Get the free Fixed Asset Guide

Show details

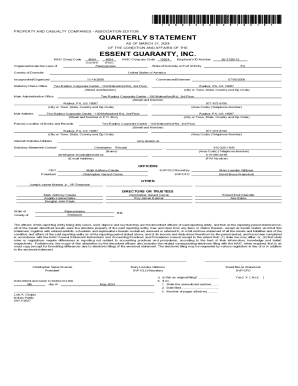

Fixed Asset Guide Financial Services Office Last updated May 4, 2015INTRODUCTION PURPOSE DEFINITIONS CAPITAL, NON-CAPITAL AND SENSITIVE PROPERTY PURCHASING ASSET TAGGING DONATIONS DISPOSITION TRADE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed asset guide

Edit your fixed asset guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed asset guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed asset guide online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fixed asset guide. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed asset guide

How to fill out a fixed asset guide:

01

Start by gathering all the necessary information about your fixed assets. This may include details such as the name, description, purchase date, purchase cost, useful life, and depreciation method for each asset.

02

Organize the information in a systematic manner. You can use spreadsheets or specialized fixed asset management software to create a structured form for recording the details of each asset.

03

Begin filling out the fixed asset guide by entering the asset's unique identification or serial number. This will help track and identify each asset individually.

04

Record a clear and concise description of the asset. Include any relevant details that can help identify the asset easily, such as the make, model, or specifications.

05

Enter the purchase date of the asset. This is important for tracking the age of the asset and determining its useful life for depreciation purposes.

06

Note down the purchase cost of the asset. This should include any additional costs incurred during the acquisition, such as taxes or shipping fees.

07

Specify the useful life of each asset. This refers to the estimated duration over which the asset is expected to provide economic benefits. It is essential for calculating depreciation expenses accurately.

08

Determine the appropriate depreciation method for each asset. Different assets may have different depreciation methods, such as straight-line, declining balance, or units of production. Consult accounting standards or a financial expert to ensure you choose the correct method.

09

As you fill out the fixed asset guide, make sure to keep it regularly updated. Update information whenever there are changes to the asset, such as repairs, improvements, or disposals.

Who needs a fixed asset guide?

01

Small businesses: Fixed asset guides are crucial for small businesses that own and manage tangible assets. It helps them accurately track, manage, and report their fixed assets for financial and tax purposes.

02

Corporations: Large corporations with extensive fixed asset holdings require detailed guides to ensure compliance with accounting standards, tax regulations, and asset management strategies. These guides help streamline financial reporting and control processes.

03

Nonprofit organizations: Nonprofit organizations, just like any other entity, have fixed assets that need proper tracking and management. A fixed asset guide helps them accurately report assets, assess their financial health, and make informed decisions regarding acquisitions or disposals.

04

Government entities: Government agencies often possess a significant number of fixed assets. As responsible custodians of public resources, they require robust guides to efficiently manage these assets, ensure accountability, and accurately report their financial statements.

05

Educational institutions: Schools, universities, and colleges maintain numerous fixed assets, ranging from furniture and equipment to buildings and vehicles. A fixed asset guide is essential for these institutions to track, maintain, and assess the value of their assets.

In conclusion, anyone who owns or manages fixed assets can benefit from a fixed asset guide. It helps ensure accurate record-keeping, compliance with regulations, efficient financial reporting, and informed decision-making.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fixed asset guide?

Fixed asset guide is a document that provides instructions and guidelines for reporting fixed assets owned by a company or organization.

Who is required to file fixed asset guide?

Companies and organizations that own fixed assets are required to file a fixed asset guide.

How to fill out fixed asset guide?

Fixed asset guide can be filled out by including information about the fixed assets owned by the company, such as their description, cost, acquisition date, and useful life.

What is the purpose of fixed asset guide?

The purpose of fixed asset guide is to accurately report and document the fixed assets owned by a company for accounting and tax purposes.

What information must be reported on fixed asset guide?

Information such as description, cost, acquisition date, and useful life of fixed assets must be reported on a fixed asset guide.

Can I sign the fixed asset guide electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your fixed asset guide in seconds.

How do I edit fixed asset guide on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign fixed asset guide right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out fixed asset guide on an Android device?

On Android, use the pdfFiller mobile app to finish your fixed asset guide. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your fixed asset guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Asset Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.