and regulatory requirements. Proper accounting practices help government entities manage budgets, conduct financial audits, and provide accurate financial reports to the public.

In conclusion, business process and accounting are essential for various entities, including small businesses, large corporations, startups, non-profit organizations, government agencies, and institutions. Implementing proper accounting practices ensures accurate financial reporting, transparency, and informed decision-making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete business process and accounting online?

pdfFiller makes it easy to finish and sign business process and accounting online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit business process and accounting in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing business process and accounting and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the business process and accounting in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your business process and accounting in seconds.

What is business process and accounting?

Business process and accounting refers to the set of procedures followed by a company to record financial transactions and manage its financial resources.

Who is required to file business process and accounting?

All companies, regardless of size or industry, are required to maintain and file business process and accounting records.

How to fill out business process and accounting?

Business process and accounting records can be filled out manually or using accounting software to track income, expenses, assets, and liabilities.

What is the purpose of business process and accounting?

The purpose of business process and accounting is to provide an accurate and reliable representation of a company's financial health and performance.

What information must be reported on business process and accounting?

Business process and accounting reports typically include income statements, balance sheets, cash flow statements, and other financial data.

Fill out your business process and accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Process And Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.