Get the free Uniform Accountancy Act - nasba

Show details

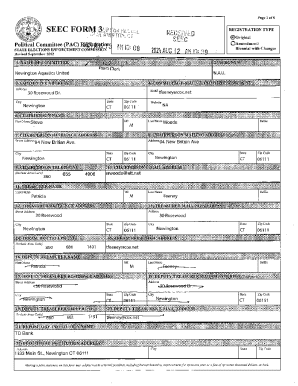

Uniform Accountancy Act Model Rules As approved by NASA Board of Directors July 29, 2011, Published by the National Association of State Boards of Accountancy 150 4th Avenue North, Nashville, TN 372192417

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uniform accountancy act

Edit your uniform accountancy act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uniform accountancy act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uniform accountancy act online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit uniform accountancy act. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uniform accountancy act

How to fill out the uniform accountancy act:

01

Review the requirements of the uniform accountancy act: Start by familiarizing yourself with the specific provisions and regulations outlined in the uniform accountancy act. Understand the purpose and objectives of the act to ensure accurate and compliant filling.

02

Gather necessary information: Collect all relevant financial and accounting data required to fill out the uniform accountancy act. This may include financial statements, transaction records, and other relevant documentation.

03

Understand the reporting period: Determine the reporting period for which you need to fill out the uniform accountancy act. It could be monthly, quarterly, or annually, depending on the specific requirements applicable to your situation.

04

Organize and analyze financial data: Sort and organize the gathered financial information. Perform necessary calculations, verify accuracy, and identify any missing or incomplete data.

05

Complete the required sections: Follow the guidelines provided within the uniform accountancy act to complete each section accurately. Include all necessary details, supporting documentation, and any additional information required by the act.

06

Review and cross-check: Once you have filled out the uniform accountancy act, ensure you review it thoroughly. Double-check for any errors, inconsistencies, or missing information. Cross-reference the completed sections with the act's guidelines to confirm accuracy.

07

Seek professional assistance if needed: If you encounter complexities or challenges during the filling process, consider seeking guidance from a professional accountant or legal advisor who has expertise in complying with the uniform accountancy act.

Who needs the uniform accountancy act?

01

Certified Public Accountants (CPAs): The uniform accountancy act is particularly relevant for CPAs as it sets forth the standards, regulations, and ethical requirements they need to abide by in their professional practice.

02

State Regulatory Boards: State regulatory boards overseeing the accounting profession often adopt the uniform accountancy act. They enforce compliance with the act's provisions to ensure the integrity, transparency, and professionalism within the accounting field.

03

Accounting Firms: Accounting firms, especially those providing services across multiple states, need to adhere to the uniform accountancy act to maintain consistency in their practice and meet regulatory requirements.

04

Businesses and Entities: Companies and organizations involved in financial reporting, auditing, or maintaining accounting records may also come under the purview of the uniform accountancy act. Compliance with the act helps ensure accurate and transparent financial reporting.

05

Accounting Students: Aspiring accountants and accounting students can benefit from understanding the uniform accountancy act as it provides them with a foundational knowledge of professional standards and practices in the accounting field.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is uniform accountancy act?

The Uniform Accountancy Act is a model law developed by the American Institute of Certified Public Accountants (AICPA) and the National Association of State Boards of Accountancy (NASBA) to promote uniformity in the regulation of the accounting profession across states.

Who is required to file uniform accountancy act?

Certified Public Accountants (CPAs) and accounting firms are required to comply with the provisions of the Uniform Accountancy Act.

How to fill out uniform accountancy act?

CPAs and accounting firms must carefully review the requirements of the Uniform Accountancy Act and ensure that all necessary information is accurately reported.

What is the purpose of uniform accountancy act?

The purpose of the Uniform Accountancy Act is to enhance public protection, uphold professional standards, and promote consistency in the regulation of the accounting profession.

What information must be reported on uniform accountancy act?

The Uniform Accountancy Act requires CPAs and accounting firms to report their licensure status, disciplinary history, and compliance with ethical standards.

How can I edit uniform accountancy act from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including uniform accountancy act, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I sign the uniform accountancy act electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your uniform accountancy act in minutes.

How do I fill out the uniform accountancy act form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign uniform accountancy act. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your uniform accountancy act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uniform Accountancy Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.