Get the free Child Trust Fund Direct Debit form

Show details

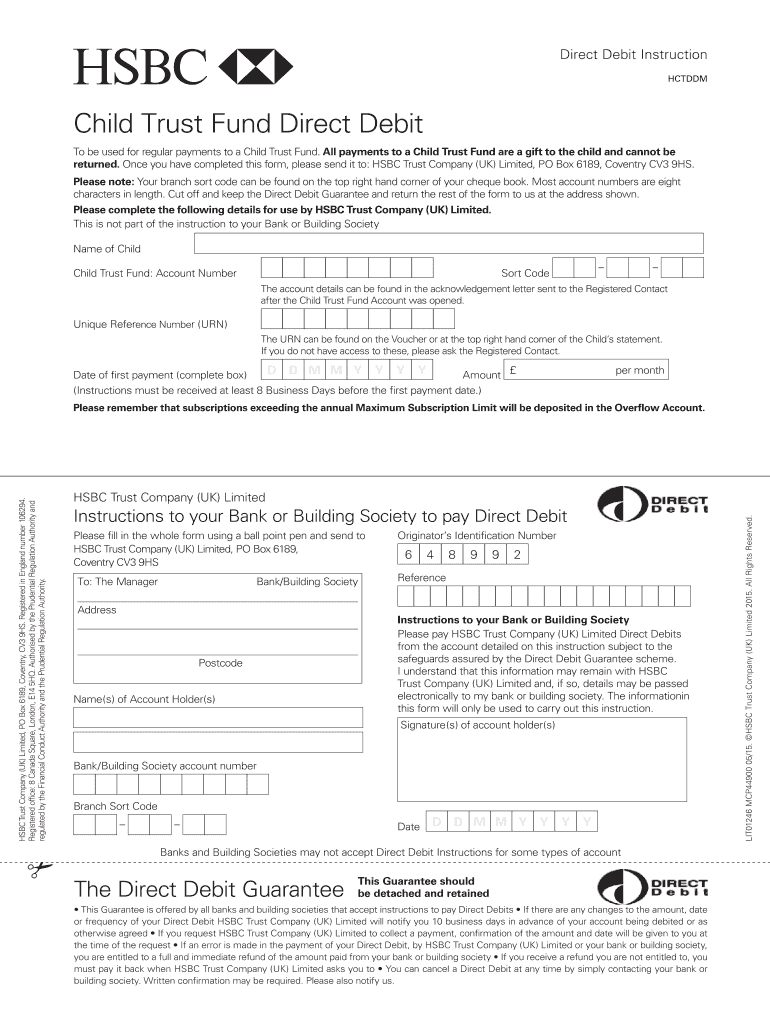

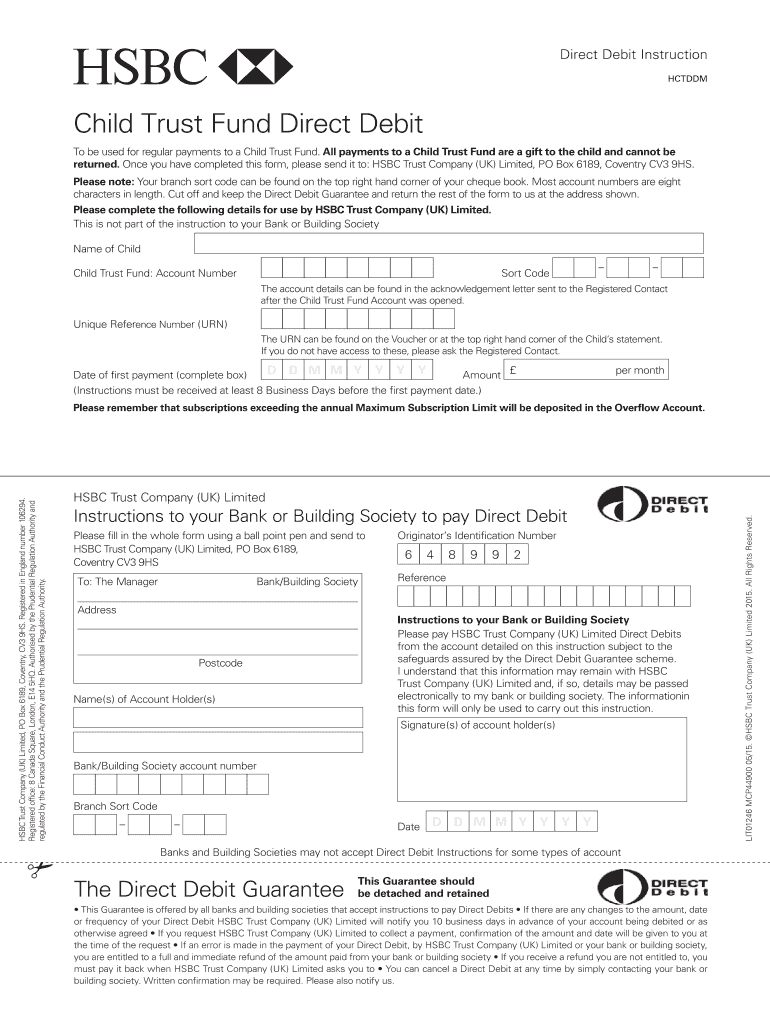

Direct Debit Instruction ACTED Child Trust Fund Direct Debit To be used for regular payments to a Child Trust Fund. All payments to a Child Trust Fund are a gift to the child and cannot be returned.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign child trust fund direct

Edit your child trust fund direct form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your child trust fund direct form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit child trust fund direct online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit child trust fund direct. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out child trust fund direct

How to fill out child trust fund direct:

01

Gather all necessary information and documents, such as your child's personal details, their National Insurance number, and your own contact details.

02

Contact a suitable provider for child trust funds, such as a bank or financial institution that offers this service. Research different providers to find one that offers competitive rates and suitable investment options for your child's future.

03

Open a child trust fund account with the chosen provider. This can often be done through their website or by visiting a local branch. Follow their specific instructions and provide all the required information accurately.

04

Choose the type of child trust fund account that best suits your needs. There are two options available: stakeholder child trust fund and non-stakeholder child trust fund. Consider factors such as fees, investment options, and flexibility before making a decision.

05

Allocate funds to the child trust fund account. You can choose to deposit a lump sum or set up regular contributions. Decide on the amount you are comfortable investing and set up automatic transfers if possible.

06

Monitor the child trust fund account regularly. Keep track of the fund's performance and make adjustments if necessary. Stay informed about any changes in government policies or regulations regarding child trust funds.

07

Review the investment options offered by the provider periodically. As your child grows older, you may want to consider adjusting the investment strategy to align with their changing needs and future goals.

Who needs child trust fund direct:

01

Parents or legal guardians who want to save and invest money for their child's future financial needs.

02

Individuals who wish to take advantage of tax-free savings for their child. Child trust funds offer tax-free growth and withdrawals, making them an attractive option for long-term savings.

03

Families who desire a structured and disciplined approach to saving money for their child. Child trust funds provide a designated account for this purpose, helping parents stay committed to their savings goals.

04

Parents who want to teach their child about financial responsibility. Involving children in discussions about their trust fund and teaching them basic financial concepts can help foster good money management habits from an early age.

05

Individuals who believe in the potential benefits of long-term investing. Child trust funds provide an opportunity to invest in a diversified portfolio, which can potentially yield higher returns compared to traditional savings accounts.

Remember, it is always advisable to consult a financial advisor or seek professional guidance before making any financial decisions related to child trust funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is child trust fund direct?

Child trust fund direct is a type of financial account set up for a child with the aim of providing them with a savings fund as they grow older.

Who is required to file child trust fund direct?

Parents or legal guardians are usually required to set up and manage a child trust fund direct on behalf of the child.

How to fill out child trust fund direct?

To fill out a child trust fund direct, the parent or guardian would need to provide personal information, select investment options, and make regular contributions to the account.

What is the purpose of child trust fund direct?

The purpose of child trust fund direct is to help families save money for their child's future expenses, such as education or buying a home.

What information must be reported on child trust fund direct?

Information such as parent's or legal guardian's personal details, child's details, investment choices, and contributions made to the fund must be reported on child trust fund direct.

How can I edit child trust fund direct from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including child trust fund direct, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit child trust fund direct on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign child trust fund direct right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit child trust fund direct on an Android device?

With the pdfFiller Android app, you can edit, sign, and share child trust fund direct on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your child trust fund direct online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Child Trust Fund Direct is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.