CA RI-F01 2011 free printable template

Show details

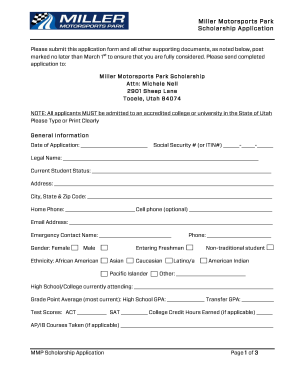

SUPERIOR COURT OF CALIFORNIA, COUNTY OF RIVERSIDE BLYTHE HEMET INDIO RIVERSIDE RIF01 Name, State Bar Number and Address) FOR COURT USE ONLY (Optional) Optional): (Name): REQUEST TO SET UNCONTESTED

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA RI-F01

Edit your CA RI-F01 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA RI-F01 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA RI-F01 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA RI-F01. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA RI-F01 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA RI-F01

How to fill out CA RI-F01

01

Gather your financial documents, including your income statements and expense reports.

02

Download the CA RI-F01 form from the official website.

03

Fill in your personal information such as name, address, and Social Security number in the designated fields.

04

Provide details of your income sources in Section A.

05

Enter your expenses in Section B, making sure to categorize them appropriately.

06

Calculate your total income and total expenses as instructed on the form.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form in the required section.

09

Submit the form to the appropriate tax office or agency as indicated.

Who needs CA RI-F01?

01

Residents of California who are required to report their income and expenses for tax purposes.

02

Self-employed individuals or freelancers who need to document their earnings.

03

Individuals filing for specific tax credits or deductions that require the use of the CA RI-F01.

Fill

form

: Try Risk Free

People Also Ask about

How do I pay sanctions in Riverside Superior Court?

How do I pay the restitution? You may make your payment online via Epay-It (external site ) with a credit or debit card, use a credit card over the phone, mail in a check, or go to any Riverside County Court location that is open to the public.

How do you stipulate to continue a trial in Riverside County?

A party seeking to continue a law and motion hearing, must submit either a written stipulation signed by all parties, or a declaration from counsel for the moving party, signed under penalty of perjury, informing the court that all parties have been notified and agree to have the motion continued.

How do I pay court fees in California?

Payment is accepted by cash, check (payable to "Clerk/Superior Court"), or credit card. Checks accepted include: personal check, cashier's check, certified check, traveler's check, or money order. Counter credit card payment can be made via NCourt, which accesses a 3.5% convenience fee per transaction.

How do I pay my Superior Court of California?

To Pay Via Telephone Call (909) 481-4228 or (760) 241-9529 24 hours a day.

How do I pay my court fees in Riverside County?

Select one of the following options: Online. By telephone: 951.222.0384. In person at any Traffic Court location. By mail: Please make your check or money order payable to 'Riverside Superior Court' and note your citation number on the check.

What is the rule 5153 in Riverside court?

This rule is essentially forcing parties to try to settle issues in their case before going to trial. If Local Rule 5153 is not complied with, the Court will not allow your case to go forward until these procedures are met.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA RI-F01 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your CA RI-F01 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit CA RI-F01 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign CA RI-F01 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out CA RI-F01 on an Android device?

Complete your CA RI-F01 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CA RI-F01?

CA RI-F01 is a tax form used in California for reporting specific financial information and tax liabilities.

Who is required to file CA RI-F01?

Businesses and individuals who meet certain income criteria or engage in specific activities necessitating the reporting of income and taxes in California are required to file CA RI-F01.

How to fill out CA RI-F01?

To fill out CA RI-F01, gather all relevant financial documents, follow the instructions provided with the form, and complete each section accurately, ensuring all required information is included.

What is the purpose of CA RI-F01?

The purpose of CA RI-F01 is to provide the state of California with detailed information regarding the income, deductions, and tax liabilities of the filer for accurate tax assessment.

What information must be reported on CA RI-F01?

CA RI-F01 requires reporting of income earned, deductions claimed, credits applied, and any other relevant financial information that impacts tax obligations.

Fill out your CA RI-F01 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA RI-f01 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.