Get the free Grant Cost Accounting Standards Unallowable Costs

Show details

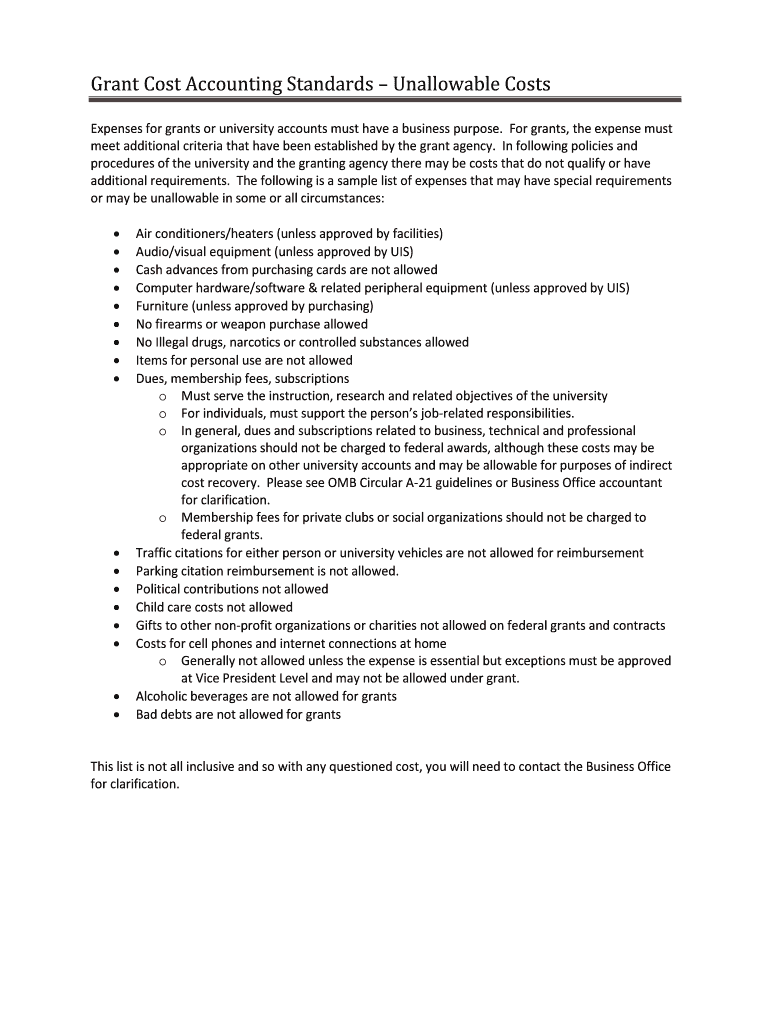

Grant Cost Accounting Standards Unallowable Costs Expenses for grants or university accounts must have a business purpose. For grants, the expense must meet additional criteria that have been established

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign grant cost accounting standards

Edit your grant cost accounting standards form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your grant cost accounting standards form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit grant cost accounting standards online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit grant cost accounting standards. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out grant cost accounting standards

How to fill out grant cost accounting standards:

01

Familiarize yourself with the Grant Cost Accounting Standards (CAS) regulations. CAS is a set of guidelines established by the government to ensure consistent and appropriate accounting practices for organizations that receive grants.

02

Review the specific grant requirements and conditions. Each grant may have its own unique accounting standards that you need to adhere to. Understand the allowed costs, indirect cost rates, and any other financial restrictions or limitations imposed by the grant provider.

03

Create a chart of accounts specific to the grant. Customize your accounting system to include separate accounts for tracking grant-related expenses, revenue, and indirect costs. This will allow you to accurately allocate and track all funding related to the grant.

04

Determine your indirect cost rate. Indirect costs are expenses that cannot be directly attributed to a specific grant but are necessary for the operation of your organization as a whole. Calculate your indirect cost rate in accordance with the guidelines provided by the grantor.

05

Document all grant-related transactions. Keep detailed records of all financial transactions related to the grant. This includes invoices, receipts, payroll records, and other supporting documentation. Proper documentation will help you demonstrate compliance with the grant CAS requirements.

06

Regularly reconcile grant-related accounts. Conduct frequent checks to ensure that your grant accounts are accurately reflecting the financial activities and are in line with the grant CAS regulations. Reconcile your grant revenue and expenses to maintain transparency and integrity in your financial reporting.

Who needs grant cost accounting standards?

01

Non-profit organizations: Non-profit organizations often rely on grants to fund their operations and programs. Grant cost accounting standards help ensure that these organizations effectively manage and report the financial aspects of their grants.

02

Government agencies: Government entities that provide grants to organizations also need grant cost accounting standards. These standards help them establish consistent guidelines for grant recipients, ensure funds are used appropriately, and enable proper oversight and reporting.

03

All organizations receiving grants: Any organization that receives grants, regardless of the sector or industry, should follow grant cost accounting standards. Compliance with these standards helps maintain accountability, transparency, and fiscal responsibility when managing grant funds.

In conclusion, to fill out grant cost accounting standards, it is crucial to familiarize yourself with the regulations, review grant requirements, customize your accounting system, track transactions, reconcile accounts, and maintain proper documentation. These standards are applicable to non-profit organizations, government agencies, and any other organizations that receive grants.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is grant cost accounting standards?

Grant cost accounting standards are regulations that govern how organizations receiving grants must account for and report the costs associated with those grants.

Who is required to file grant cost accounting standards?

Organizations that receive grants and funding from government agencies or other sources are required to file grant cost accounting standards.

How to fill out grant cost accounting standards?

To fill out grant cost accounting standards, organizations must detail all costs associated with a particular grant, including direct and indirect costs.

What is the purpose of grant cost accounting standards?

The purpose of grant cost accounting standards is to ensure transparency and accountability in how grant funds are used by organizations.

What information must be reported on grant cost accounting standards?

Information that must be reported on grant cost accounting standards includes direct costs, indirect costs, cost allocations, and explanations of how grant funds were spent.

How do I make edits in grant cost accounting standards without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your grant cost accounting standards, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit grant cost accounting standards on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing grant cost accounting standards.

How do I fill out the grant cost accounting standards form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign grant cost accounting standards. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your grant cost accounting standards online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grant Cost Accounting Standards is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.