CA CAPS Wage formft Prevention Act free printable template

Get, Create, Make and Sign california wage theft form

How to edit ca wage formft form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ca wage formft form

How to fill out CA CAPS Wage Theft Prevention Act (WTPA)

Who needs CA CAPS Wage Theft Prevention Act (WTPA)?

Video instructions and help with filling out and completing ca wage theft form

Instructions and Help about ca wage formft form

Last week President Trump signed a bill that repealed an Obama-era regulation that forced government contractors to comply with labor laws specifically laws related to worker safety and worker pay If a company didn't comply with these regulations they would lose their federal contracts Now that this regulation is gone federal contractors have been given a green light to engage in questionable labor practice sand the door has been opened for contractors to engage in legal forms of wage theft Stealing The phrase wage theft refers to any action taken by a company that denies a worker the pay that they are entitled to There are many ways that these corporate schemes are carried out The first is to simply deny workers overtime pay for any hours that are worked over the standard 40 per week Some businesses require employees to workfare beyond the typical 40-hour work week, but they don't pay employees overtime mayor they simply don't pay them for the extra hours at all This is typical of salaried employees whoa rent paid by the hour Another typical scam that we see businesses pull off is to re-classify employees as independent contractors When this happens the companies simply pay their workers a set amount regardless of how many hours that the employee actually works If the worker puts in more hours than theyvebeen paid for they never see the rest of the money that they've earned and the corporation gets to pocket the difference There are also instances particularly with the garment industry where workers only get paid for the amount of clothing that they fold often a few pennies per item causing their real hourly pay rate to hover around three dollars And here show bad the problem is a three-yearlong study by the Department of Labor found that 85 of the garment industry in Southern California was found to be stealing wages from their employees These were companies like TJ MAX ROSS forever 21 More than 660 investigations found that more than 5000 of these workers had lost out on over eight million dollars because of wage theft Across the country the Labor DepartmentsWage and Hour division managed to recover about 700000 dollars every single day in2015 from employers who were illegally withholding wages from their employees The victims of wage theft are typically inlow-wage industries like textiles construction and manufacturing with foreign workers falling prey to predatory businesses because they are the least likely to speak up and the least likely to be aware of labor laws Wage theft isn't only limited to low-wageindustries or foreign workers, and I'm joined now by attorney Brandon Boyle who handles wage and hour cases for plaintiffs who have been denied their earned income Brandon tell us a little about the bill that Donald Trump signed and how this is going to affect wages for federal contract workers Yes under the Obama administration there was a rule implemented which basically required companies who were bidding for government contract work...

People Also Ask about

What is Section 203 of the California Labor Code?

Is wage theft a crime in California?

What does wage theft mean?

What is a CA 2810.5 form?

What is a wage theft prevention notice?

What is a California wage theft form for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ca wage formft form in Gmail?

Can I create an electronic signature for the ca wage formft form in Chrome?

Can I edit ca wage formft form on an iOS device?

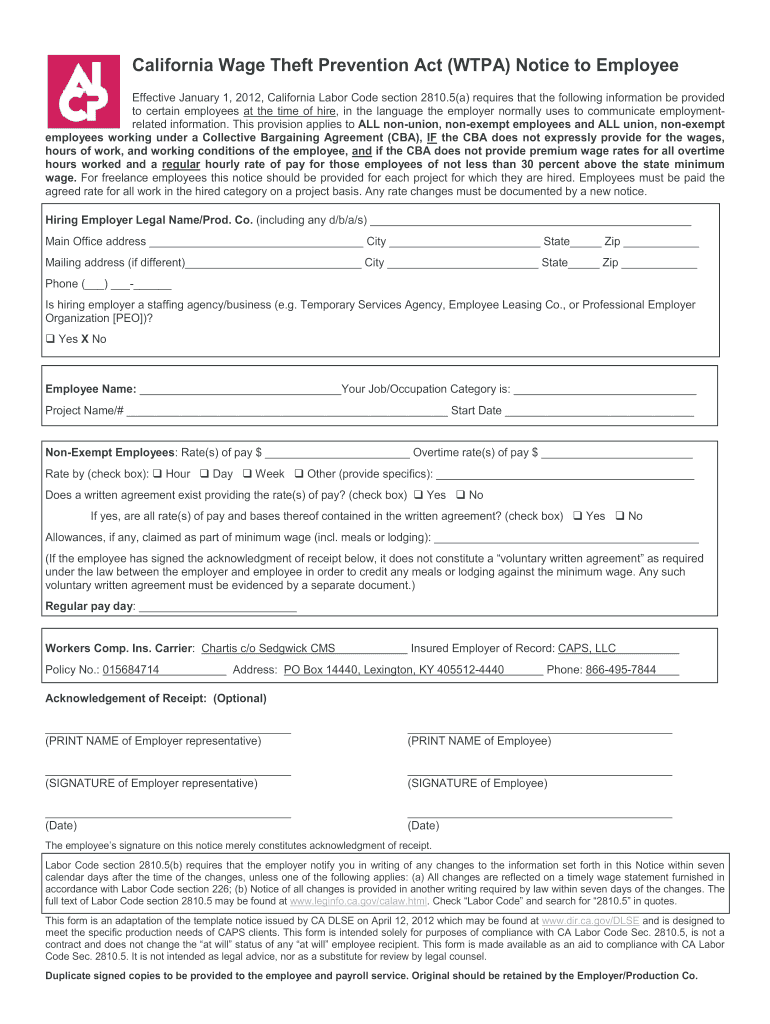

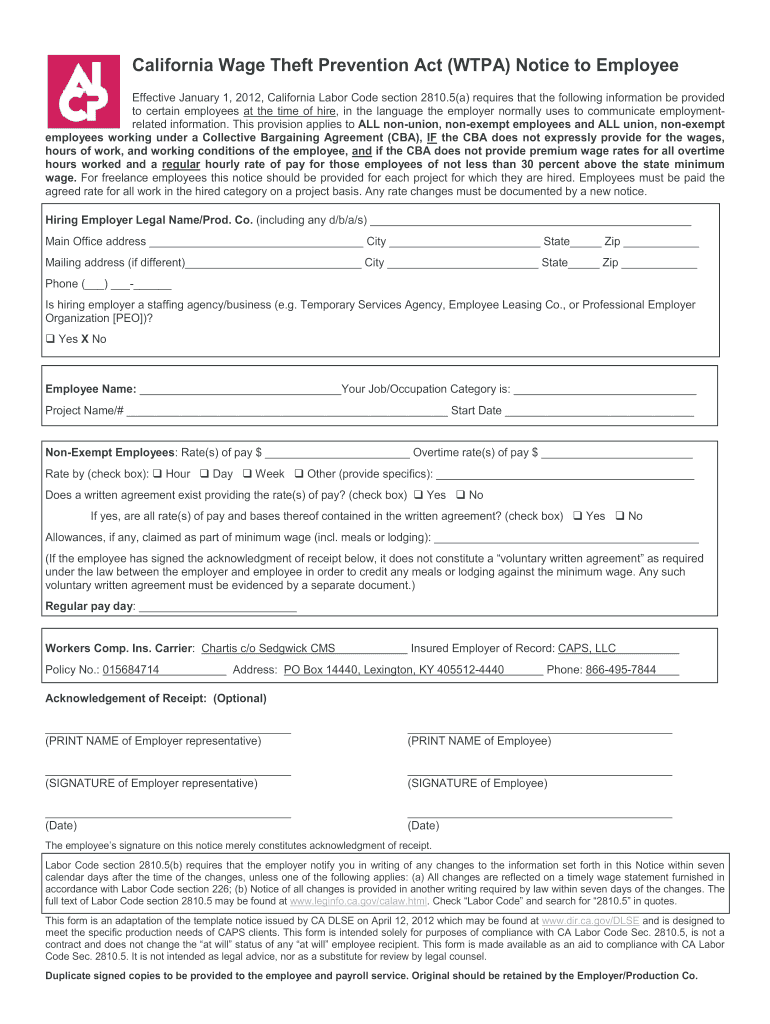

What is CA CAPS Wage Theft Prevention Act (WTPA)?

Who is required to file CA CAPS Wage Theft Prevention Act (WTPA)?

How to fill out CA CAPS Wage Theft Prevention Act (WTPA)?

What is the purpose of CA CAPS Wage Theft Prevention Act (WTPA)?

What information must be reported on CA CAPS Wage Theft Prevention Act (WTPA)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.