Get the free ccim cash flow model

Show details

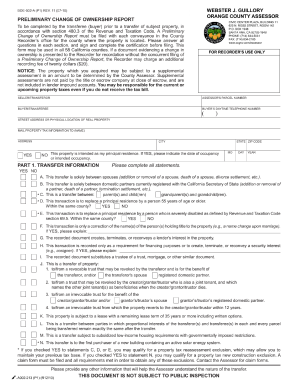

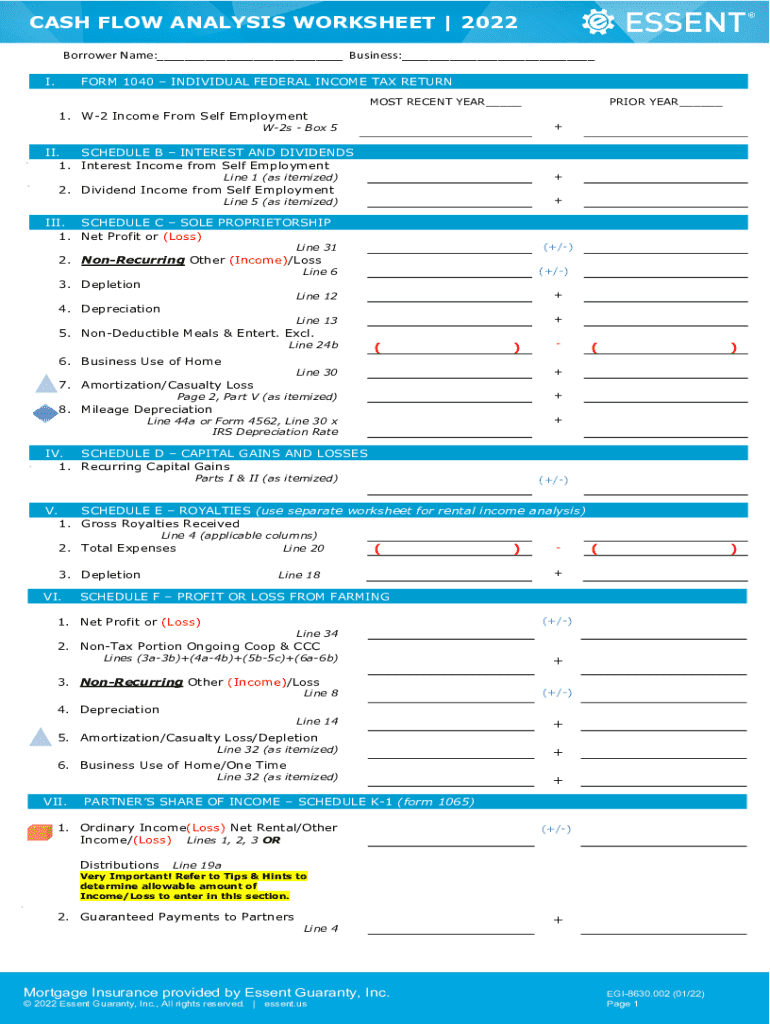

Cash Flow Analysis Worksheet Property Name Prepared For Purchase Price Plus Acquisition Costs Prepared By Plus Loan Fees/Costs Date Prepared Less Mortgages Equals Initial Investment Mortgage Data

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ccim cash flow model

Edit your ccim cash flow model form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ccim cash flow model form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ccim cash flow model online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ccim cash flow model. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ccim cash flow model

How to fill out ccim cash flow model:

01

Gather all the necessary financial information such as rental income, operating expenses, financing costs, and other relevant data.

02

Start by inputting the rental income, taking into account any vacancy or potential rental increases.

03

Add all the operating expenses including property taxes, insurance, maintenance costs, and property management fees.

04

Calculate the net operating income (NOI) by subtracting the total operating expenses from the rental income.

05

Determine the financing costs such as loan payments, interest rates, and any other financial obligations related to the property.

06

Input these financing costs to calculate the cash flow before tax (CFBT).

07

Consider any taxes that will be applicable to the cash flow and deduct accordingly to obtain the after-tax cash flow (CFAT).

08

Assess the investment's value by determining the net present value (NPV) or internal rate of return (IRR) using appropriate discount rates or expected rate of return.

09

Review and analyze the results to make informed financial decisions and evaluate the feasibility of the investment.

Who needs ccim cash flow model:

01

Real estate investors who are looking to calculate and analyze the potential financial performance of a property.

02

Property owners and managers who need a comprehensive tool to assess the profitability and sustainability of their investment.

03

Financial institutions and lenders who require detailed financial projections for loan approvals or risk assessments.

04

Real estate agents and brokers who want to provide clients with accurate financial analysis for property comparisons and investment recommendations.

05

Commercial real estate professionals who need to evaluate lease options, lease renewals, and potential investment opportunities for their clients.

06

Appraisers and valuation experts who rely on accurate cash flow modeling to determine the market value of a property.

07

Insurance companies and risk assessors who need a thorough understanding of the financial viability of a property for underwriting purposes.

08

Anyone involved in the decision-making process of real estate investments or commercial property management can benefit from using the ccim cash flow model as a comprehensive financial analysis tool.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ccim cash flow model in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit ccim cash flow model on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing ccim cash flow model right away.

Can I edit ccim cash flow model on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share ccim cash flow model on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is ccim cash flow model?

The CCIM Cash Flow Model is a financial tool used to analyze the cash flow generated by real estate investments. It helps investors assess income, expenses, and overall returns.

Who is required to file ccim cash flow model?

Individuals and entities engaging in commercial real estate transactions may be required to file the CCIM Cash Flow Model to evaluate their investment performance and for tax purposes.

How to fill out ccim cash flow model?

To fill out the CCIM Cash Flow Model, you need to input data regarding income sources, operating expenses, financing details, tax considerations, and any other relevant financial information related to the property.

What is the purpose of ccim cash flow model?

The purpose of the CCIM Cash Flow Model is to provide a structured approach to calculate and visualize the cash flows from a property, enabling better investment decision-making and financial planning.

What information must be reported on ccim cash flow model?

The CCIM Cash Flow Model requires the reporting of gross income, operating expenses, net operating income, debt service, taxes, cash flows before and after tax, and the overall return on investment.

Fill out your ccim cash flow model online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ccim Cash Flow Model is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.