Get the free Small Business and Self-Employed

Show details

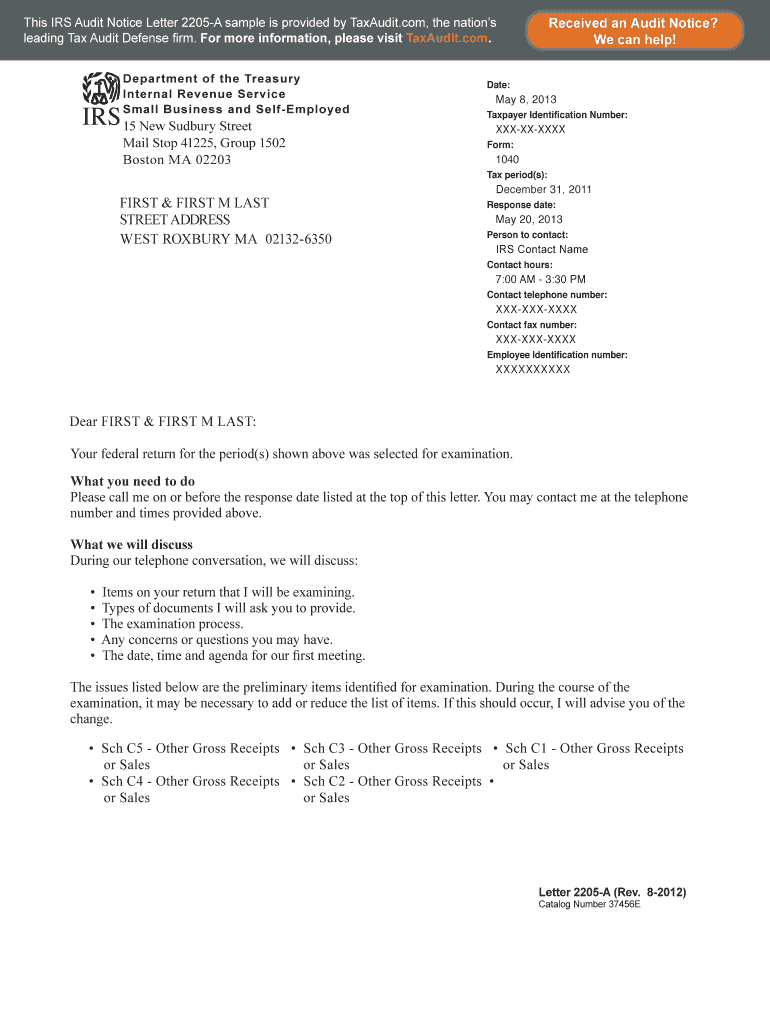

This IRS Audit Notice Letter 2205A sample is provided by TaxAudit.com, the nations leading Tax Audit Defense firm. For more information, please visit TaxAudit.com. Department of the Treasury Internal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business and self-employed

Edit your small business and self-employed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business and self-employed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business and self-employed online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit small business and self-employed. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business and self-employed

How to Fill Out Small Business and Self-Employed:

01

Gather all necessary information: Start by collecting all the necessary documentation and information required to fill out your small business and self-employed forms. This may include details about your business, income and expenses, deductions, and any relevant tax identification numbers.

02

Choose the right form: Depending on the structure of your business, you may need to fill out different forms. For example, a sole proprietorship would typically use Schedule C to report business income and expenses, while a partnership may require Form 1065. Make sure to select the appropriate form based on your business type.

03

Report your income: Begin by reporting your business income accurately. Include all sources of revenue, such as sales, services, or any other business-related income. This should be documented meticulously to ensure accurate reporting.

04

Deduct business expenses: Deductible business expenses can help reduce your taxable income, potentially saving you money. Keep detailed records of all your business expenses, such as office supplies, travel expenses, equipment purchases, or advertising costs. Consult a tax professional or refer to the IRS guidelines for a comprehensive list of allowable deductions.

05

Calculate self-employment tax: As a self-employed individual, you are responsible for paying both the employee and employer portions of Social Security and Medicare taxes. Use Schedule SE to calculate and report your self-employment tax.

06

Consider estimated tax payments: If you anticipate owing a significant amount of tax, it is advisable to make estimated tax payments throughout the year to avoid penalties and interest charges. Refer to IRS Publication 505 to determine if you need to make estimated tax payments and for guidance on calculating the amounts.

07

Review and double-check your forms: Once you have completed your small business and self-employed forms, review them carefully for accuracy. Check calculations, ensure all necessary information is included, and make sure you have signed and dated where required. Accuracy is crucial to avoid any potential issues or audits.

Who Needs Small Business and Self-Employed:

01

Entrepreneurs and business owners: Individuals who have established their own businesses or are self-employed are the primary recipients of small business and self-employed tax forms. This includes sole proprietors, freelancers, independent contractors, and small business owners who operate as partnerships or limited liability companies.

02

Independent professionals: Individuals in various professions, such as doctors, lawyers, consultants, artists, photographers, or writers, often work independently and need to report their income and expenses accurately through small business and self-employed forms.

03

Gig economy workers: The rise of the gig economy has led to an increase in self-employed individuals providing services through platforms like ride-sharing, food delivery, or short-term rentals. These workers need to report their earnings and qualify for any applicable tax deductions.

In conclusion, anyone who operates a small business or works for themselves needs to fill out small business and self-employed forms. It is essential to follow the appropriate procedures, accurately report income and deductions, and ensure compliance with relevant tax laws and regulations. Seek professional guidance if required to maximize tax benefits and minimize potential issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is small business and self-employed?

Small business refers to a company, firm, or enterprise that has a small number of employees. Self-employed individuals work for themselves rather than an employer.

Who is required to file small business and self-employed?

Small business owners and self-employed individuals are required to file relevant tax returns.

How to fill out small business and self-employed?

Small businesses and self-employed individuals can fill out their tax forms by gathering all necessary financial information and completing the appropriate forms accurately.

What is the purpose of small business and self-employed?

The purpose of small business and self-employed tax filings is to report income, expenses, and deductions accurately to comply with tax laws and regulations.

What information must be reported on small business and self-employed?

Information such as income, expenses, deductions, and any other relevant financial data must be reported on small business and self-employed tax forms.

How can I send small business and self-employed to be eSigned by others?

Once your small business and self-employed is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the small business and self-employed electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your small business and self-employed and you'll be done in minutes.

How do I complete small business and self-employed on an Android device?

Complete small business and self-employed and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your small business and self-employed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business And Self-Employed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.