WageWorks 3725 2014 free printable template

Show details

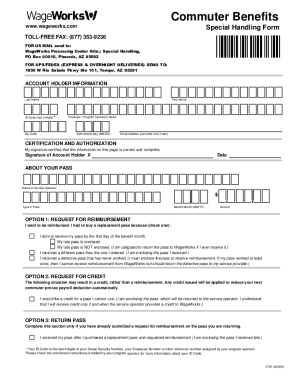

Commuter Benefits Special Handling Form www.wageworks.com TOLL-FREE FAX: (877) 3539236 Or, mail to: Waterworks Processing Center Attn.: Special Handling, PO Box 60010, Phoenix, AZ 85082 Waterworks

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign WageWorks 3725

Edit your WageWorks 3725 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WageWorks 3725 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WageWorks 3725 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WageWorks 3725. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WageWorks 3725 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WageWorks 3725

How to fill out WageWorks 3725

01

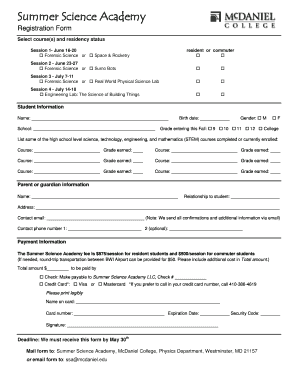

Obtain the WageWorks 3725 form from the WageWorks website or your employer.

02

Fill in your personal information, including your name, address, and employee identification number.

03

Provide details of your eligible expenses related to transportation or parking.

04

Attach any required documentation or receipts that support your claims.

05

Review the form for accuracy and completeness.

06

Submit the completed form through the specified submission method (mail, online, etc.).

07

Keep a copy of the submitted form for your records.

Who needs WageWorks 3725?

01

Employees who incur transportation or parking expenses while commuting to work.

02

Individuals who are enrolled in a WageWorks commuter benefits program.

03

Employers who offer commuter benefits to their employees.

Fill

form

: Try Risk Free

People Also Ask about

How do I cash out my HSA?

You can submit a withdrawal request form to receive funds (cash) from your HSA. If the cash is used to pay for ineligible purchases, it must be reported when you're filing your taxes. Once it's reported, it's subject to an income tax and treated as though it had never been in your tax-free HSA.

Can I use my WageWorks card for Uber?

WageWorks and Uber give you more options to get to and from work. With our partnership with Uber, you can now use your WageWorks® Commuter Card to pay for uberPOOL rides. This gives you the flexibility to use pre-tax funds to pay for uberPOOL rides when commuting to and from work.

Does WageWorks balance expire?

You have ninety (90) days from your termination date to use your card to access the transit funds remaining in your account.

How do I cash out WageWorks?

Log into your WageWorks account to submit a Pay Me Back claim. You can arrange to have a check mailed to you. Or, even faster and easier, you can have funds directly deposited into your bank account.

What happens to unused WageWorks money?

Any unused pre-tax funds will be forfeited to your employer, and any post-tax funds will be refunded to you at the end of the ninety (90)-day period.

Can I transfer money from my HSA to my bank account?

Yes, you can withdraw funds from your HSA at any time. But please keep in mind that if you use your HSA funds for any reason other than to pay for a qualified medical expense, those funds will be taxed as ordinary income, and the IRS will impose a 20% penalty.

Can I withdraw money from my WageWorks commuter card?

Your card can be used for debit or credit transactions to make qualified transit or parking purchases. Purchases can be made where Visa® is accepted by selecting “Credit or Debit” at the time of purchase. Your card cannot be used for cash advances or to make cash withdrawals.

Can I withdraw cash from my HSA at an ATM?

Your HSA Bank Health Benefits Debit Card provides access to your HSA funds at point-of-sale with signature or PIN and at ATMs for withdrawals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete WageWorks 3725 online?

Filling out and eSigning WageWorks 3725 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my WageWorks 3725 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your WageWorks 3725 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit WageWorks 3725 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing WageWorks 3725, you need to install and log in to the app.

What is WageWorks 3725?

WageWorks 3725 is a form related to the administration of health benefits, specifically designed for reporting and compliance within certain employer-sponsored programs.

Who is required to file WageWorks 3725?

Employers who offer specific health benefit plans and need to report information for regulatory compliance are required to file WageWorks 3725.

How to fill out WageWorks 3725?

To fill out WageWorks 3725, employers should gather the required employee and benefits information, complete the form accurately, and submit it according to the provided guidelines.

What is the purpose of WageWorks 3725?

The purpose of WageWorks 3725 is to ensure that employers are compliant with healthcare regulations and to provide necessary information about employer-sponsored benefits.

What information must be reported on WageWorks 3725?

The information that must be reported on WageWorks 3725 includes employee details, types of benefits offered, eligibility criteria, and any other required compliance information.

Fill out your WageWorks 3725 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WageWorks 3725 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.