OH JFS 07048 2013 free printable template

Show details

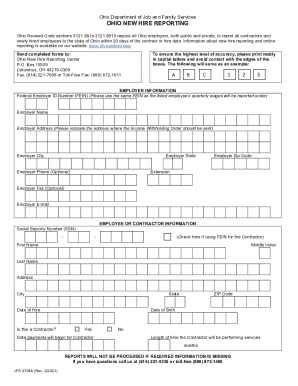

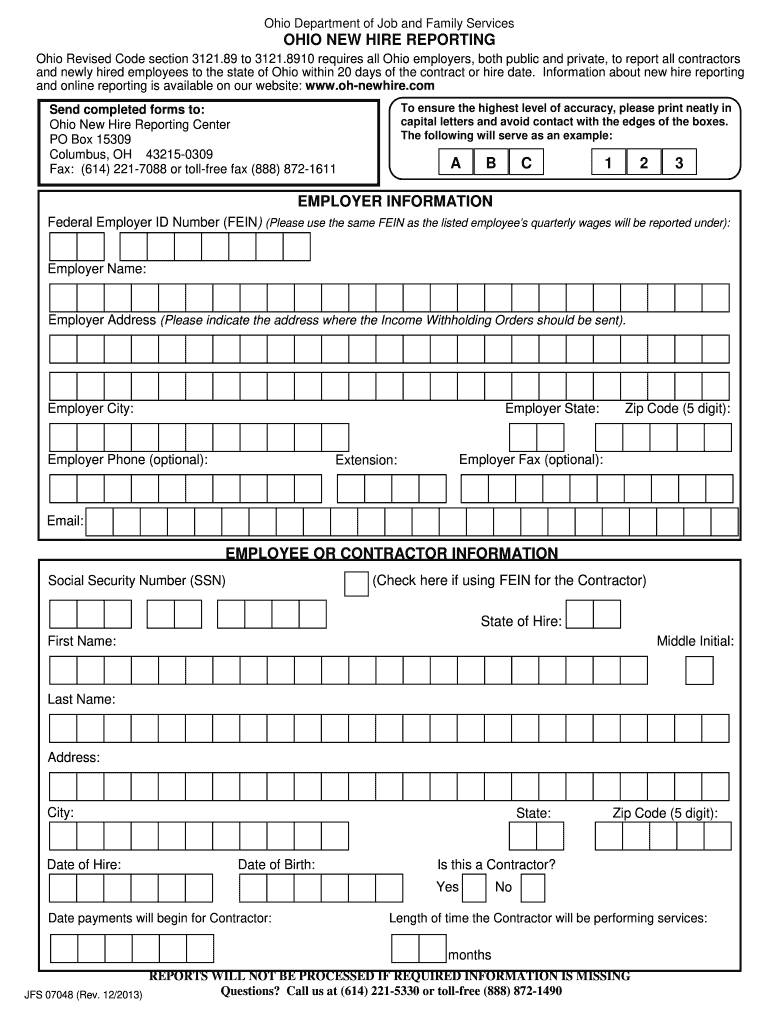

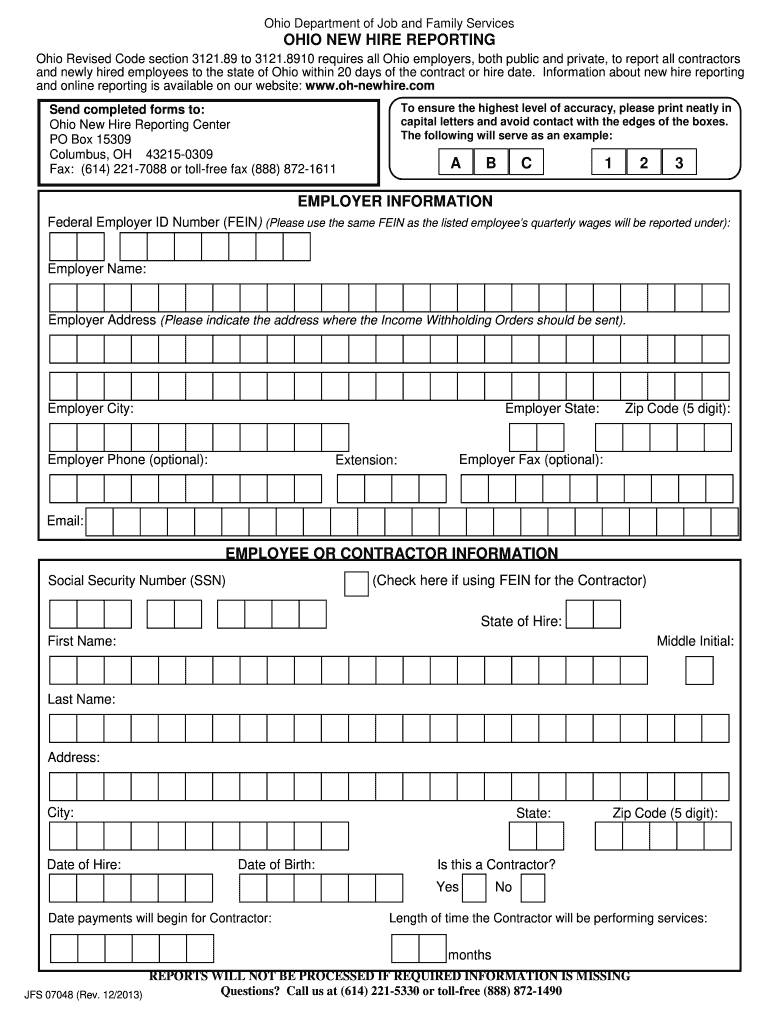

Ohio Department of Job and Family Services OHIO NEW HIRE REPORTING Ohio Revised Code section 3121. 89 to 3121. 8910 requires all Ohio employers both public and private to report all contractors and newly hired employees to the state of Ohio within 20 days of the contract or hire date. Information about new hire reporting and online reporting is available on our website www. oh-newhire. The following will serve as an example Send completed forms to Ohio New Hire Reporting Center PO Box 15309...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ohio new hire reporting form

Edit your ohio new hire reporting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio new hire forms 2021 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new hire reporting ohio online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ohio new hire form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH JFS 07048 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH JFS 07048

How to fill out OH JFS 07048

01

Start by downloading the OH JFS 07048 form from the official website.

02

Read the instructions carefully before filling out the form.

03

Enter your personal information in the designated fields including your name, address, and contact details.

04

Provide details about the specific services or assistance you are requesting.

05

Include any required supporting documentation as specified in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form according to the directions provided, either by mail or electronically.

Who needs OH JFS 07048?

01

Individuals or families seeking financial assistance or support services from the Ohio Department of Job and Family Services.

02

Individuals applying for public assistance programs in the state of Ohio.

03

People needing help with food assistance, healthcare, or child care support.

Fill

form

: Try Risk Free

People Also Ask about

What forms do you need when hiring a new employee?

Papers required for hiring paperwork W-4 (or W-9) form. The W-4 form tells employers how much money the employee wants to withhold from their pay for the correct federal tax income. I-9 form. State tax withholding form. Direct deposit form. Internal forms. Personal data for emergencies form.

How do I report a new hire to the IRS?

Online. Use e-Services for Business to submit a Report of New Employee(s) (DE 34). Submit a paper report of new employees by mail or fax using one of the following options: Mail. Mail or fax your paper DE 34 to: Employment Development Department. Fax. Fax your form to 1-916-319-4400. Additional Resources.

What is required to hire an employee in Ohio?

Suppose you wish to hire employees in Ohio. In that case, you must ask your employees to submit the Employment Eligibility Form, the Federal Tax withholding form, the W-4 Form, Workers Compensation Claim Form, Disability Self- Identification Form, U.S. Citizenship and Immigration Services Form, etc.

Which of the following is a purpose of new hire reporting laws?

All employers must report the hiring, rehiring, and return to work of all paid employees. A few of the many procedural goals of reporting are to detect fraud, help locate individuals for establishing paternity, and/or establishing, notifying, and enforcing child support orders.

What do you do with new hire paperwork?

New hire paperwork checklist Prepare an employment contract and receive signed, if applicable. You can send this contract along with your job offer email or letter. Make sure you and new hires complete employment forms required by law. Prepare and obtain signatures on internal forms. Prepare employee benefits documents.

What is the purpose of new hire paperwork?

New hire paperwork is the paperwork any new employee needs to complete in order to begin working for your company. This paperwork is a combination of documents. Some of these forms are government forms for income tax and legal obligations.

Do you have to report new hires in Ohio?

All employers are required to report every employee and independent contractor working in Ohio to the Ohio New Hire Reporting Center within 20 days of the date of hire.

What forms do new employees need to fill out in Ohio?

All employers must establish employment eligibility and the identity of new employees by completing Form I-9.

What is the purpose of new hire reporting?

What is New Hire reporting? New Hire reporting is a process by which you, as an employer, report information on newly hired employees to a designated state agency shortly after the date of hire. As an employer, you play a key role in this important program by reporting all your newly hired employees to your state.

What document is signed by a new hire requiring?

Copy of pan card, Aadhar card & passport sized photographs. Tax declarations. Declaration of income from the previous employer. Personal Details.

What do I need to do if I hire an employee in Ohio?

Employers must complete the Application for Registering as an Ohio Withholding Agent (Form IT- 1) and return it to the Ohio Department of Taxation. After you return the form, you will receive a coupon booklet to report and pay the tax withheld from your employees' pay.

What forms are required for new hires in Ohio?

All employers must establish employment eligibility and the identity of new employees by completing Form I-9.

How do I report new hires to the IRS?

Online. Use e-Services for Business to submit a Report of New Employee(s) (DE 34). Submit a paper report of new employees by mail or fax using one of the following options: Mail. Mail or fax your paper DE 34 to: Employment Development Department. Fax. Fax your form to 1-916-319-4400. Additional Resources.

What is a hiring report?

A new hire report is a submission of information to a US state about a new or rehired employee in that state. The employee can be completely new to you, or he or she may have worked for you previously but stopped being your employee for at least 60 consecutive days.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OH JFS 07048 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your OH JFS 07048 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete OH JFS 07048 online?

With pdfFiller, you may easily complete and sign OH JFS 07048 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out OH JFS 07048 on an Android device?

Use the pdfFiller app for Android to finish your OH JFS 07048. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is OH JFS 07048?

OH JFS 07048 is a form used by the Ohio Department of Job and Family Services for reporting specific employment and income information.

Who is required to file OH JFS 07048?

Employers and individuals receiving certain types of assistance or engaging in specific transactions may be required to file OH JFS 07048.

How to fill out OH JFS 07048?

To fill out OH JFS 07048, provide all required personal and employment information, including income details, and ensure all fields are completed accurately before submission.

What is the purpose of OH JFS 07048?

The purpose of OH JFS 07048 is to collect relevant employment and income data to assess eligibility for various assistance programs within Ohio.

What information must be reported on OH JFS 07048?

The information required on OH JFS 07048 includes the individual's personal details, employment status, income sources, and amounts, as well as any other relevant financial information.

Fill out your OH JFS 07048 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH JFS 07048 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.