Get the free Child Support Account Set Up Form - Collin County - co collin tx

Show details

Child Support Account Set Up Form THIS FORM MUST BE COMPLETED AND TURNED IN TO COLLIN COUNTY CHILD SUPPORT FOR AN ACCOUNT TO BE ACTIVATED This form may be emailed to: child support collincountytx.gov

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign child support account set

Edit your child support account set form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your child support account set form via URL. You can also download, print, or export forms to your preferred cloud storage service.

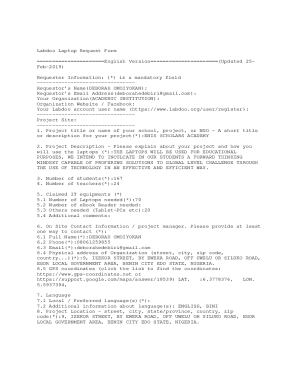

Editing child support account set online

Follow the steps down below to take advantage of the professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit child support account set. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

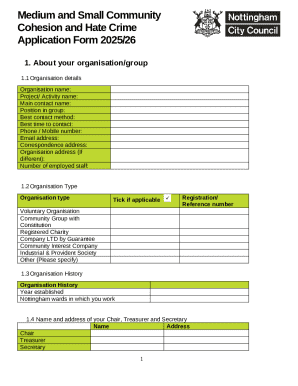

How to fill out child support account set

How to fill out TX Child Support Account Set Up Form

01

Gather all necessary personal information, including your Social Security number and contact details.

02

Provide information about the other parent, including their name, address, and Social Security number.

03

Fill out the sections related to your income and employment details.

04

Indicate your child or children's names and birthdates.

05

Review the form for accuracy and completeness.

06

Sign and date the form to verify the information provided.

07

Submit the completed form to the appropriate child support office.

Who needs TX Child Support Account Set Up Form?

01

Any parent or guardian seeking to establish or modify child support arrangements in Texas.

02

Individuals involved in a divorce or custody case where child support is determined.

03

Custodial parents who need government assistance to receive child support payments.

Fill

form

: Try Risk Free

People Also Ask about

Does child support automatically start in Texas?

The Texas OAG opens a child support case when a custodial parent applies for benefits, such as Medicaid. Even if neither parent specifically opened a case, the OAG automatically opens the case.

How do I check my Texas child support balance online?

Go to the Texas Attorney General Website and log into your account. Go to the child support division webpage and click the menu icon in the upper right side, and click “Child Support Interactive” (CSI). This will take you to the Texas interactive child support record keeping site.

How do I check my child support payments in Texas?

1. Go to the Texas Attorney General Website and log into your account. Go to the child support division webpage and click the menu icon in the upper right side, and click “Child Support Interactive” (CSI). This will take you to the Texas interactive child support record keeping site.

How long does it take for a child support payment to post in Texas?

It generally takes 5 to 7 business days for you to receive your payment by mail from the time it is received by the State Disbursement Unit. Direct deposit takes 3 to 5 business days. If you want direct deposit services with the SDU, please use the Direct Deposit form on the Texas Attorney General web site.

Is child support capped in Texas?

Texas child support guidelines have a cap on the amount of monthly net income (figured on Texas Office of the Attorney General tax tables) on which a parent must pay child support. Every six years the Texas legislature adjusts the cap on that monthly net income amount for inflation.

How much is child support for 1 child?

Assuming you're on the basic rate, you'll need to pay: 12% of your gross weekly income for one child. 16% of your gross weekly income for two children. 19% of your gross weekly income for three or more children.

How do I set up a child support account in Texas?

Call (800) 252-8014 to receive a form in the mail. Apply for Child Support. Click here to apply for child support services now. Apply Online Now. Child Support Online. Login to Your Account. Are you concerned about your safety? Get Child Support Safely.

What app is for child support in Texas?

You can pay child support online using the DComply app for Iphone or Android.

How much is child support for 1 kid in Texas?

Texas child support laws provide the following Guideline calculations: one child= 20% of Net Monthly Income (discussed further below); two children = 25% of Net Monthly Income; three children = 30% of Net Monthly Income; four children = 35% of Net Monthly Income; five children = 40% of Net Monthly Income; and six

How do I change direct deposit for child support Texas?

2. What do I do if I want to change financial institutions or stop my direct deposit? Written requests are required for any change or to stop direct deposit. You must call 1-800-252-8014 for a TXCSDU Authorization Form.

What is the child support cap in Texas 2022?

When calculating child support, the noncustodial parent's net resources are capped at $8,550 per month. If the noncustodial parent earns more than $8,550 per month, the judge can order additional child support based on the income of the parties and the proven needs of the child.

How much can child support take from paycheck in Texas?

1 child = 20% of net resources. 2 children = 25% of net resources. 3 children = 30% of net resources. 4 children = 35% of net resources.

What is the most child support can take?

50 percent of disposable income if an obligated parent has a second family. 60 percent if there is no second family.

Is child support public record in Texas?

In Texas, child support payments are considered confidential information, which means they are not open to the public. That doesn't mean both parties involved in the child support agreement – the paying party and the receiving one – can't view information about the payments as needed, though.

What is the maximum child support in Texas 2022?

**The Guidelines for the support of a child are specifically designed to apply to monthly net resources not greater than $9,200. This calculator does not calculate support in excess of the $9,200 net resource amount per Texas Family Code Sec.

How much does non custodial parent pay in child support in Texas?

HOW THE AMOUNT OF CHILD SUPPORT IN TEXAS IS DETERMINED: In general, child support guidelines in Texas include: Noncustodial parents are required to contribute 20 percent of net income for one child and an additional five percent for each subsequent child.

What is the average child support payment in Texas?

Texas child support laws provide the following Guideline calculations: one child= 20% of Net Monthly Income (discussed further below); two children = 25% of Net Monthly Income; three children = 30% of Net Monthly Income; four children = 35% of Net Monthly Income; five children = 40% of Net Monthly Income; and six

How does Texas calculate child support?

Formula for How Child support Is Determined in Texas Once monthly net income is calculated, take that amount and multiply it by a percentage based on how many children the parent supports: 1 child – 20% 2 children – 25% 3 children – 30%

What is the maximum child support payment in Texas?

The Texas Family Code has guidelines that implement a “soft cap,” under which the courts will rarely order child support payments that exceed 20% of the custodial parent's net income plus 5% for each additional child.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the child support account set in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your child support account set right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit child support account set on an iOS device?

Create, edit, and share child support account set from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete child support account set on an Android device?

On an Android device, use the pdfFiller mobile app to finish your child support account set. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

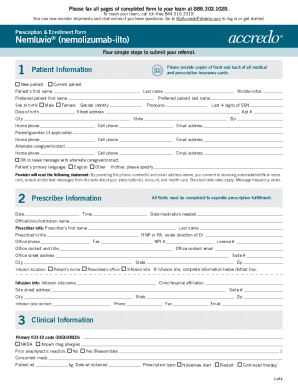

What is TX Child Support Account Set Up Form?

The TX Child Support Account Set Up Form is a document used by the state of Texas to establish a child support account for the purposes of collecting and distributing child support payments.

Who is required to file TX Child Support Account Set Up Form?

Parents or guardians who are seeking to establish, modify, or enforce a child support order are required to file the TX Child Support Account Set Up Form.

How to fill out TX Child Support Account Set Up Form?

To fill out the TX Child Support Account Set Up Form, you need to provide personal information such as your name, address, and Social Security number, as well as information about the child, the non-custodial parent, and the custodial parent.

What is the purpose of TX Child Support Account Set Up Form?

The purpose of the TX Child Support Account Set Up Form is to formalize the financial obligation of the non-custodial parent to provide support for their child, ensuring that payments are processed and tracked correctly.

What information must be reported on TX Child Support Account Set Up Form?

The TX Child Support Account Set Up Form must report information such as the names and addresses of both parents, the child's date of birth, the court case number (if applicable), and the type of child support payment arrangements.

Fill out your child support account set online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Child Support Account Set is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.