Get the free GST: Supply of Electricity to Master-Metered - iras gov

Show details

IRAS tax Guide

GST: Supply of Electricity to MasterMetered

and

Unmetered ConsumersPublished by

Inland Revenue Authority of SingaporePublished on 30 Sep 2013Disclaimers: IRAS shall not be responsible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gst supply of electricity

Edit your gst supply of electricity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst supply of electricity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gst supply of electricity online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gst supply of electricity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

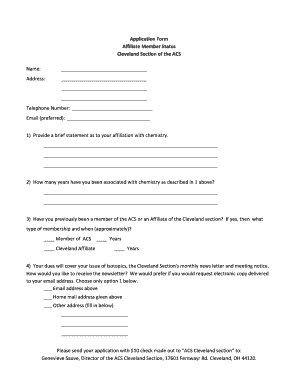

How to fill out gst supply of electricity

How to fill out GST supply of electricity:

01

Fill out the taxpayer details section: Provide your GST registration number, legal name, trade name (if applicable), and the period for which you are filing the return.

02

Input electricity supply details: Enter the details of the electricity supplied during the period, including the units supplied, tariff rate, and applicable taxes.

03

Calculate the GST liability: Calculate the GST liability on the electricity supply by multiplying the taxable value (units supplied multiplied by the tariff rate) by the applicable GST rate (5% or 18% depending on the category).

04

Report exempt supplies, if any: If you have made any exempt supplies of electricity, report them separately in the corresponding section.

05

Adjustments and modifications, if required: Make adjustments or modifications to the liability, if any, based on the rules and regulations provided by the tax authorities.

06

Enter any previous period adjustments: If there are any adjustments to be made for previous periods, report them in the relevant section.

07

Declare the total tax liability: Declare the total tax liability for the period, which includes the GST on electricity supply and any adjustments or modifications made.

08

Make payment and submit the return: Pay the GST liability through the prescribed mode of payment and submit the return online or offline as per the GST rules and regulations.

Who needs GST supply of electricity?

01

Power generation companies: Power generation companies that supply electricity to consumers fall under the purview of GST on supply of electricity. They need to comply with the GST regulations and file returns accordingly.

02

Power distribution companies: Power distribution companies that distribute electricity to consumers also need to account for the GST on the supply of electricity and file returns as per the GST laws.

03

Commercial establishments: Commercial establishments such as factories, industries, offices, shopping malls, and hotels that consume electricity for their operations are the recipients of electricity supply. They need to ensure that they pay the applicable GST on the electricity consumed.

04

Residential consumers: Residential consumers who receive electricity supply from power distribution companies may not directly be responsible for filing GST returns. However, they indirectly bear the burden of GST as it impacts the electricity tariff rates.

05

Government and public sector organizations: Government departments, public sector undertakings, and local authorities that consume electricity for their operations also need to account for the GST on the supply of electricity and comply with the GST regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gst supply of electricity?

GST supply of electricity refers to the supply of electricity that is subject to Goods and Services Tax.

Who is required to file gst supply of electricity?

Any entity or individual that supplies electricity and is registered under GST is required to file gst supply of electricity.

How to fill out gst supply of electricity?

GST supply of electricity can be filled out using the GST portal provided by the government.

What is the purpose of gst supply of electricity?

The purpose of gst supply of electricity is to ensure that the supply of electricity is taxed appropriately under the GST system.

What information must be reported on gst supply of electricity?

Information such as the amount of electricity supplied, the applicable tax rate, and the total tax amount must be reported on gst supply of electricity.

How can I send gst supply of electricity for eSignature?

When you're ready to share your gst supply of electricity, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find gst supply of electricity?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the gst supply of electricity in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute gst supply of electricity online?

pdfFiller has made filling out and eSigning gst supply of electricity easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Fill out your gst supply of electricity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gst Supply Of Electricity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.