Get the free Promissory Note, Loan Agreement and disclosure statement Lender : Alpha Omega Consul...

Show details

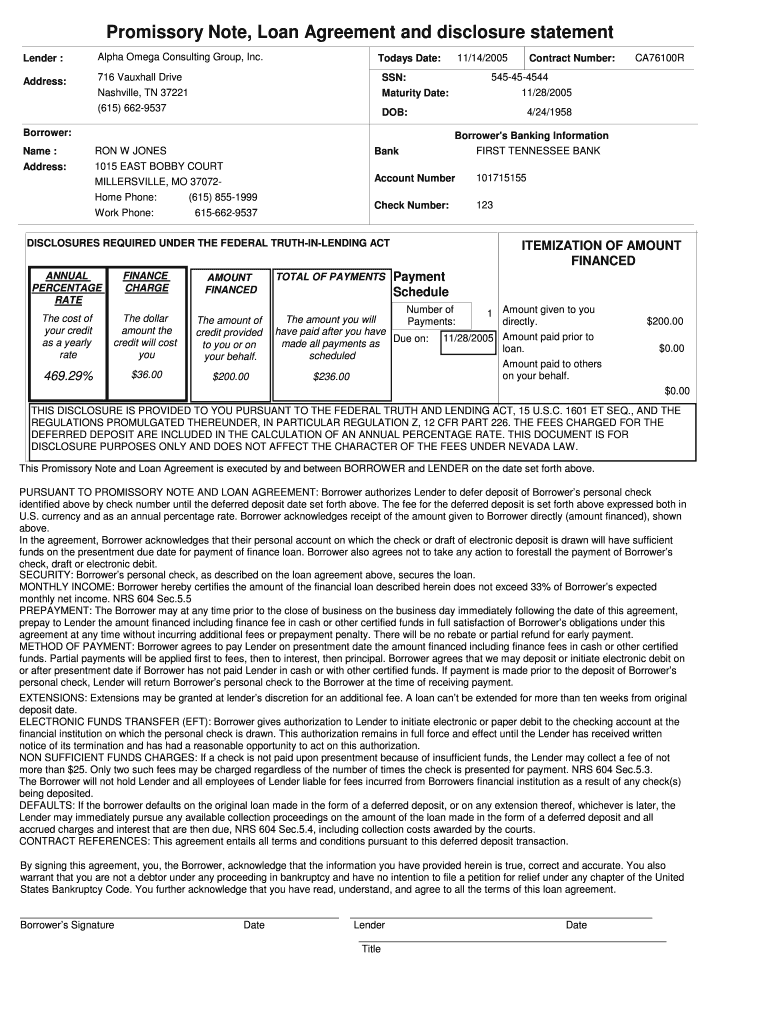

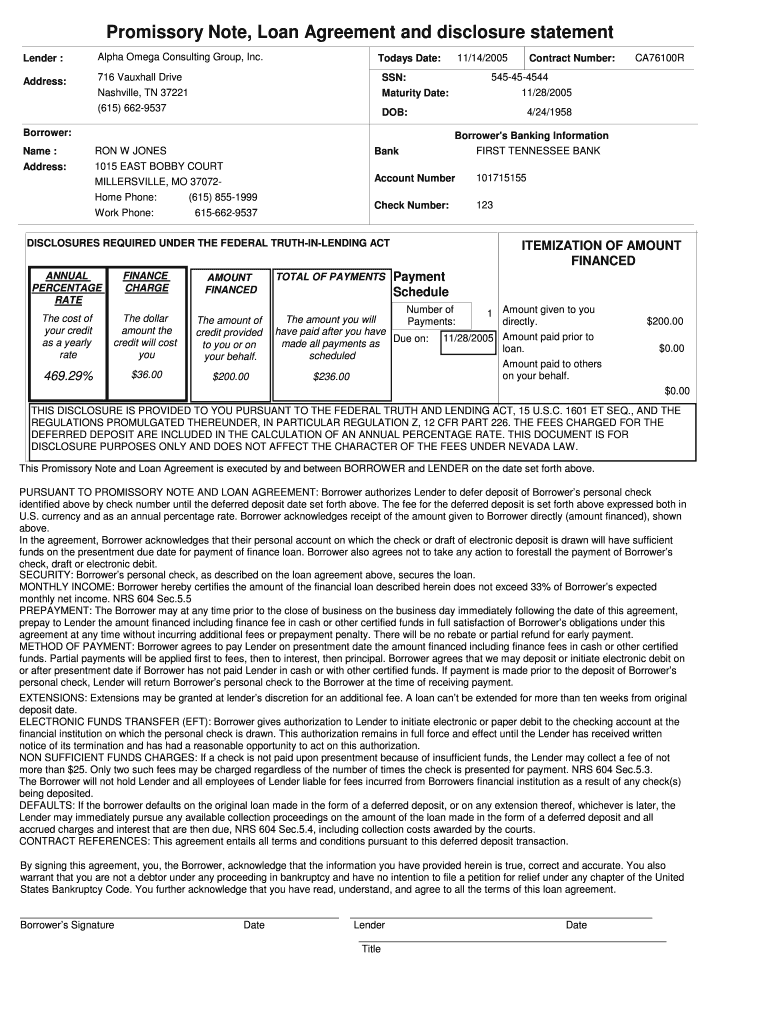

Promissory Note, Loan Agreement and disclosure statement Lender : Alpha Omega Consulting Group, Inc. Address: 716 Vauxhall Drive SSN: Nashville, TN 37221 (615) 6629537 Maturity Date: Name : RON W

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign promissory note loan agreement

Edit your promissory note loan agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory note loan agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing promissory note loan agreement online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit promissory note loan agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out promissory note loan agreement

How to fill out a promissory note loan agreement:

01

Begin by including the date at the top of the document. This is important for record-keeping purposes and helps establish the timeline of the agreement.

02

Identify the parties involved. Include the full legal names, addresses, and contact information of both the lender and the borrower. It is crucial to accurately identify and distinguish the parties involved.

03

Specify the loan amount. Clearly state the exact amount of money being borrowed or lent. Be precise and include any applicable details, such as whether the loan is in a specific currency or if there are any penalty charges for late payment.

04

Outline the terms of the loan. Define the interest rate, repayment schedule, and any additional fees or charges that may be applicable. Ensure that both parties understand and agree upon the terms set forth in the agreement.

05

Include any collateral or security measures. If the loan is secured by any assets or property, specify the details in the agreement. This provides security for the lender in case the borrower defaults on the loan.

06

State the consequences of default. Clearly outline the repercussions if the borrower fails to repay the loan as agreed. This may include penalties, late fees, or legal action that the lender can take to recover the loaned amount.

07

Specify the governing law. Determine the jurisdiction under which the promissory note will be governed and interpreted. This ensures consistency and legal clarity in case of any disputes or conflicts.

08

Include signatures. Both the lender and the borrower must sign the promissory note loan agreement to make it legally binding. Additionally, witnesses or notaries may be required depending on the jurisdiction.

Who needs a promissory note loan agreement?

A promissory note loan agreement can be beneficial for anyone involved in a private loan transaction, including individuals, businesses, or organizations. It is particularly useful in situations where a significant amount of money is being loaned or borrowed. By having a formal agreement in place, both the lender and the borrower have legal protection and clarity regarding the loan terms, repayment schedule, and any potential consequences of default. It is advisable for anyone entering into a loan agreement to consider utilizing a promissory note to safeguard their interests and ensure that both parties are on the same page.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is promissory note loan agreement?

A promissory note loan agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower, including the amount borrowed, interest rate, repayment schedule, and any collateral.

Who is required to file promissory note loan agreement?

The borrower is generally required to file the promissory note loan agreement, although both parties may keep a copy for their records.

How to fill out promissory note loan agreement?

To fill out a promissory note loan agreement, both parties must provide their names, addresses, loan amount, interest rate, repayment terms, and any collateral that is being used to secure the loan.

What is the purpose of promissory note loan agreement?

The purpose of a promissory note loan agreement is to formalize the borrowing and lending of money between two parties, and to ensure that both parties understand and agree to the terms of the loan.

What information must be reported on promissory note loan agreement?

The promissory note loan agreement must include the names and addresses of the borrower and lender, loan amount, interest rate, repayment schedule, and any collateral that is being used to secure the loan.

How can I send promissory note loan agreement to be eSigned by others?

promissory note loan agreement is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete promissory note loan agreement online?

Easy online promissory note loan agreement completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the promissory note loan agreement in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your promissory note loan agreement in seconds.

Fill out your promissory note loan agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Note Loan Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.