Get the free 060 Income Analysis Worksheet - 064-0309 Rev 7-14 - CHFA - chfa

Show details

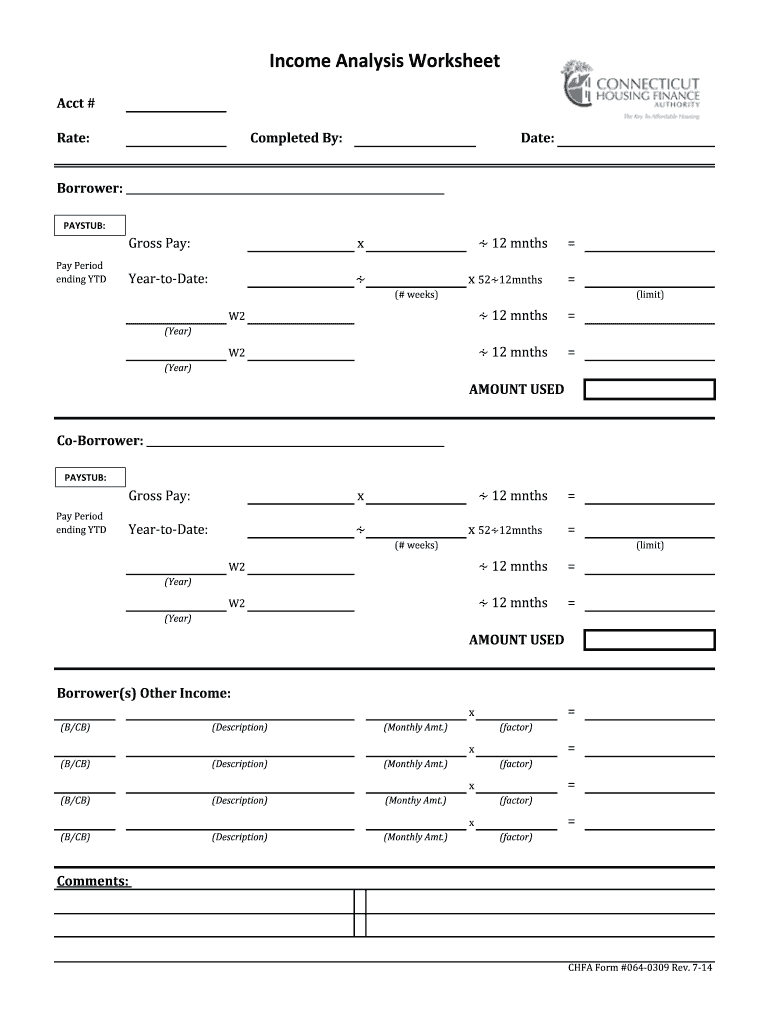

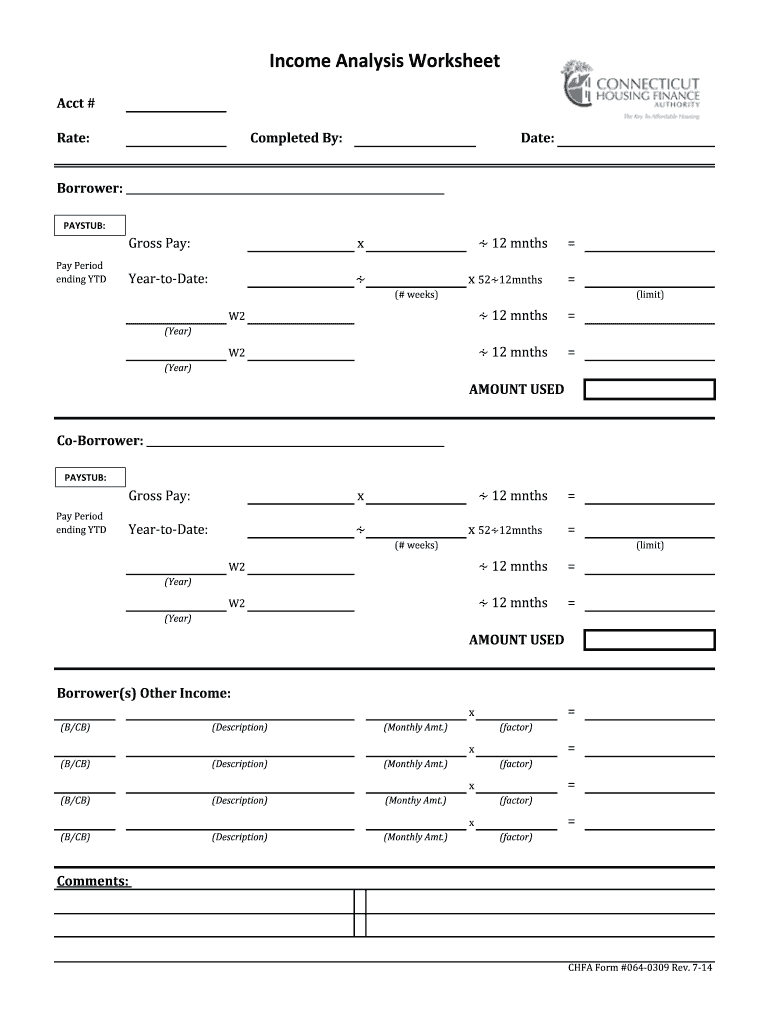

Income Analysis Worksheet Acct # Rate: Completed By: Date: Borrower: PAYS TUB: Gross Pay: Pay Period ending YTD x Areolate: 12 months x 5212mnths (# weeks) (limit) W2 12 months W2 12 months (Year)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 060 income analysis worksheet

Edit your 060 income analysis worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 060 income analysis worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 060 income analysis worksheet online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 060 income analysis worksheet. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 060 income analysis worksheet

Who needs 060 income analysis worksheet?

01

Individuals applying for a loan: When applying for a loan, financial institutions often require applicants to provide an income analysis. This worksheet helps lenders assess the borrower's ability to repay the loan by analyzing their income sources and expenses.

02

Individuals seeking financial assistance: Nonprofit organizations, government agencies, or community programs may request an income analysis to determine an individual's eligibility for financial assistance. This can include programs such as housing assistance, scholarships, or social security benefits.

03

Individuals preparing for tax purposes: Some individuals use the 060 income analysis worksheet to gather and organize their financial information when preparing their tax returns. This worksheet provides a comprehensive overview of their income and expenses, making it easier to track and report any tax-deductible expenses accurately.

How to fill out 060 income analysis worksheet:

01

Gather all your income sources: Begin by listing all your sources of income, such as employment wages, self-employment income, rental income, or investment dividends. Include any other forms of income you receive regularly.

02

Calculate your total income: Add up all the sources of income to calculate your total income. This will give you a clear understanding of the amount you earn before deducting any expenses.

03

Document your expenses: Next, document all your monthly expenses. This can include housing costs, utilities, transportation expenses, groceries, healthcare bills, insurance, and any other recurring expenditures.

04

Calculate your total expenses: Add up all the expenses to calculate your total monthly expenses. This will give you an overview of your financial obligations and help in determining your disposable income.

05

Calculate your disposable income: Subtract your total monthly expenses from your total income. The resulting amount is your disposable income, which is the money you have available for savings, investments, or other discretionary spending.

06

Provide additional documentation: In some cases, you may need to provide supporting documentation to verify the information provided in the income analysis worksheet. This can include pay stubs, bank statements, tax returns, or any other relevant financial documents.

07

Review and update regularly: It is essential to review and update your income analysis regularly. Changes in income or expenses may impact your financial situation, and keeping your analysis up to date will ensure accurate financial planning.

By following these steps, individuals can effectively fill out the 060 income analysis worksheet and provide comprehensive information regarding their income and expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 060 income analysis worksheet?

The 060 income analysis worksheet is a document used to analyze an individual's income.

Who is required to file 060 income analysis worksheet?

Individuals who meet certain financial criteria may be required to file the 060 income analysis worksheet.

How to fill out 060 income analysis worksheet?

The 060 income analysis worksheet can be filled out by providing detailed information about sources of income, expenses, and other financial data.

What is the purpose of 060 income analysis worksheet?

The purpose of the 060 income analysis worksheet is to assess an individual's financial situation and determine eligibility for certain programs or benefits.

What information must be reported on 060 income analysis worksheet?

Information such as income sources, expenses, assets, and liabilities must be reported on the 060 income analysis worksheet.

How do I make changes in 060 income analysis worksheet?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 060 income analysis worksheet to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the 060 income analysis worksheet in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your 060 income analysis worksheet in seconds.

Can I edit 060 income analysis worksheet on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign 060 income analysis worksheet. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your 060 income analysis worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

060 Income Analysis Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.