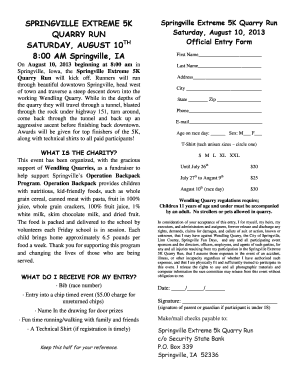

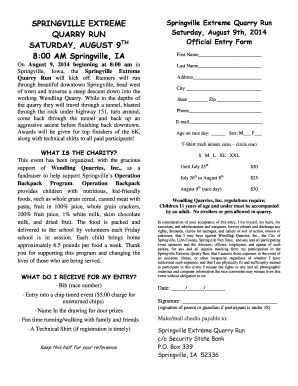

Get the free 1stHomeIllinois Second Mortgage - ihda

Show details

This document was prepared by: When recorded, please return to: Illinois Housing Development Authority 401 N. Michigan Avenue, Suite 700 Chicago, IL 60611 Attn: Hardest Hit Fund (Space Above This

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1sthomeillinois second mortgage

Edit your 1sthomeillinois second mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1sthomeillinois second mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1sthomeillinois second mortgage online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 1sthomeillinois second mortgage. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1sthomeillinois second mortgage

How to fill out 1sthomeillinois second mortgage:

01

Gather necessary documents: Start by gathering all the required documents for filling out the 1sthomeillinois second mortgage application. These may include income statements, tax returns, bank statements, identification documents, and proof of home ownership.

02

Understand the eligibility criteria: Before filling out the application, make sure you meet the eligibility criteria for the 1sthomeillinois second mortgage. Familiarize yourself with the income limitations, credit score requirements, and any other eligibility factors specified by the program.

03

Fill out the application accurately: Take your time to fill out the application form accurately. Double-check all the information you provide, ensuring its correctness and completeness. This may include personal information, financial details, and property information.

04

Provide supporting documents: Alongside the application form, you will need to submit supporting documents to verify the information provided. Review the application guidelines to know which documents are required and make sure to include them with your application.

05

Seek professional assistance if needed: If you find the application process confusing or overwhelming, consider seeking assistance from a mortgage professional or reaching out to the 1sthomeillinois program for guidance. They can provide valuable insights and ensure your application is filled out correctly.

Who needs 1sthomeillinois second mortgage:

01

First-time homebuyers: The 1sthomeillinois second mortgage program is designed to assist first-time homebuyers who may not have enough funds for a down payment or closing costs. If you're a first-time homebuyer and require additional financial support, the 1sthomeillinois second mortgage could be beneficial for you.

02

Low and moderate-income individuals: The program targets low and moderate-income individuals who may face financial barriers to homeownership. If you fall within the income limits specified by the 1sthomeillinois program and require assistance in securing a mortgage, the second mortgage option could be suitable for you.

03

Homeowners with limited savings: If you have limited savings to cover the upfront costs of purchasing a home, such as the down payment and closing costs, the 1sthomeillinois second mortgage can provide the additional funds necessary to make homeownership more affordable and accessible for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 1sthomeillinois second mortgage?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 1sthomeillinois second mortgage in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the 1sthomeillinois second mortgage electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your 1sthomeillinois second mortgage.

How do I complete 1sthomeillinois second mortgage on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 1sthomeillinois second mortgage from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is 1sthomeillinois second mortgage?

1sthomeillinois second mortgage is a type of loan that allows homeowners to borrow money using their home as collateral, in addition to their primary mortgage.

Who is required to file 1sthomeillinois second mortgage?

Homeowners who wish to take out a second mortgage through 1sthomeillinois are required to file the necessary paperwork and meet the eligibility criteria set by the program.

How to fill out 1sthomeillinois second mortgage?

To fill out 1sthomeillinois second mortgage, homeowners must complete the application form provided by 1sthomeillinois, provide all required documentation, and meet the program's eligibility criteria.

What is the purpose of 1sthomeillinois second mortgage?

The purpose of 1sthomeillinois second mortgage is to provide homeowners with additional funds for home improvements, debt consolidation, or other financial needs.

What information must be reported on 1sthomeillinois second mortgage?

The information required to be reported on 1sthomeillinois second mortgage includes details about the property, the loan amount, the borrower's financial information, and any other relevant data.

Fill out your 1sthomeillinois second mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1sthomeillinois Second Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.