Get the free LIFE INSURANCE CORPORATION OF INDIA NAVY PERSONNEL QUESTIONNAIRE Proposal No Form No

Show details

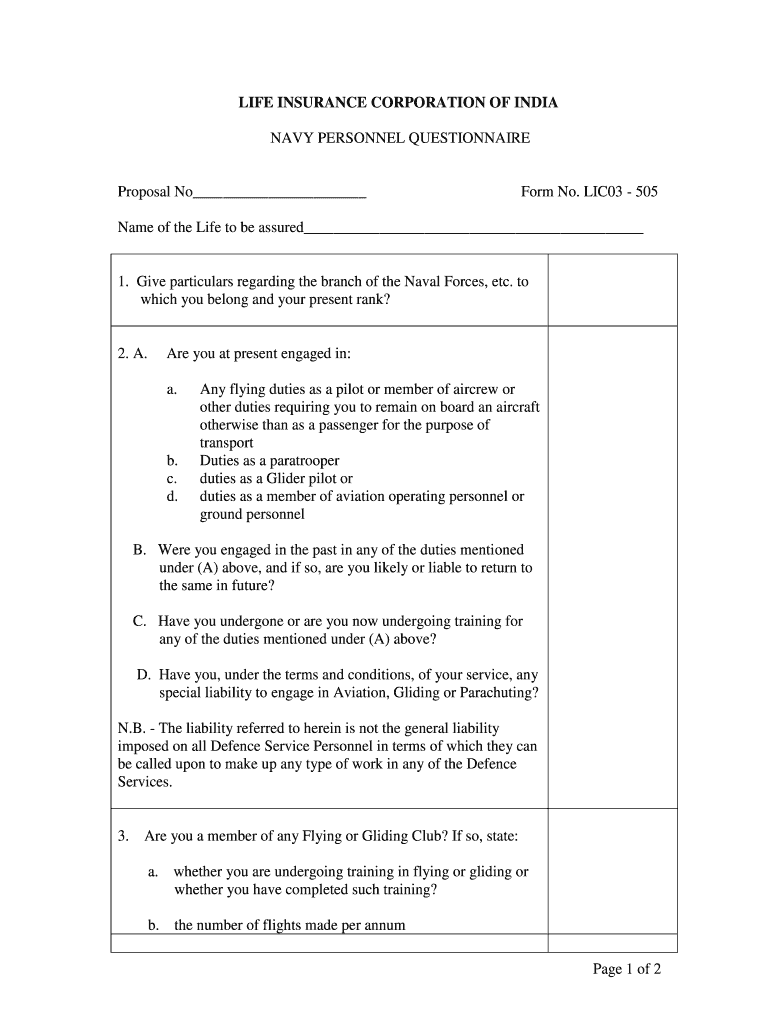

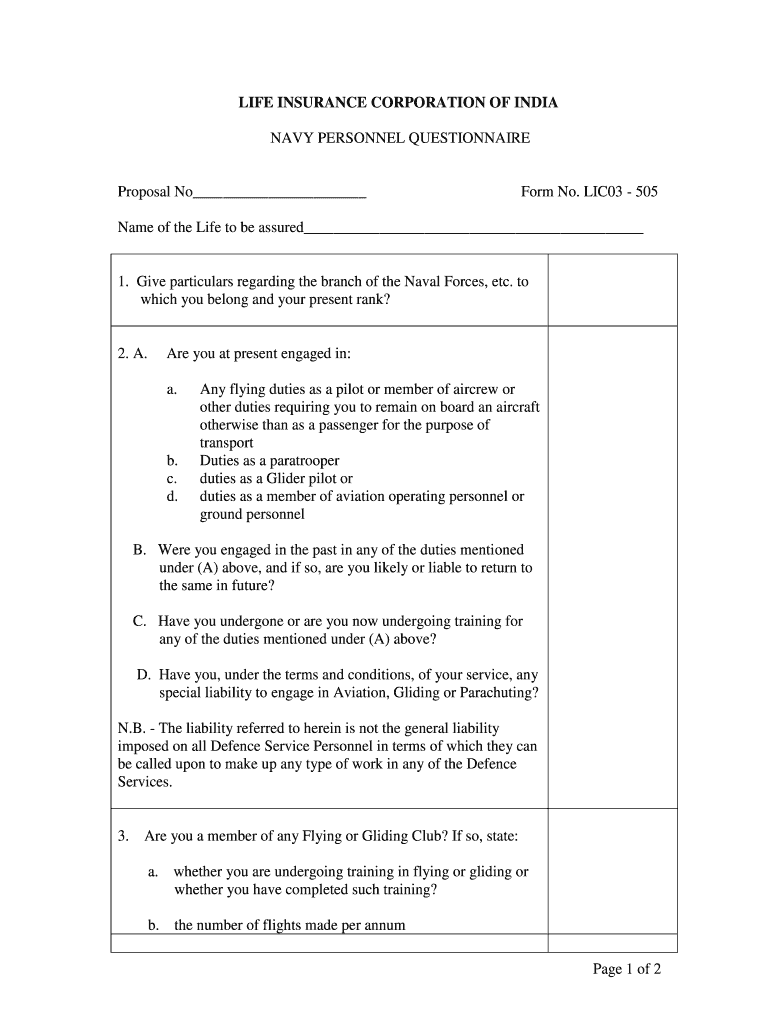

LIFE INSURANCE CORPORATION OF INDIA NAVY PERSONNEL QUESTIONNAIRE Proposal No Form No. LIC03 505 Names of the Life to be assured 1. Give particulars regarding the branch of the Naval Forces, etc. to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance corporation of

Edit your life insurance corporation of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance corporation of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance corporation of online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit life insurance corporation of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance corporation of

How to fill out life insurance corporation of?

01

Obtain the necessary forms from the life insurance corporation of your choice. These forms may be available online or can be requested through their customer service.

02

Read through the forms carefully to understand the information required and the specific instructions provided. Make sure you have all the necessary documents and details ready.

03

Fill in your personal information accurately, including your full name, address, contact details, and social security number.

04

Provide information about the beneficiaries you wish to designate. Include their full names, relationship to you, and their contact information.

05

Specify the policy details, such as the type of life insurance you are applying for, the coverage amount, and the desired term or duration of the policy.

06

Disclose any relevant medical history. Some life insurance corporations may require you to provide details about your health, pre-existing conditions, or medical exams.

07

Answer the underwriting questions honestly and to the best of your knowledge. These questions are designed to assess your risk profile and may impact the premium or terms of your policy.

08

Review your filled-out form thoroughly before submitting it. Ensure that all information is accurate and complete to avoid any potential issues or delays in the application process.

09

Sign and date the form where required, and follow any additional instructions provided by the life insurance corporation regarding submission or payment.

Who needs life insurance corporation of?

01

Individuals who want to financially protect their loved ones in the event of their death may require life insurance.

02

Parents with young children often consider life insurance as a way to provide for their children's future expenses, such as education or daily living costs.

03

People with dependents, such as elderly parents or disabled family members, may choose life insurance to ensure their dependents are supported financially.

04

Individuals who have outstanding debts, such as mortgages, loans, or credit card balances, may consider life insurance to cover these liabilities in case of their death.

05

Business owners who want to provide key person insurance or fund buy-sell agreements may opt for life insurance as a means of safeguarding their business interests.

06

Those who wish to leave a financial legacy, donate to charity, or contribute to a cause important to them may find life insurance beneficial for these purposes.

07

Individuals with estate planning needs may utilize life insurance as a way to provide liquidity and cover any potential estate taxes or other expenses.

Note: It's important to consider your specific financial situation, goals, and consult with a qualified professional when determining if life insurance is suitable for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is life insurance corporation of?

Life Insurance Corporation of India is the largest insurance company in India that offers various life insurance products.

Who is required to file life insurance corporation of?

Any individual or entity that has a life insurance policy with LIC is required to file the life insurance corporation of.

How to fill out life insurance corporation of?

The life insurance corporation of can be filled out online on the official LIC website or through a licensed insurance agent.

What is the purpose of life insurance corporation of?

The purpose of the life insurance corporation of is to report the details of the life insurance policy held with LIC for regulatory and taxation purposes.

What information must be reported on life insurance corporation of?

The life insurance corporation of must include details such as policy number, premium amount, coverage amount, and beneficiary information.

How do I make changes in life insurance corporation of?

The editing procedure is simple with pdfFiller. Open your life insurance corporation of in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete life insurance corporation of on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your life insurance corporation of from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit life insurance corporation of on an Android device?

You can make any changes to PDF files, such as life insurance corporation of, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your life insurance corporation of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Corporation Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.