Get the free Gifting of Securities between

Show details

SiT508 Gifting of Securities between Scotia trade Accounts Date: To: Scotia trade, a division of Scotia Capital Inc. Attention: Operations Department From: Account No.: With this letter, I/we give

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifting of securities between

Edit your gifting of securities between form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifting of securities between form via URL. You can also download, print, or export forms to your preferred cloud storage service.

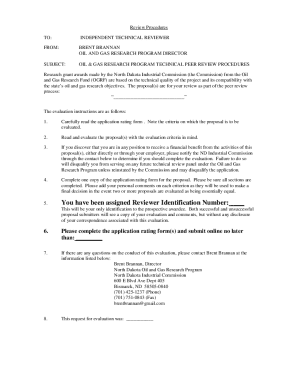

How to edit gifting of securities between online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gifting of securities between. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

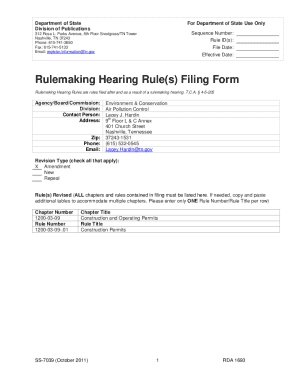

How to fill out gifting of securities between

How to fill out gifting of securities between:

01

Obtain the necessary forms: Start by contacting the brokerage firm or financial institution holding the securities to request the appropriate gifting forms. They will guide you through the process and ensure that you have the required documentation.

02

Provide the required information: Fill out the forms accurately, providing all the necessary details about the securities being gifted. This typically includes the security type (stocks, bonds, mutual funds, etc.), the number of shares or units, and the current value of the securities.

03

Specify the recipient: Clearly indicate the name and contact information of the person or organization you wish to gift the securities to. Ensure that you have the correct spelling and accurate details to avoid any confusion.

04

Consider tax implications: It's essential to consult with a tax professional or financial advisor to understand the potential tax consequences of gifting securities. There may be gift tax or capital gains tax considerations. They can provide guidance on how to minimize any tax obligations associated with the gift.

05

Review and sign the forms: Carefully review all the information you have provided on the gifting forms. Double-check for any errors or missing details. Once you are satisfied with the accuracy, sign the forms as required. Be aware that some forms may require additional signatures, such as a medallion signature guarantee for certain types of securities.

06

Deliver the forms: Submit the completed and signed forms to the brokerage firm or financial institution handling the securities. Follow their instructions for the submission process, which may include mailing the forms or delivering them in person.

Who needs gifting of securities between:

01

Individuals looking to make charitable donations: Gifting securities can be an efficient way to support a charitable cause while potentially obtaining tax benefits. By donating appreciated securities instead of cash, individuals can avoid paying capital gains tax on the appreciation, and the receiving organization can benefit from the full value of the securities.

02

Family members or friends: Gifting securities between family members or friends can be a thoughtful and strategic way to transfer wealth or provide financial support. It can allow the recipient to benefit from any future growth of the securities while potentially minimizing tax obligations.

03

Estate planning purposes: Gifting securities can play a vital role in estate planning, helping individuals to distribute their assets to heirs or beneficiaries as per their wishes. It can also contribute to reducing the overall taxable value of an estate, potentially minimizing estate taxes.

Overall, gifting securities between parties is a process that requires careful consideration, accurate documentation, and often professional guidance. It can be a valuable tool for philanthropy, financial planning, and wealth transfer.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gifting of securities between?

Gifting of securities between refers to the transfer of securities from one party to another as a gift.

Who is required to file gifting of securities between?

The party making the gift is required to file the gifting of securities between.

How to fill out gifting of securities between?

To fill out gifting of securities between, the parties involved must provide relevant information such as details of the securities, the value of the gift, and any other required information.

What is the purpose of gifting of securities between?

The purpose of gifting of securities between is to document and track the transfer of securities as a gift between parties.

What information must be reported on gifting of securities between?

Information such as details of the securities, the value of the gift, and any other relevant information must be reported on gifting of securities between.

How can I edit gifting of securities between from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your gifting of securities between into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the gifting of securities between in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your gifting of securities between and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out gifting of securities between using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign gifting of securities between and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your gifting of securities between online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifting Of Securities Between is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.